Consumer Trends, Portfolio Management 18 August 2025

Why Portfolio Management Must Transcend Marketing Silos: The Case for Cross-Functional C-Suite Leadership

Portfolio management is at the core of CPG performance. The question about the role complexity plays in effectively managing business is fundamental.

Sevendots, Querétaro

5 minute read

“More diversified portfolios with more proactive management, will allow CPG companies to cope more effectively with the emerging macro forces.”

Today, different macro forces are violently and rapidly shaping the CPG industry of tomorrow.

In the past, a lot of attention and money was directed towards avoiding complexity and simply focusing on increasing scale which justified the role and importance of mega brands.

Today, and even more so tomorrow, complexity is becoming a key asset in the value equation. Portfolio management needs to recognize the importance of this dimension and provide a strong combination of bigger and smaller brands to answer different needs. Of course, this requires new governance, industrial and distribution models. Similarly, measurement needs to adapt to capture the real performance of the portfolio as a whole.

More diversified portfolios with more proactive management of them will allow international CPG companies to cope more effectively with the emerging macro forces.

The traditional approach of delegating portfolio decisions exclusively to marketing and commercial functions represents a fundamental misalignment with the realities of modern CPG operations. While these functions undoubtedly possess crucial market insights, portfolio optimization extends far beyond consumer preferences and promotional strategies—it’s a complex orchestration that directly impacts operational capacity, financial performance, and strategic resource allocation.

“C-suite transforms portfolio decisions from marketing exercises into strategic value creation engines.”

The financial implications of siloed portfolio management extend well beyond immediate P&L considerations, creating cascading effects that demand C-suite oversight and cross-functional integration. Finance teams possess unique visibility into working capital implications, margin structures, and resource allocation trade-offs that marketing-led decisions often overlook. Operations teams understand manufacturing constraints, capacity utilization, and the true cost of complexity that can make seemingly attractive products financially destructive. According to KPMG’s 2 survey of 600 organizations, 49% of organizations had suffered a project failure in just a 12-month period, often due to inadequate cross-functional input during critical decision-making phases. When portfolio management becomes a C-suite responsibility with mandatory cross-functional input, companies unlock an optimized allocation of firm resources with maximized market share and revenues, transforming portfolio decisions from marketing exercises into strategic value creation engines.

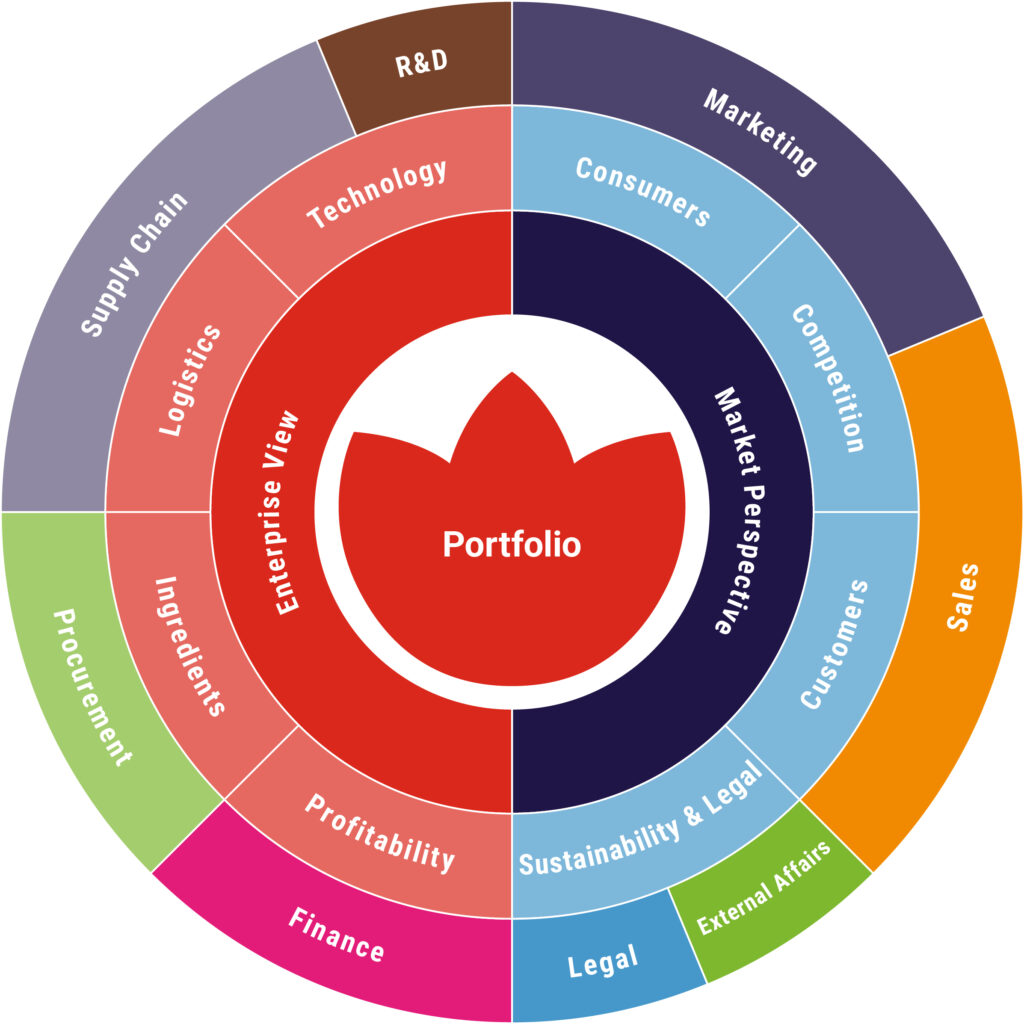

The following diagram provides a visual representation of the interplay between different functions. When portfolio decisions engage the full C-suite in a cross-functional dialogue, companies unlock superior strategic outcomes by aligning marketing insights with operational realities, financial constraints with growth ambitions, and innovation priorities with supply chain capabilities, ultimately delivering more robust and executable portfolio strategies.

Portfolio Strategic Decisions

Growth and portfolio decisions are strongly linked. In fact, they help to prioritize investment, optimize the product mix and steer the strategic direction.

There is value in trying to understand how different growth strategies impact the portfolio management decisions both in terms of the primary level they need to focus on (categories, brands, SKUs) and the triggers (strategy, financial, consumer, customers).

The following table summarizes the decisions and approaches to have a Strategic Portfolio Management:

| Portfolio Need | Strategic Approach |

|---|---|

| Revitalization Reinvigorate underperforming assets and restore competitive positioning. | Brand identity and Brand Purpose review Realign brand positioning with evolving consumer values and market dynamics. Complexity Optimization Streamline Category/Brand/SKU architecture to eliminate low-performing variants and reduce operational burden. Innovation pipeline acceleration Fast-track product development cycles to close competitive gaps. Channel strategy reformation Optimize go-to-market approach and distribution partner alignment. |

| Expansion Capture new growth opportunities while managing risk and resource allocation. | Adjacent categories analysis Evaluate brand extension, partnership and licensing opportunities leveraging core competencies and consumer equity. Geographical expansion analysis Assess market entry strategies with localization requirements and regulatory considerations. M&A strategic fit analysis Evaluate acquisition targets for synergy potential, cultural alignment, and integration complexity. Digital ecosystem expansion Leverage e-commerce and direct-to-consumer channels for market approach. Foresight forecasting Quantify expansion scenarios across multiple strategic dimensions (risk, equity and complexity). Strategic Supply Network Design Configure operational infrastructure to support scalable growth trajectories through integrated technological, logistics, and digital capabilities, while embedding ESG principles and organizational development as foundational elements for all expansion strategies. |

| Profitability Optimize value extraction and margin enhancement across the portfolio. | Strategic Revenue Management Implement dynamic pricing strategies and promotional optimization frameworks. It considers the mix between products, customer segments and distribution channels. Premiumization Elevate product positioning through innovation, packaging, and brand storytelling. Design to Consumer Preference (DCP) Engineer products that maximize willingness-to-pay while optimizing cost structures. Portfolio architecture optimization Rationalize product lines to focus resources on highest-margin opportunities. This may include assets divestiture assessment. |

A hint for long-term sustainable growth: Stop bleeding cash cows!

Long-term Total Shareholder Return requires balanced cost structure interventions to ensure sustained growth. According to BCG4, revenue and costs drive three-quarters of financial performance over five-year periods, making their optimization critical for shareholder value creation.

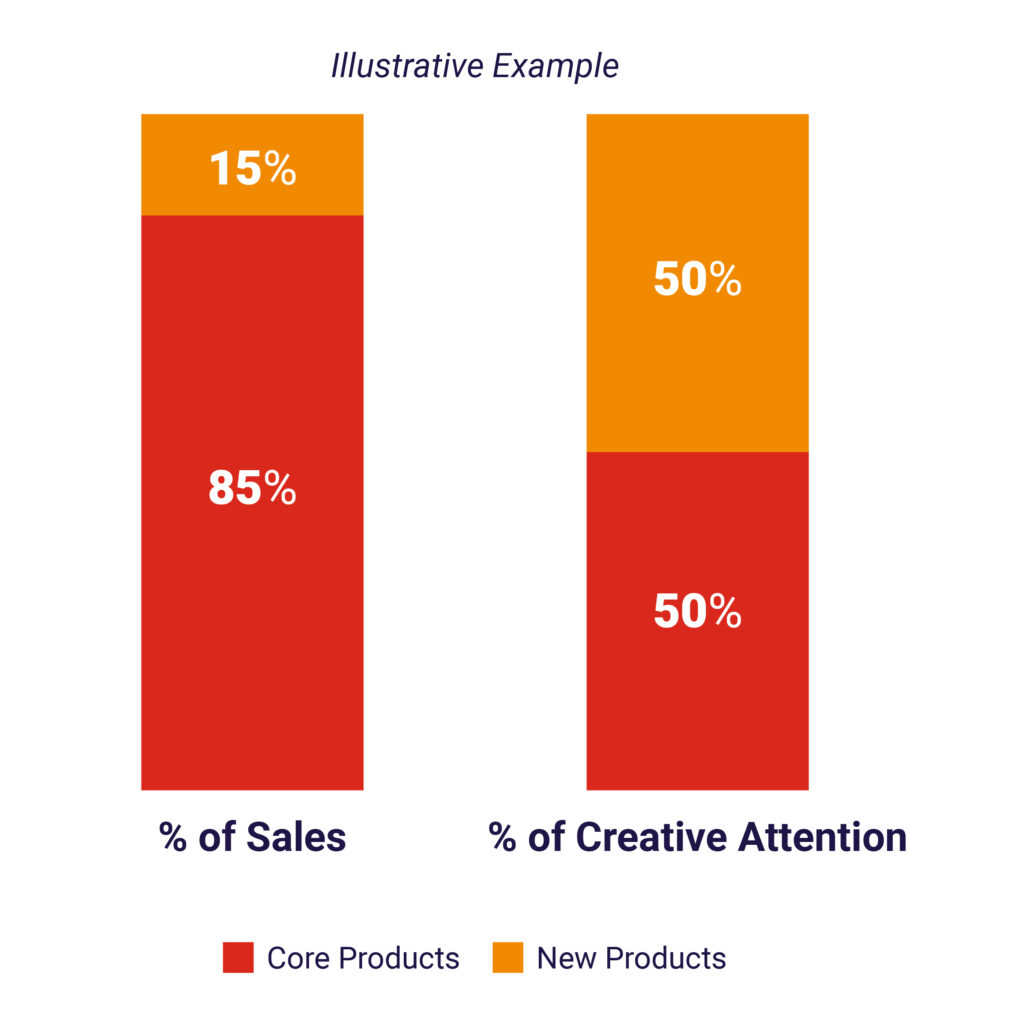

Strategic decisions regarding high-margin core SKUs must balance sustained volume growth, profitability, and competitive differentiation. These SKUs, representing major portions of both revenue and income, face two primary challenges:

- Continuous cost pressures that risk quality degradation through incremental reformulations using cheaper ingredients and lower cost sourcing strategies, ultimately jeopardizing long-term brand equity.

- These SKUs receive less attention in relation to innovation products, behind these potential reasons: concern in touching a major sales contributor, quest to keep up with emerging consumer needs and need to respond to competition.

The breakthrough solution is to apply Sevendots Design to Consumer Preference (DCP) methodology which combines the wealth of your internal knowledge with external knowledge on consumer understanding and product and process benchmarking. This proven methodology will allow to extract more value from the core products and moving their design into today’s and tomorrow’s consumer preference.

Design to Consumer Preference is a proven five steps methodology:

The process results into tangible deliverables:

- Comprehensive understanding of competitive landscape and consumer trends.

- Consumer feedback on current brand and product design vs competition and benchmark products.

- Evaluation of tradeoff between top line and bottom-line growth.

- Development of Business Case

- Implementation plan and timings

A case study of applying DCP comes from Unilever Ice Cream in Indonesia.

| Context | Actions | Results |

|---|---|---|

| Market share declining. AICE, a low-cost Chinese brand, was entering the market and rapidly gaining share. AICE has a market entry not covered by Unilever (<50% price). | Product range diversification into different size and price ranges. Product size reduction (25%) of Cornetto Classico as main and entry product to meet hot price point. Improvement of wafer quality and sourcing change. | Savings funnel ideas for 800 bps GM improvement over 4 years. Savings invested into low-cost portfolio allowing direct competition with AICE. Market share and GM decline stopped. |

Conclusions

Multinational CPG companies face a pivotal moment. Overcoming stagnant volume growth and ensuring long-term shareholder returns necessitates strategically portfolio management. Companies applying the right methodologies to balance immediate opportunities with long-term strategic growth will achieve sustained market success and superior shareholder value.

At Sevendots, we advise CPG companies on how to win in today’s dynamic environment. If you are looking to extract greater value from your core business and evolve the design of your core products to align with current and future consumer preferences, we would be glad to support you through the application of our Design to Consumer Preference methodology.

Contact Sevendots today to explore how we can work together to define your next winning move.