Growth 29 April 2024

Boosting CPG performance by linking portfolio management to growth strategies: Advice for decision makers

Without a clear strategic roadmap for your portfolio management, growth can stall. Sevendots presents advice for decision makers to better leverage growth strategies in the CPG industry.

Sevendots, Rome

5 minute read

The evolution of portfolio management

In 2019, as part of our Sevendots Growth Series, we released a pivotal study on portfolio management within the Consumer-Packaged Goods (CPG) industry. At the time, our exchanges with senior brand owners revealed a surprisingly limited focus on this critical area. Also, it appeared that many decisions surrounding portfolio management were being made without a clear strategic roadmap in mind. To address this gap, we developed a straightforward framework linking the three levels of portfolio management (Categories, Brands and SKUs) with their corresponding decision triggers, providing a clear snapshot of both passive and active decision-making processes.

Adapting to new dynamics of product portfolio management: the 2024 update

If we fast forward to today, the landscape has evolved significantly due to various trends and events that have reshaped the CPG sector. The pandemic, followed by high inflation and the devastating consequences of wars in different regions have further impacted CPG companies’ priorities and focus. Our updated study delves deeper into how these changes have influenced approaches to portfolio management. The above framework remains valid, but we have also explored the correlation between portfolio management and business growth, hypothesizing a logical connection between these decisions and tangible business outcomes.

In fact, as many studies and reports proved over the years, one of the most effective ways for a company to sustain long term Total Shareholders Return is through an active management of its portfolio both making sure to revisit it periodically and ensure resource allocation and investment occurs in the most productive way, prioritizing these in alignment with the wider business strategy(1).

Exploring growth strategies to your product portfolio: a four-pronged approach

There is value in trying to understand how different growth strategies impact portfolio management decisions both in terms of the primary level they need to focus on (categories, brands, or SKUs) and the triggers (i.e. strategy, financials, consumers, customers). After having reviewed many cases, data sets and literature we identified four prevailing CPG company growth strategies that can be related to portfolio decisions. They are represented in the slide below and the implications of each are then analyzed.

Mergers and acquisitions (M&A) driven growth

M&A remains a dominant strategy and revolves around buying companies that can provide an accretive margin level and a more solid growth trend versus the existing business. For example, Unilever’s attempted acquisition of GSK’s consumer health business aimed to capitalize on the high margins of the consumer health sector. Unilever offered a very high purchasing price (considered too high by some analysts) but the bet was to expand profit considering that consumer health, in addition to double digit projected growth, is generally running at 15%-25% net margin(2) vs. Unilever’s which is just above 10%(3). At the same time, the recent decision from Unilever to sell off their ice cream business can be seen as a reactive decision to remove lower margin business among their five business areas(4). These actions highlight the strategic use of M&A to refine company portfolios and enhance financial performance.

M&A driven growth can be valid also within the same category, allowing companies to increase their market share, but in this case, the way to get accretive margin is mainly linked to scale and operational efficiencies (besides the possibility of reaching a new segment of the market or a new geography). However, we can see that the bet associated with these acquisitions is generally bigger as they represent a higher risk of failing to meet expectations. A well-known example of this was the Coty acquisition of P&G beauty brands in 2016 that did not produce the expected results and drove the company to take a nearly $1bn write down on the assets in 2019(5).This is why we see that M&A growth strategies are increasingly linked to a category level decision within the portfolio, with the main driver being expansion.

Growth from scale

This is a strategy based on further leveraging existing assets. As in the M&A growth strategy, we can see a shift from scaling an existing brand in the same category to stretching it across different categories, mainly adjacent ones. In this case, scale is reached primarily through intangible (and sometimes tangible) brand equity elements that are spread across different categories (normally through a selected single or multiple stretching driver). This is the concept of ‘Powerbranding’: the ability for a brand to cover a much broader territory. A great example of this growth from scale is represented by Nivea. With a well-structured and long-term stretching strategy, Nivea became a €5 Billion plus revenue brand in 2023(6). Nivea strongly expanded its territory with close to 100 different products, and is now seeing its future more in beauty (where margins could be more interesting) than in personal care(7). This expansion was well governed and reinforced the equity of the brand, and was made possible mainly thanks to strongly differentiated and highly performing products. The main driver of this growth strategy is well governed and smart stretching.

Higher margin development

This could be considered as an ongoing premiumization strategy, where the company periodically substitutes the lower margin units from its portfolio in favor of new higher margin ones. This can normally be played both at a brand and SKU level.

A good example within the first area was Danone YoPro (with slightly different branding from country to country). This was a successful protein-based dairy brand that boosted and targeted more specifically the functional element of the yogurt category. The strong and well-articulated targeting exercise attracted fitness and sport-oriented individuals, which allowed the brand to build a broad consumer base and a strong brand profile. Also, the product, thanks to its functionality linked to high protein content, is premiumizing the category by developing a new segment The high-protein platform in 2022, just after a few years from the launch, sales exceeded €500M in sales (8). The main driver of this growth strategy is mainly innovation and or renovation.

Cost-cutting margin expansion

This growth strategy is focusing mainly, but not only, on the bottom line. It aims to streamline the portfolio, removing those items that not only have a low margin but also a low rotation. Cutting low rotation items can boost the performance on other items that better leverage their scale. An example here is P&G USA. For the company, the bottom 25% of SKUs in the categories it operates in, deliver a very small contribution to absolute retail sales. In an initiative created in conjunction with the customers, P&G leveraged POS data and their own proprietary algorithms to determine which SKUs they should focus on across all regions and all categories(9). In this case the main driver of this growth strategy is a well thought and grounded rationalization.

The synergy of strategies

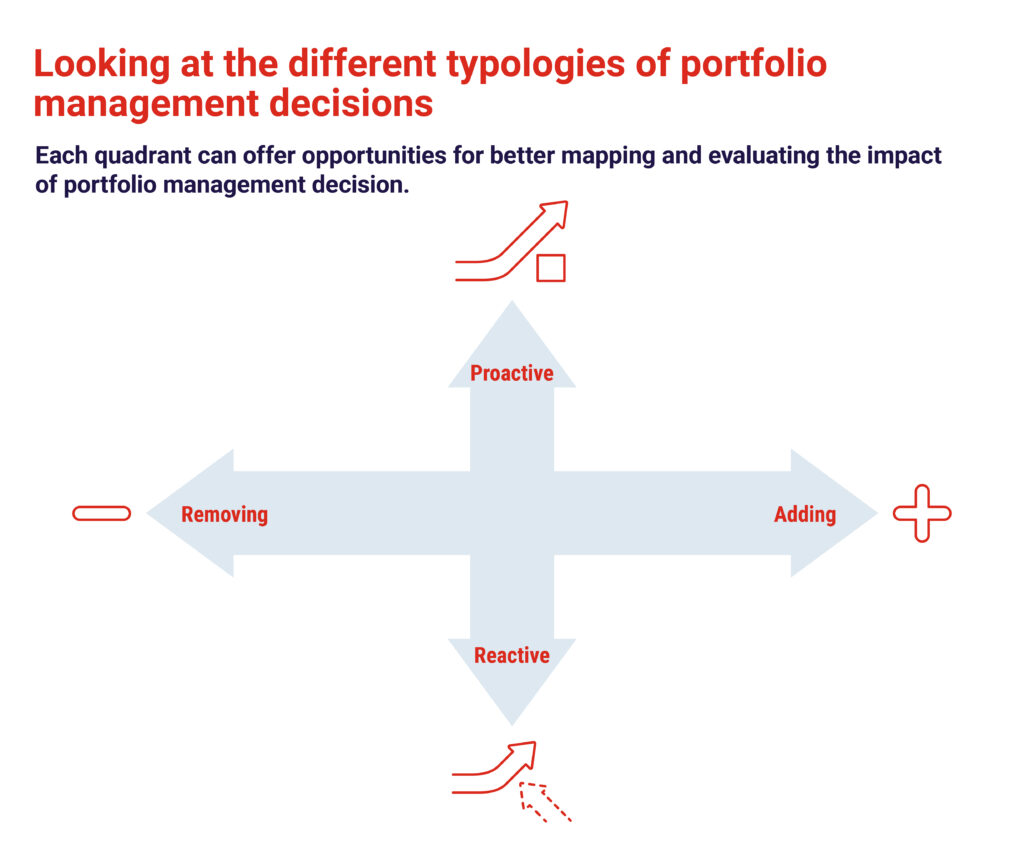

While these growth strategies may appear distinct, they are often employed in synergy to enhance a company’s growth trajectory. It could be relevant to look at a distinction between proactive and reactive portfolio management decisions that impact incremental or decremental units within the portfolio. This simple perspective can provide CPG companies with a robust framework to evaluate possibilities as well as measure the potential impacts on revenue and margin growth.

While a reactive approach, accompanied by removal of low value items, should remain an integral part of an ongoing portfolio optimization process, strengthening competitive advantage through a more proactive approach should also be a considered as a strategic priority.