Brand Growth, Consumer Trends 01 April 2025

Navigating Growth Challenges: How major CPG companies plan to sustain growth despite volume pressures

Large consumer packaged goods (CPG) companies continue to seek sustainable growth despite a mixed set of financial results in 2024, driven primarily by challenging market conditions that have suppressed volume growth.

Sevendots, Rome

4 minute read

Low Volume Growth

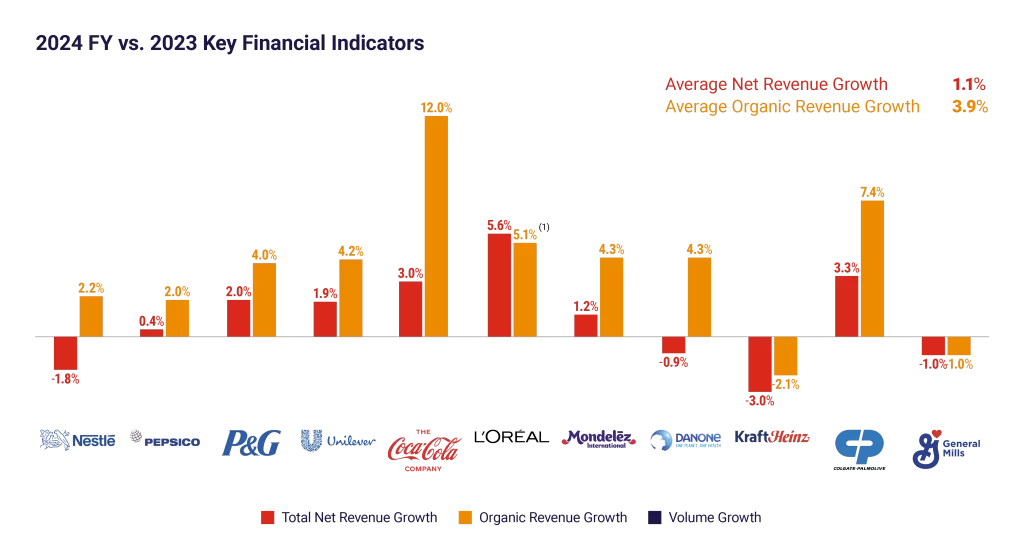

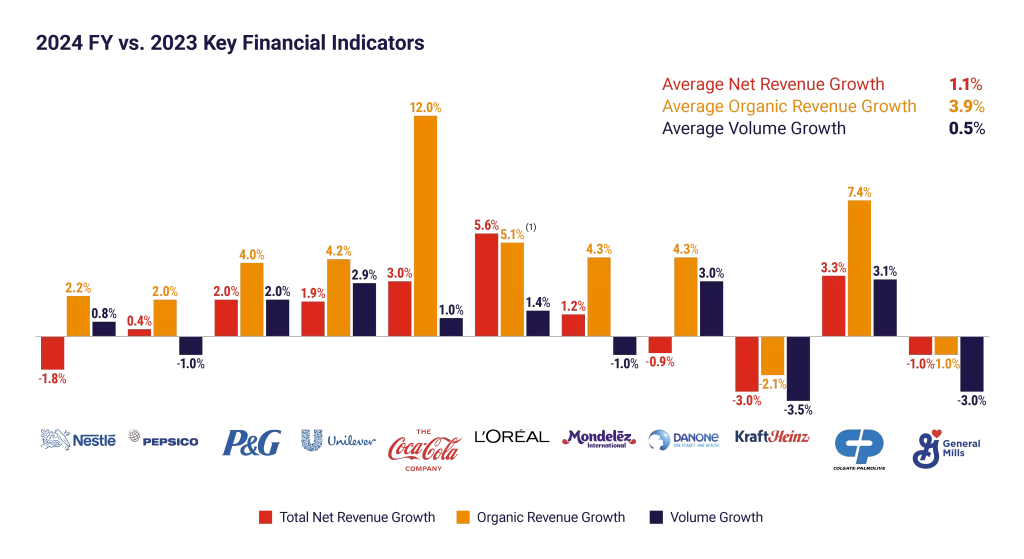

Based on the low volume growth experienced in 2024, overall organic growth among the eleven leading CPG companies analyzed averaged approximately 4%, but only 0.4% was volume-driven, with three companies experiencing declines. This creates significant tension, pushing companies to rethink and re-balance their growth strategies. Companies like Nestlé are notably prioritizing volume growth, using specific metrics like Real Internal Growth (RIG) to closely track and manage underlying performance.

2024 FY showed close to 4% as average organic growth

But generally struggling in driving volume

Focusing on three areas to boost growth

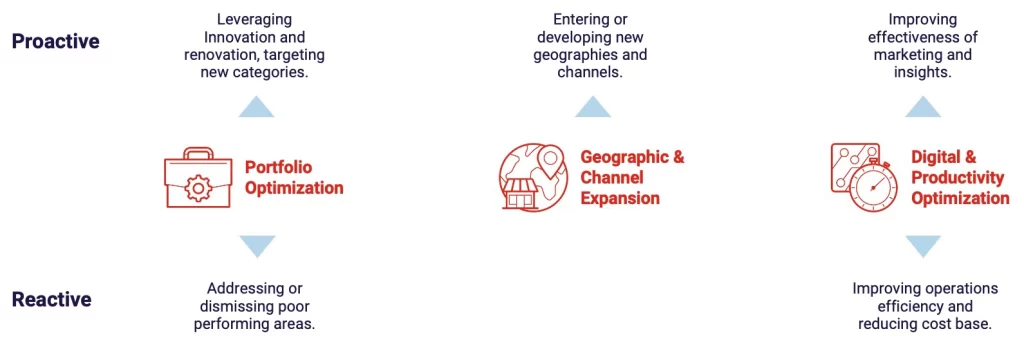

Three primary growth levers, among others, have emerged as crucial to addressing the challenge analyzing the different announced strategies of the companies:

In the identified growth strategies there is a mix of proactive and reactive approaches

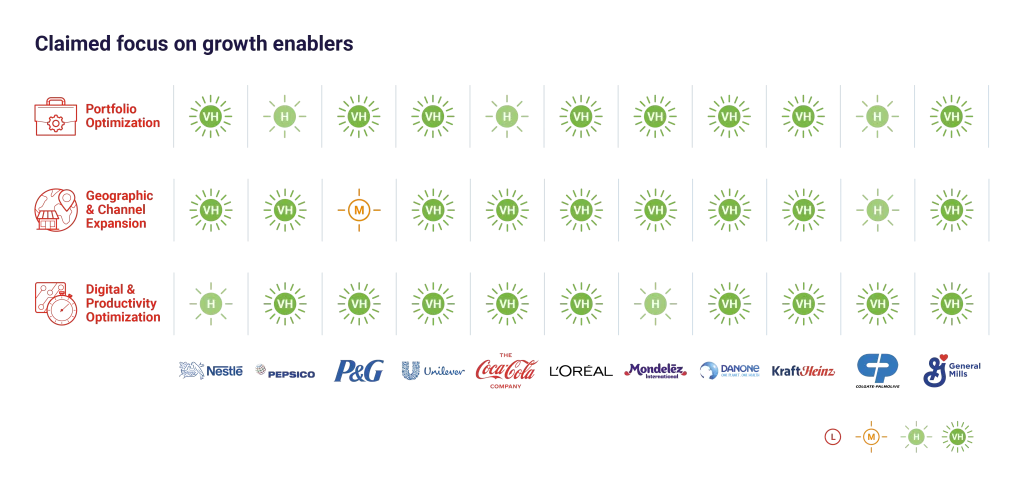

Most companies claim to leverage all three areas but with different levels of priority and intensity

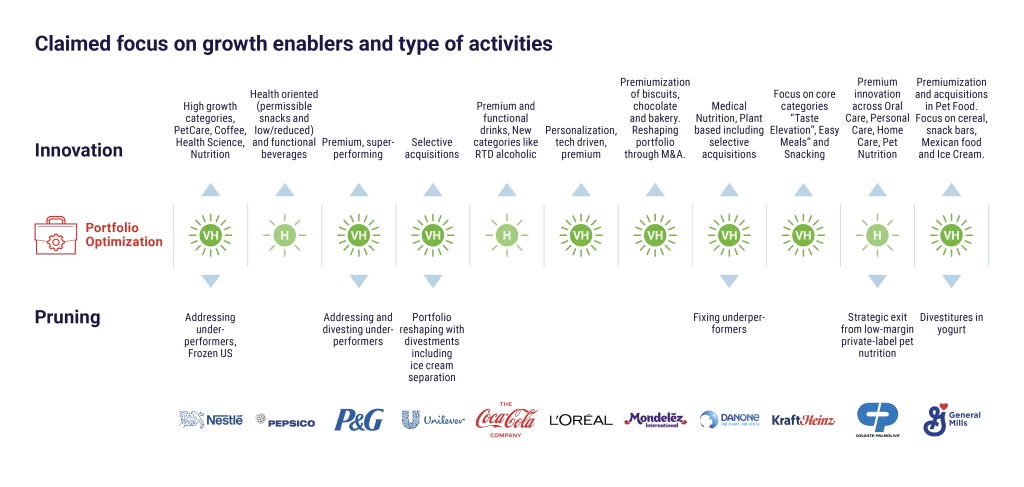

Portfolio Optimization: Focusing on higher growth categories and Effective Innovation

Portfolio optimization has become essential for responding effectively to volume pressures. Companies increasingly leverage innovation and targeted category management to attract consumers and stimulate volume growth.

Coca-Cola is expanding into functional beverages, as well as new categories such as ready-to-drink alcoholic products. P&G emphasizes superior-performing product innovations alongside actively addressing or divesting underperforming brands. PepsiCo is also betting on functional beverages and together with Mondelez innovating with health-oriented and premium snacks.

L’Oreal is investing in technologically supported innovation. Nestlé selectively innovates in high-growth categories such as pet care, coffee, and nutrition, while Kraft Heinz sharpens its portfolio focus around Taste Elevation, Easy Meals, and Snacking.

The ability to address underperforming parts of the portfolio, invest in high growth potential categories and develop more differentiated and transformative innovation become crucial elements to sustain volume increases.

Most of the focus in portfolio optimization is on innovation driving premiumization or leveraging higher potential categories

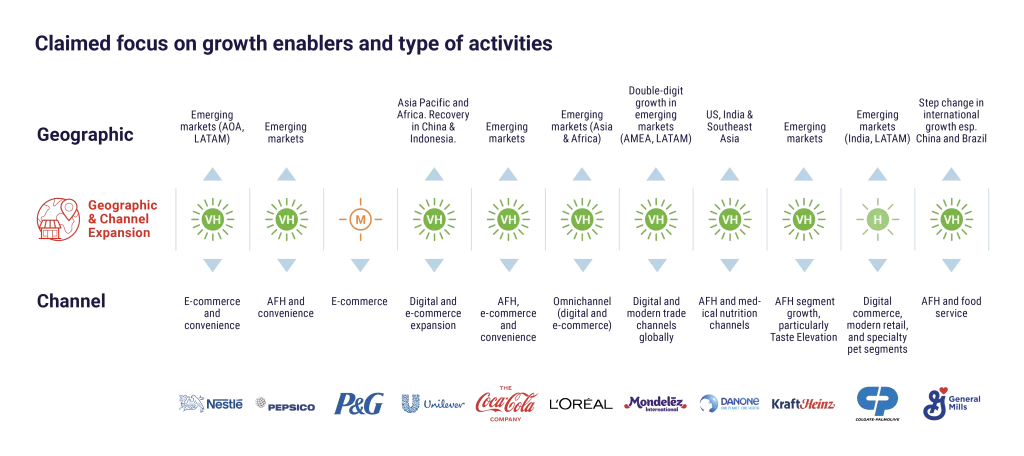

Geographic & Channel Expansion: Developing Emerging Markets and Away From Home Channels

Geographic and channel expansion are key responses to the volume growth challenge, with emerging markets, digital commerce and Away-From-Home (AFH) prominently featured in growth strategies.

Kraft Heinz aggressively expands in AFH segments through the Taste Elevation category, while PepsiCo, Mondelez, and Coca-Cola emphasize growth in emerging markets and diversified channels like AFH, digital, and convenience stores. Colgate-Palmolive and L’Oréal strongly underline emerging market penetration, particularly in Asia, Africa, and Latin America, with a targeted focus on digital commerce to capture incremental consumer volume.

The right choices on geographies and channels impact directly the ability for companies to increase their portfolio footprint reaching more consumers and fueling penetration.

Most brands still have ample room to increase global penetration and are underperforming in new sales channels, reducing the ability to fuel growth and extract more value from the existing assets.

Large potential is still seen in emerging markets while AFH and digital channels are focus areas for retail expansion

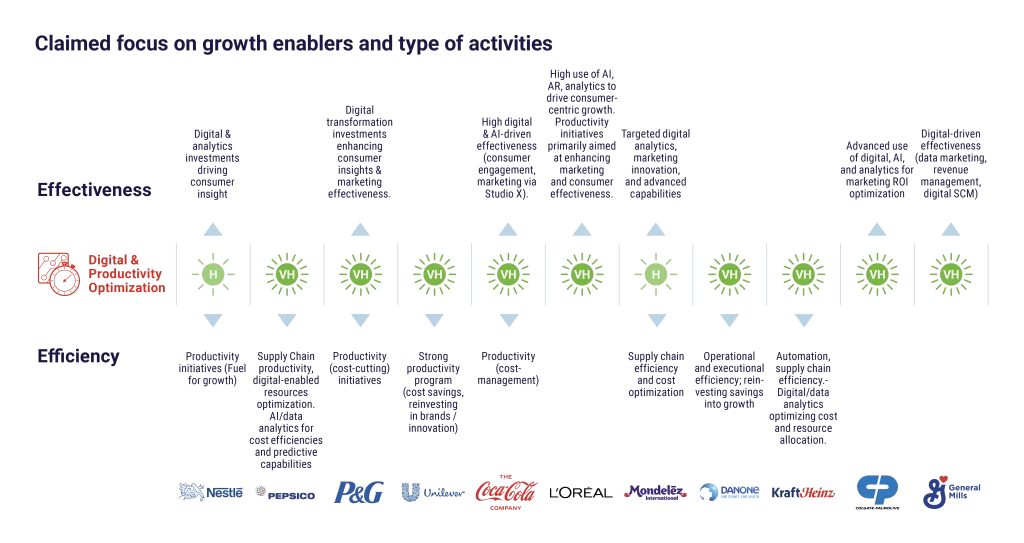

Digital & Productivity Optimization: Unleashing Resources and Increasing Marketing Effectiveness

Digitalization and productivity initiatives are increasingly directed toward reinvestment in marketing, innovation, and strategic market activities that directly drive consumer demand, enhance brand penetration, and stimulate volume growth.

Companies like Coca-Cola and L’Oréal prioritize digital effectiveness, utilizing AI-driven marketing and consumer analytics to improve ROI and enhance brand engagement. Kraft Heinz and PepsiCo heavily focus on productivity-driven efficiency, investing savings into innovation and market growth initiatives.

Nestlé, Mondelez, and P&G balance productivity-driven cost savings with effectiveness-driven consumer insight and marketing investments.

Leveraging AI and reducing the distance between data and their leverage is a key driver for improving marketing effectiveness and consumer engagement. Releasing resources through operations optimization allows for bigger investments in brands support.

Companies are splitting equally between increased marketing effectiveness and supply chain efficiencies

Conclusion: Navigating the Volume Growth Challenge

As volume growth remains subdued for large CPG companies, portfolio strategies, geographic and channel expansion and strategic reinvestments enabled by digitalization and productivity optimization become increasingly critical.

Companies that redefine their portfolio, develop successful differentiating innovation, target new geographies and channels and successfully leverage digital transformation and cost efficiencies will likely achieve sustainable growth and competitive advantage. Bringing back volume at the center of their strategies. Ensuring alignment among these strategic priorities and continuously adapting to evolving consumer expectations and market dynamics remain essential for sustained growth and profitability.

The Sevendots Value Creation Path allows companies to make an objective and deep assessment of their portfolio, identifying optimization opportunities. Based on that Design To Consumer Preference offers the opportunity to increase top and bottom-line growth in the short and long term, releasing resources to be invested in real innovation. Transformative Innovation Path allows companies to leverage internal capabilities with a start up mindset to identify real breakthrough and differentiating new products and offer. This ensures strong long term sustainable growth.

Sevendots also supports CPG companies to identify and implement geographic expansion and channel development, offering direct and implementable solutions that accelerate client business growth.

Contact Sevendots today to discover more.