Growth, Innovation & Disruption 21 March 2024

Innovation drives growth. How can CPG ensure investment pays back?

Innovation is seriously under-leveraged in the CPG industry compared to other industries. The question is: Why? And what will it take for CPGs to catch up and ensure that any investment is paid back? This article provides key steps for leveraging innovation more effectively.

Sevendots, Rome

5 minute read

In our latest Growth Series report, we investigated the state of innovation in the consumer packaged goods industry. What becomes clear when analyzing data, cases and listening to the opinions of many brand owners is that innovation is seriously under-leveraged in the CPG industry when compared to other industries. The question is: Why is this the case? How significant is this lag behind other sectors? And what will it take for CPGs to catch up and ensure that any investment is paid back?

In this article:

- Understanding the innovation landscape in the CPG industry

- Current investment in innovation

- The risks of not investing in innovation

- The opportunities presented by innovation

- Key steps forward for the CPG industry

1. The innovation landscape: Diagnosing the dilemma in CPG innovation

Innovation in the CPG realm is misaligned with return on investment, as companies disproportionately bank on returns from other avenues instead of from new CPG products or product innovation. Echoing a 2018 Harvard Business Review insight (1):

“Among CPG firms, R&D spending has not driven sales; marketing spending seems to have been the primary driver.”

When it comes to innovation initiatives, there is the pervasive sentiment of high risk and governance disillusionment which seems embedded in CPG firms. In our surveys, it was significant to discover that 40% of brand owners dismiss the notion of setting innovation-driven revenue growth targets. This skepticism fosters a preference for scaling existing operations deemed less risky for immediate returns.

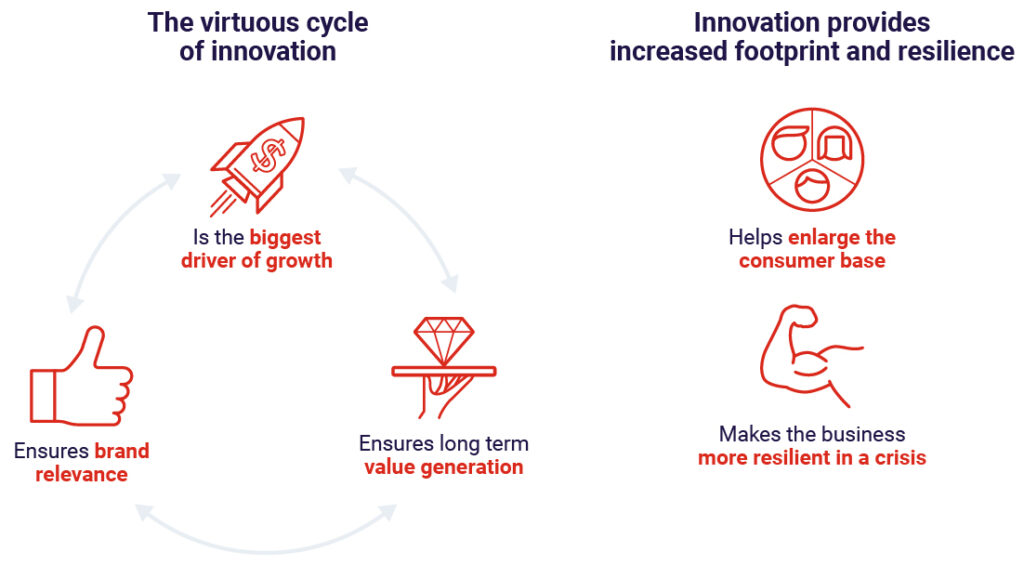

We believe this represents a lost opportunity. In fact, the undeniable link between innovation and revenue expansion underscores:

- Innovation’s role as a growth accelerator, enabling companies to surpass competitors.

- Evident long-term value and shareholder returns derived from innovation, ensuring brand vitality and market distinction.

- Opportunity for resilience and consumer base broadening through innovation, aiding companies in navigating economic challenges by tapping into new demographics.

Innovation in the CPG industry is highly necessary to expand market share. Macro forces like sustainability, consumer behavior and consumer trends, or tech advancements (like artificial intelligence) are heavily impacting consumption models and companies will need to adapt. Innovation is the key tool for this adaptation and could also become a way to proactively drive required change, ensuring improved consumption models and long term sustainable value generation.

2. Current investment in innovation: A comparative perspective

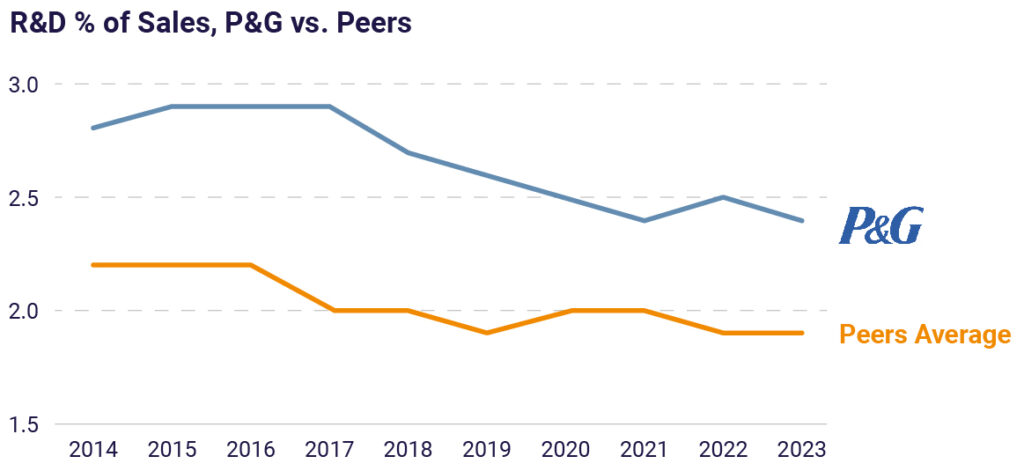

At the recent CAGNY conference, P&G unveiled data showing its R&D spending nears 2.5% of revenue, overshadowing its peers who linger below the 2% mark. This, however, highlights a declining investment trend, underscoring a gradual contraction in R&D allocations.

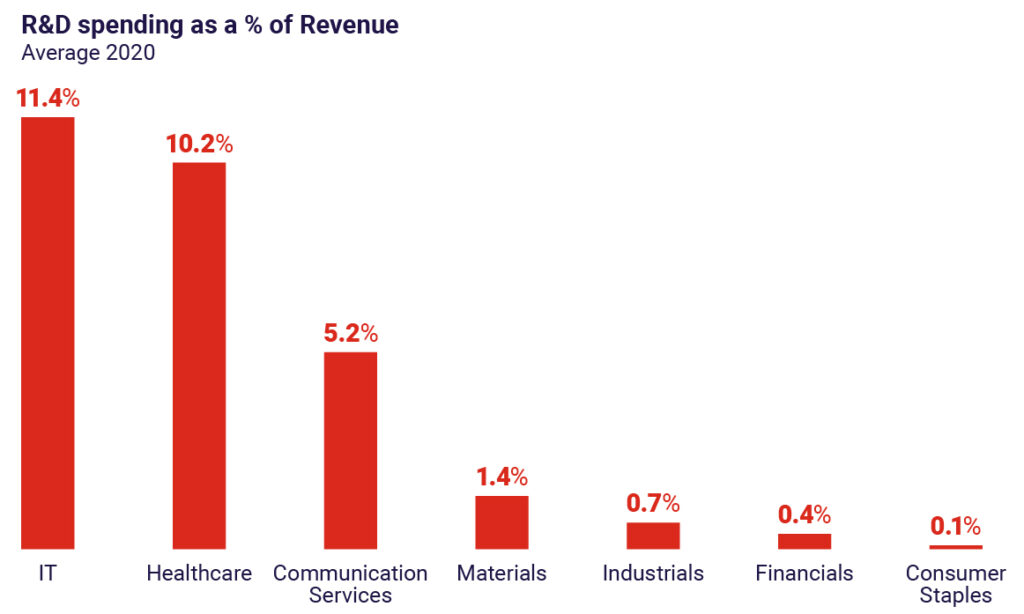

Benchmarking the CPG sector’s R&D expenditure against other industries reveals a stark underinvestment in innovation. It’s telling that amongst the top 50 most innovative firms (as ranked by BCG from a pool of over 1,000 global innovation executives), only four CPG companies are listed, and none above the 26th rank (2).

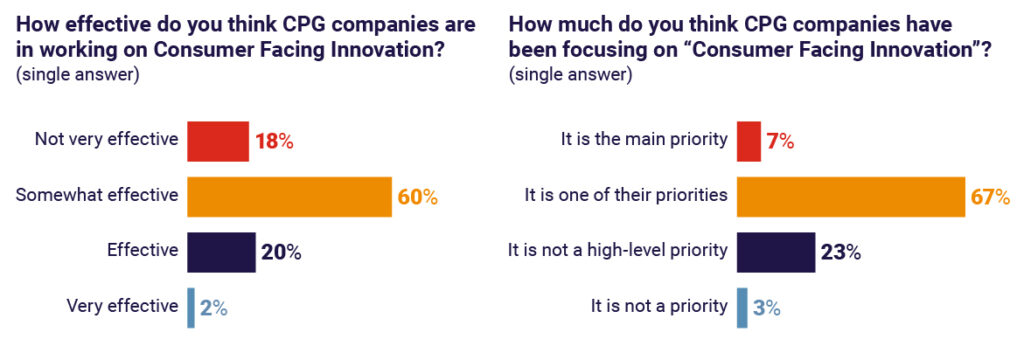

CPG brands and brand owners recognize that innovation is managed in only a somewhat effective way by CPG companies and that it is rarely considered as the most important growth driver for the industry. Therefore, it should not be a surprise that the number of new product launches has contracted in the past years along with the success rate of innovation. All of this represents a vicious cycle that is limiting and slows down the benefit that innovation could bring both to industry and consumers.

3. The risks of denying the role of innovation in the CPG industry

“Innovation guarantees a solid connection with consumers and the trade, it refreshes the brand, it provides newness. But today, companies don’t have a real focus on it.”

Corporate and Business Development Director, Beverage Multinational (3)

A prevailing view of innovation’s uncertain ROI and high risk has led to dwindling R&D investments, eroding CPG companies’ capacity to deliver groundbreaking consumer products. While a billion-dollar R&D investment might boost a pharma company’s stock, a similar move by a CPG firm could deflate its share value. As a result, the CPG industry tends towards innovation acquisition – many companies have preferred putting money into acquiring innovative businesses than in developing something new internally. The idea of incorporating existing innovative capabilities was perceived as less risky than investing in internal development. However, acquisitions are not risk free and the number of inherent failures indicates that this may not be a better way to pursue innovation.

4. Seizing opportunities presented by innovation

Maximizing innovation efficacy begins with a clear methodology, which is based on an unwavering focus on consumer needs and consumer insights to inspire every innovation endeavor. Essential principles include:

- Embracing holistic innovation: Look beyond products to solutions that span and transcend existing categories, offering meaningful differentiation.

- Setting clear targets: Despite potential discomfort, establishing innovation metrics is crucial for evaluating effectiveness, including capital expenditure, profit expectations, and the balance between short-term and long-term innovation impacts.

- Cultivating an open ecosystem: An inclusive approach that embraces external cues and partnerships enhances innovation scope, necessitating a flexible strategy that encompasses evolving business models and ventures.

- Fostering collective involvement: Encouraging stakeholder engagement in the innovation process promotes a culture of shared ownership and insight.

This can revive and instil a stronger focus and related payback from innovation, allowing companies to build effective and sustainable differentiation that is able to generate value in the long term. Also, innovation helps expanding the brand territory recruiting new consumers and converting more occasions.

5. Key steps forward for CPG growth

To fully unlock innovation’s potential, a strategic blueprint is essential, starting with a clear vision and defined objectives for innovation’s role. This involves identifying opportunities within a structured framework, delineating the innovation territory, and crafting the opportunity with specific considerations for the requisite value chain and business model adjustments.

Only through a disciplined, even if still creative, effort is it possible to activate an ongoing effective innovation pipeline that can structurally contribute to growth and sustained value generation.

Restoring faith in the competitive advantage provided by innovation requires its reintegration at the heart of strategic planning. This requires business leaders to define a vision and objectives, bolstering governance structures, innovation teams, ramping up investment, and emphasizing the pivotal role of internal capabilities in driving the innovation agenda forward. In doing so, CPG companies can not only catch up with but potentially lead in the relentless march towards sustainable growth and industry leadership.

The path forward is fraught with uncertainty, with significant forces reshaping the value creation landscape in the CPG industry. Only through pioneering and effective innovation can companies sustain growth and prosperity.