Brand Growth 28 May 2024

E-commerce strategies for CPG growth with inspiration from Asia

E-commerce growth within the CPG industry presents a huge opportunity to brands. However, it comes with distinct challenges. Sam Bedi unpacks the opportunities, taking inspiration from Asia.

Sevendots, Singapore

5 minute read

CPG companies around the world are acutely aware of the growth in E-commerce. Following rapid expansion of E-commerce in recent years, particularly post-pandemic, more moderate growth rates are anticipated in the next 5 years. However, online channels are still predicted to grow 3x faster than in-store (1). Given E-commerce is still set to grow at a faster rate than traditional offline, this raises the need for CPG companies and CPG brands to ensure their marketing strategies are appropriately positioned. They must be aware of factors to incorporate this channel into their business strategies, execution, and messaging, in order to drive online sales success.

Recently, Sevendots was asked by a leading CPG player to examine and understand how they could exponentially grow their revenue from E-commerce in Europe from their current level, to a targeted 20% of revenue (or 4X the current online performance). In particular, smaller brands in the US account for 54% of sales within E-commerce compared to 22% in physical stores (2). Big companies are therefore trailing behind E-commerce sales versus smaller brands. Additionally, it can be observed that lower shopping frequency online leads to higher brand loyalty rates, as there are fewer opportunities to switch – the use of favourites/list creation on online shopping sites supports this. As brands and product listings online can be sorted alphabetically, and many brands and product pages can fit simultaneously on a screen, this reduces the impact of limited facings and less ideal shelf placements that smaller brands tend to suffer from in physical stores (3).

While tackling the specific challenges facing the client within their E-commerce marketing approach, it became evident how similar factors apply to various other consumer goods companies headquartered in Europe, across both brands and retailers. Whilst most leading providers do emerge from the USA and Europe, there is a growing understanding of the importance and role that Asia (specifically E-commerce Platforms in Asia), can play in inspiring the development of E-commerce and broader digital evolution worldwide across the CPG market.

Drawing inspiration from Asia

In identifying future trends emerging across the E-commerce and digital landscape, we could identify clear sources of inspiration from Asia. Specifically, the evolution and development of digital and E-commerce platforms and solutions across various markets, particularly China, provide examples and case studies for CPG companies across Europe and North America, as well as developing markets outside of Asia. As the analysis delved deeper, it becomes clear that there is a need to identify trends underpinned by consumer behaviour which can travel across regions and help companies focus on those specific platforms and services that expand the opportunity set for E-commerce across developed markets such as Europe and North America. What can we learn or draw inspiration on from Asia?

Social Commerce

A landscape view of E-commerce operating across regions shows increasingly defined forms of E-commerce. A notable difference can be found in social commerce, with Asia accounting for 50% of global sales in this form compared to just 15% in Europe (4).

Worth noting is how companies in Europe tend to play in a limited segment versus those in markets in Asia. A strong prevalence of players in Europe remain principally focused in E-commerce segments defined as Traditional Retailers (i.e., Tesco.com, Carrefour.com) and Online Retailers (i.e., Amazon).

However, the perspective from companies operating in Asia, particularly more recently formed local or regional CPG companies, shows a willingness to operate across several segments, finding strategies – including portfolio management and content strategies – as part of their wider channel growth strategy. These include indigenous, or locally created or developed platforms, such as TikTok (or Doyen as it is known in China).

Social Commerce in China is estimated to already account for 16% of E-commerce retail sales last year (2023), with 84% of Chinese consumers purchasing at least one product via Chinese social media platforms (5). However, within Social Commerce, the sub-division of platforms does not just include TikTok, one of the most recognised platforms around the world, but also other forms more centered on things like content sharing, or knowledge centers such as Pinduoduo.

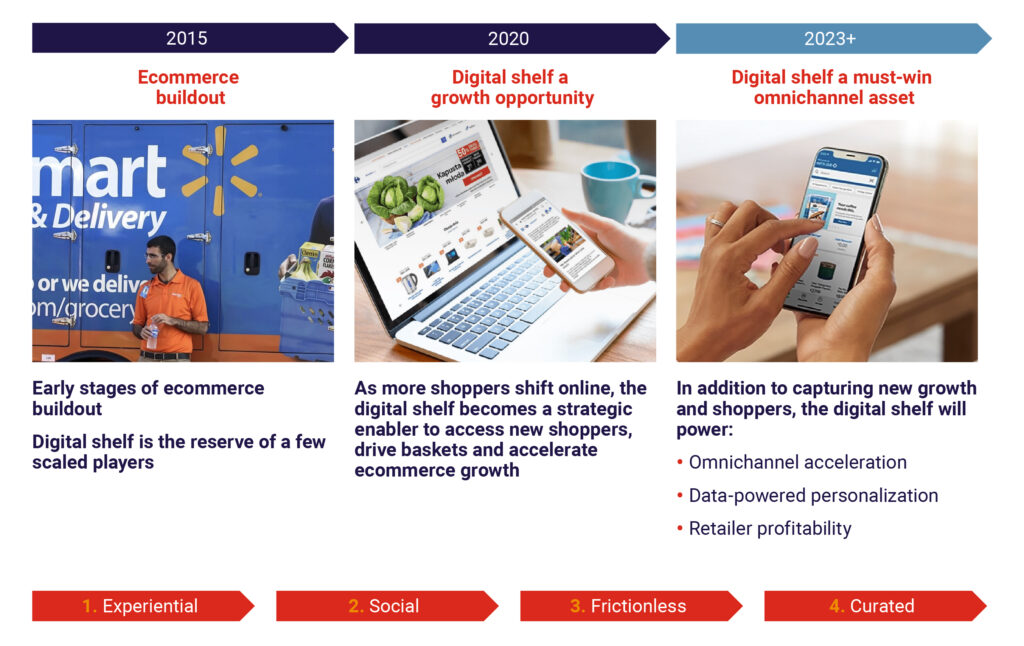

The Digital Shelf

What also emerged from the increasing time people are spending on digital devices for shopping needs is the increasing importance of the ‘Digital Shelf.’ This is a space where an ever-increasing number of brands and products want to reside. Noteworthy is the accelerating advancement over the past decade of the Digital Shelf in its increasing importance relating to maximising visibility and the customer experience.

Brands need to win at the ‘Digital Shelf’ to drive omnichannel acceleration, including ensuring availability of CPG products at the supply chain level and in accordance with consumer demand (including delivering product personalisation at scale based on customer data), driving increased traffic (through AI ready search), and conversion (including AI powered generative content creation, for maximum and immersive consumer experience). The experience of the online store therefore offers opportunities for significant conversations based on real-time data and interactive consumer experiences.

The Challenges of E-Commerce Growth

From a company point of view, the opportunity for revenue growth around based on successful online marketplaces is clear despite previous scepticism towards DTC and similar channels. Equally, there are challenges within the ecosystem when it comes to implementing successful E-Commerce businesses, starting with the need for optimization within a portfolio to suit the omnichannel world. The idea of Optimise ‘versus’ Duplicate is about selection. This not only includes clarifying metrics behind digital marketing, but also determining how to target consumers by selecting the right items within the portfolio for greater online versus offline success, factoring in tactics such as up-selling and cross-selling, for maximum ROI.

Additionally, Consumer Goods companies have experienced significant market disruption to CPG sales due to the rise of Discounters, which continue to gain market share across various regions. More recently, the surge in online purchases has added a new challenge for major CPG companies, with online market shares stabilizing at approximately 20% in Asia, 12% in the US, and 8% in Europe (6).

Tackling these challenges must be considered within three key areas: Fulfilment, Replenishment, and Forecasting & Inventory. These should be considered in addition to the sales and marketing challenges. These are key areas where companies will need to evolve both technology and capability to ensure the rising consumer demand and expectation is met by the CPG industry.

And with the increasing adoption of ‘community digital trends’ such as Gamification and AI, there is a growing need to consider how content and engagement strategies for companies will be developed for maximum consumer appeal within the Digital Shelf and surrounding social media channels, ensuring brand and product discovery going forward.