Brand Marketing 22 October 2025

The Rising Power of Retail Media

Sevendots, Milan

7 minute read

Retail Media is here to stay

In this article we review what have been the underlying drivers behind the rapid development of Retail Media as a communication and engagement platform, offering unique brand-building benefits to CPG companies.

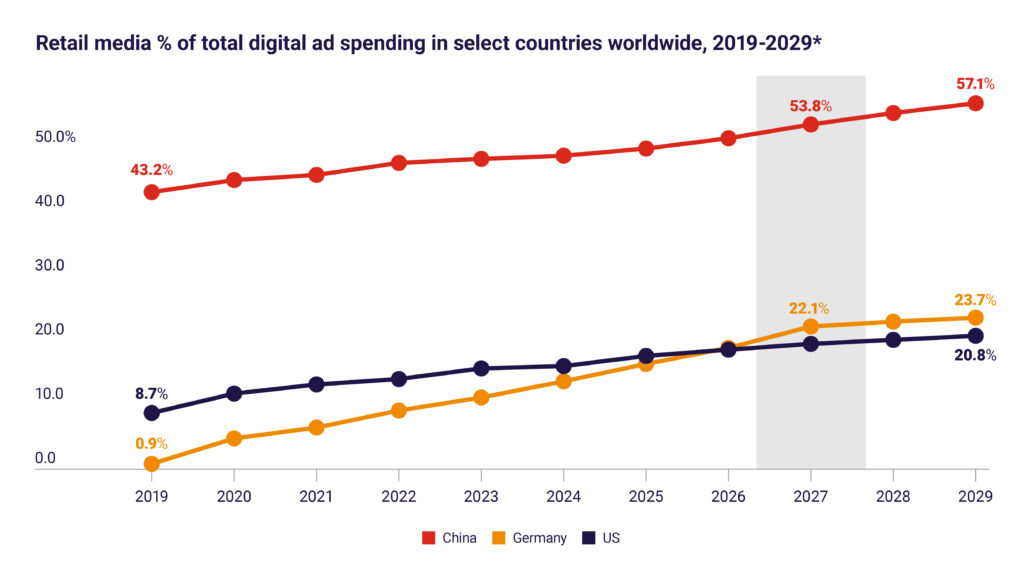

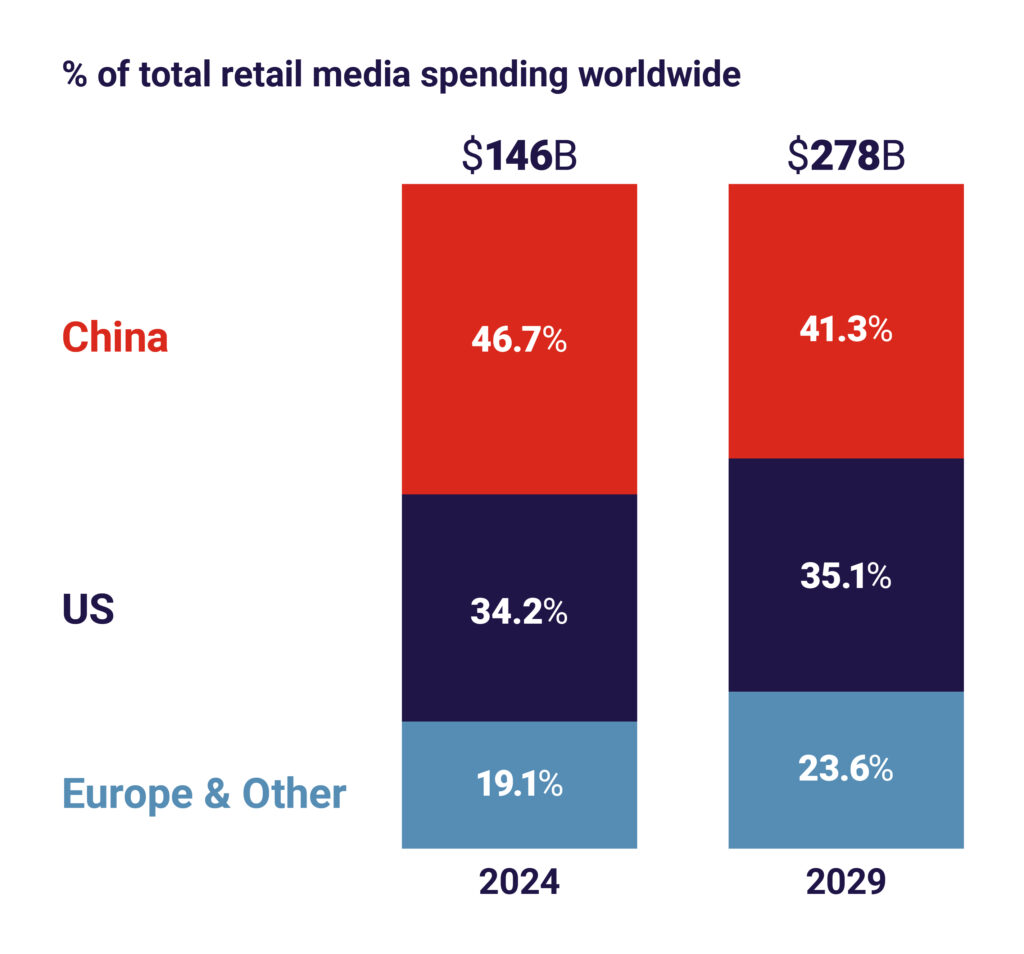

Projections are for the share of Retail Media to continue to increase as well as its expansion beyond US and China that currently account for ¾ of the global market.

By leveraging the retail data assets brands can benefit from more precise targeting, as well as a more immediate measurement of results.

An opportunity not to be missed.

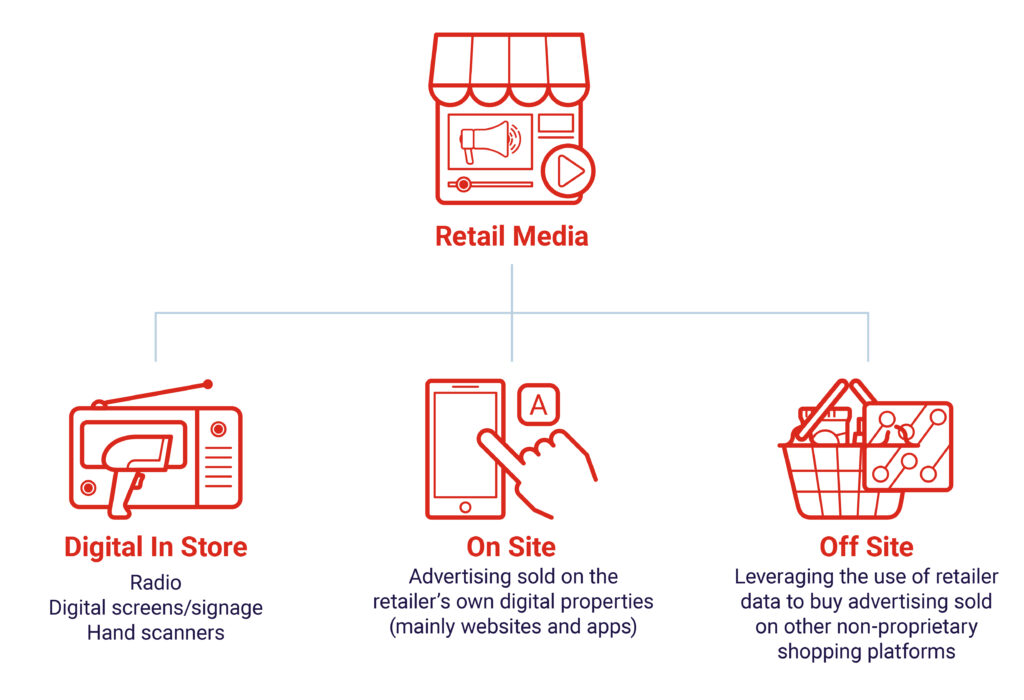

What Retail Media involves

Retail media is the practice of selling digital and in-store advertising space on a retailer’s platforms, utilizing their first-party data to offer targeted ads to brands and drive sales directly at the point of purchase. It involves brands buying ad space on a retailer’s websites, apps, or in their physical stores to reach consumers, leveraging rich customer data to deliver personalized campaigns and measure results against sales.

Global interest and ad spending in retail media continue to grow, mainly because of its unique advantages:

- Brands can access to first-party data containing customers preferences and shopping tendencies

- Retailers generate new revenue streams by selling ad space on their digital properties

- Ads are shown to customers when they are already close to making a purchase decision

Retail Media Ad Spend: Trends and Future Outlook

With an anticipated global CAGR up to 2029 of 11%, China and the US lead the way but other, smaller countries are set to claim a larger portion of retail media spending.

Who Leads the Way in Retail Media?

Given their inherent retail-oriented nature, Retail Media Networks often have a built-in advantage over traditional digital media when it comes to capitalizing on organic purchase behavior, delivering the right ad to the right consumer at the right moment.

Within the most advanced country, China, four main types of RMNs can be found:

E-Commerce RMNs: digital retail marketplaces that offer advertising spaces

- Ads typically feature promotions or discounts to encourage purchase

Social media RMNs: digital marketplaces within social media platforms

- Ads entertain and complement user-generated content to work on building awareness

Large retailer RMNs: a physical retail space

- Ads typically feature messages that induce consideration or purchase; useful to promote trials of new products

Superapp RMNs: ecosystem of services

- Allow curated ads to be served at different purchase stages and types of services; also providing an integrated payment system that captures offline and online transactions

Within the US, accounting for more than a third of the global market, there are two dominant players within the CPG RMN space:

Walmart in particular stands out as the trailblazer, having identified that retail media profit margins are typically much higher (70-90%) compared to traditional retail, which has much slimmer margin.

Walmart’s retail media network, Walmart Connect, contributes significantly to its profits, with advertising and membership revenue accounting for a little over a quarter of the company’s operating income in Q4 2024 and still growing at a rate close to 20%/year.

Leading retailers, like Walmart, have for some time moved beyond traditional retail revenue streams (capitalizing on physical assets and engagement to win with shoppers) to new digital revenues streams (leveraging data and digital assets to drive value creation).

Why is retail media important to brands?

- More precise targeting: Retail Media offers brands the ability to precisely target a vast range of audiences. The retailers’ first party data enables a precise attribution, to ensure brands can target their ads to the right audience. This will be even more crucial when third-party cookies are phased out leaving marketers unable to target two-thirds of the world’s internet users.

- A more diverse range of outcomes: Trade marketing is effective at delivering short-term sales lift, but it is narrow in terms of reach and frequency. Retail Media expands the advertising reach of brands across a vast range of touchpoints, at various points of the customer decision journey, in a brand-safe way. Broader retail audiences can also be targeted (e.g. new parents or tech enthusiasts) to drive awareness of an advertiser’s product.

- Volume potential: The rapid growth of e-commerce means Retail Media has reached critical mass – riding a third wave of digital advertising. From 2012 to 2022 the online share of retail trade more than doubled in the UK and more than tripled in Germany, with a 26.5% and 19.6% share respectively according to the Centre for Retail Research.

- Closed-loop measurement: Most Retail Media solutions can directly attribute sales to advertising activity within their reporting. This makes it extremely attractive to marketers, and commercial and finance teams alike.

- Visibility and credibility: Access to large audiences leveraging data from retailers helps establish a brand in a crowded marketplace.

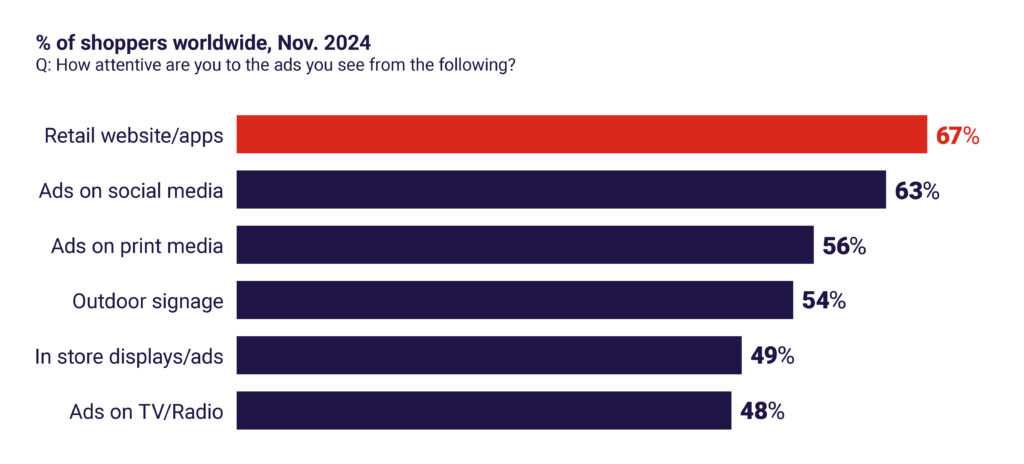

As a result of all these features Retail Media has surfaced to the top in terms of attentiveness when shoppers search for a product.

Measuring success of Retail Media campaigns

Wild Planet US, a seafood brand committed to environmental sustainability, needed to find a way to convey its important brand purpose and justify its relative cost compared to competitors. They decided to invest in retail media networks to drive sales and attract new-to-brand customers with a refined positioning strategy. In particular a combination of online and in-store advertising was used, leveraging the Walmart Connect platform.

Results: +46% new to brand sales during the defined period.

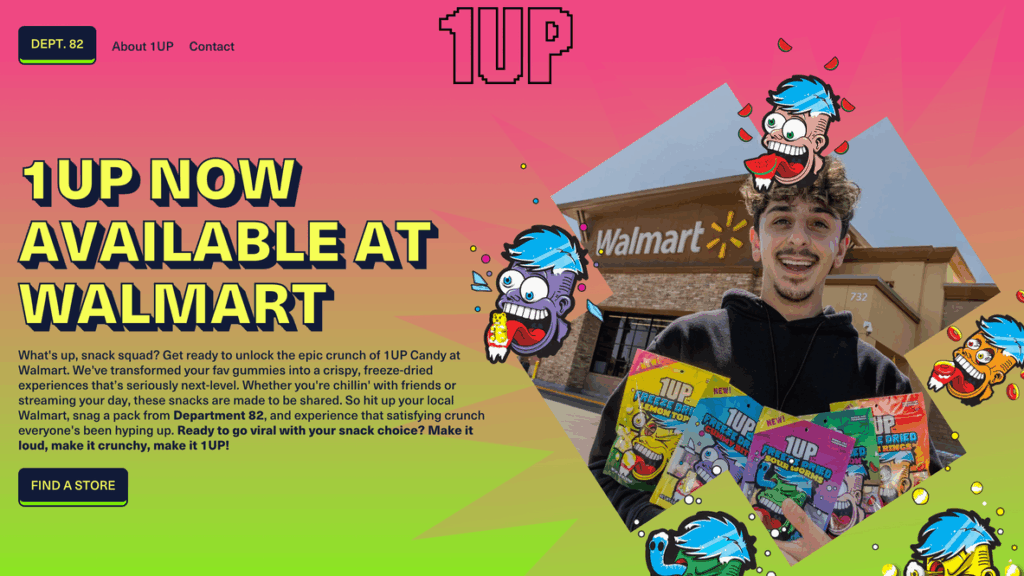

1UP US, co-founded with YouTube creator FaZe Rug, launched in May 2022 with a traditional DTC website and then pivoted to Walmart as its primary retail channel just a year later. The creator uses his social media platform to showcase Walmart, integrating the retailer into the brand’s narrative, regularly featuring Walmart store visits and employee interactions in his social content, turning the typical Walmart run into a fun and shareable event.

Results: The brand has broken through with younger generations while contributing also to the image and equity of the retailer.

Nestlé Purina Germany, focused on existing cat product buyers with a cross-media campaign combining programmatic out-of-home (OOH) and online audio advertising, leveraging purchase data provided by a leading German retailer. The impact was directly measured through subsequent in-store redemptions of the coupon via a conversion in the retailer’s app.

Results: -38% cost per acquisition when targeting loyal cat-product purchasers.

Mondelēz UK, providing a better shopper experience and greater personalisation.

- An Easter campaign for Cadbury in Tesco stores made use of stores’ ‘Scan As You Shop’ option and the link to users’ Club Card data to deliver relevant, personalised communications.

- “This delivers in terms of return on investment much more sizably for us – so there’s a big commercial upside as well.” (Hayley Hough, Category Director)

How Brands Structure Their Retail Media Management

As retail media is still a relatively new field, there is no single ‘right way’ to manage it. Management approaches and roles can differ significantly from brand to brand:

- Some organizations have dedicated positions—such as Head of Retail Media or Retail Media Campaign Manager—supported by specialized teams focused exclusively on this area of marketing and investment.

- Others adopt a more integrated approach, assembling cross-functional teams with representatives from key departments involved in retail media campaigns, including Sales, Marketing, Trade, and Media.

Roles and responsibilities can involve:

- Sales: managing overall customer relationships and coordinating the planning calendar and managing trade spending.

- Marketing: managing the overall brand message, consumer messaging, and product focus areas, as well as long-term brand planning.

- Shopper Marketing: developing and executing the strategy of retailer marketing and media programs in coordination with the trade and brand calendars.

However, the challenge remains that, when it comes to who manages the investment, in most cases there is still a tension among marketing, media, sales and commerce teams over which oversees RMN budgets and strategy – and this impacts both speed of adoption and overall effectiveness.

The bottom line

Retail media can no longer be seen as just an “add-on” for placing ads. It’s about creating meaningful connections with consumers and as such it’s becoming central to the marketing mix.

Long-term success depends on:

- Getting the fundamentals right (scale, transparency, measurement).

- Balancing on-site efficiency with off-site reach.

At Sevendots we continually monitor developments in the CPG space and identify growth opportunities for CPG companies.

Retail Media represents one of the opportunity areas being actively explored with and for our clients as a means of addressing rising consumer expectations for personalized solutions, as summarized here “Personalization at Scale: Providing increased value to your consumers”.

Contact Sevendots to learn more.