Brand Marketing 13 February 2025

Why Australia is an Excellent Test Market for CPG Products

Australia is widely regarded as an ideal test market for Consumer Product Goods (CPG) due to its diverse demographics, sophisticated retail environment, and trend-driven consumers. These factors make it a prime location for multinational companies to introduce and refine new products before expanding them globally.

Sevendots, Sydney

5 minute read

With a culturally diverse and trend-sensitive population, a strong middle class with high disposable income, and a well-developed retail ecosystem, the Australian market offers unique advantages for brands seeking to evaluate consumer behavior, pricing strategies, and product positioning.

As CPG brands navigate an evolving landscape in 2025, they must also recognize the shifting dynamics within Australia, including rising Asian migration, increased omnichannel shopping, and growing consumer demand for ethical and sustainable products. This article explores why Australia remains an optimal testing market, key factors that contribute to its effectiveness, and real-world case studies of brands that have successfully launched and tested products in the region. First, let’s explore what makes Australia such a strong test market.

1. Diverse and Multicultural Population

Australia’s ~26.5 million population (2024 estimate) is one of the most culturally diverse in the world, shaped by Indigenous heritage and significant waves of migration from Europe, Asia, the Middle East, and Africa. This mix of ethnicities, lifestyles, and consumption habits creates a unique market that mirrors global trends.

Demographics at a Glance

Urbanization: ~86% of Australians live in major cities such as Sydney, Melbourne, Brisbane, Perth, and Adelaide.

Median Age: ~38 years, with a growing elderly population contributing to demand for health, wellness, and functional CPG products.

Multicultural Representation:

- ~30% of Australians are first-generation migrants.

- ~21% are second-generation Australians (having at least one parent born overseas).

- Indigenous Australians make up 3.2% of the population.

Key Ethnic Backgrounds (2021 Census)

British/Irish ancestry: ~46% (declining over time).

Asian ancestry (rapidly increasing):

- Chinese (5.5%), Indian (3.1%), Filipino (1.2%), Vietnamese (1.1%).

European (Non-British): Italian (4.4%), Greek (1.8%).

Middle Eastern/African heritage: Lebanese, Turkish, Egyptian communities are growing.

Why This Matters for CPG Testing

Australia’s diverse population makes it an ideal testing ground for multi-ethnic food, beauty, and lifestyle products, reflecting global market trends. As consumer preferences evolve, there is a growing demand for plant-based, organic, and international cuisine, creating opportunities for brands to introduce and test innovative offerings. Additionally, Australian consumers show a high acceptance of global brands and a strong willingness to explore new and emerging product categories.

2. Middle-Class Dominance

Australia’s strong middle class (~58% of households) ensures a stable, scalable, and predictable consumer base for CPG companies.

Why the Middle Class is an Ideal Test Market

High Disposable Income: Australians spend on both essential and premium products, making the market ideal for testing different price points.

Trend Sensitivity: The middle class is early adopters of emerging trends, such as:

- Health-conscious products (organic, plant-based, low-sugar).

- Sustainability-driven consumption (eco-packaging, ethical sourcing).

- Tech-enabled shopping (online grocery, AI-driven personalization).

Balanced Spending Behavior:

- Open to new brands at reasonable prices.

- Cost-conscious but willing to pay for quality.

Testing Opportunities with the Middle Class

Testing in Australia provides valuable insights into price elasticity, allowing brands to assess how much consumers are willing to pay for a product at different price points. With a strong middle class that values quality, companies can also trial premium positioning, as many Australians are willing to trade up for higher-end goods. Companies can evaluate long-term consumer loyalty by tracking repeat purchases and assessing product longevity, helping to refine their strategies before expanding globally.

3. Sophisticated Retail Landscape

Australia’s retail sector is well-developed and diverse, offering CPG companies multiple channels to test products.

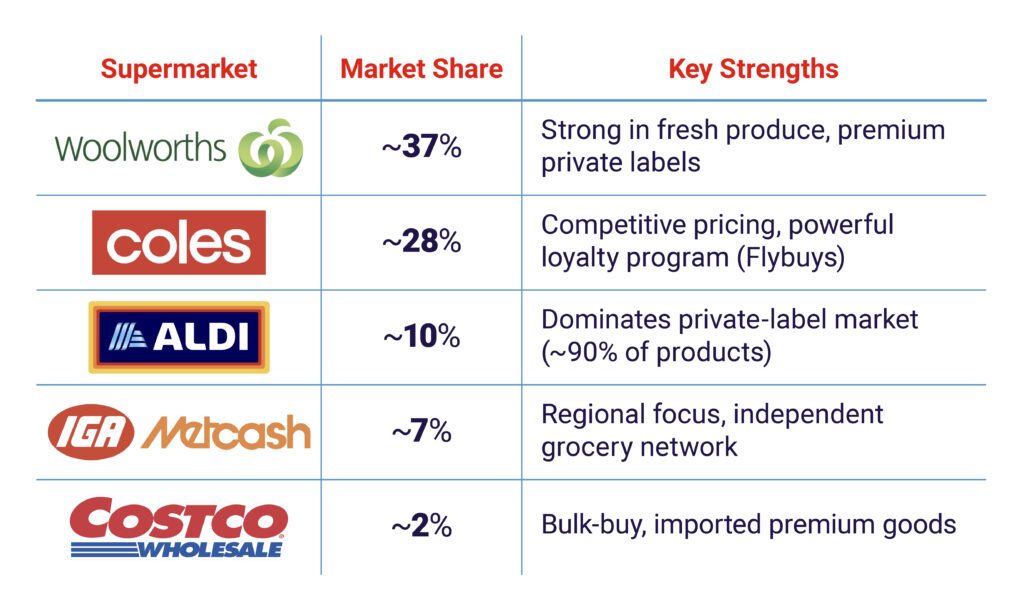

Supermarket Dominance (~65% of Grocery Sales)

Other Retail Channels

Convenience Stores (7-Eleven, BP, Ampol) – Focus on grab-and-go products.

Pharmacies (Chemist Warehouse, Priceline) – Dual role in health & personal care CPG.

E-Commerce (Amazon, Woolworths Online) – Rapid growth of DTC (Direct-to-Consumer) brands.

4. Early Adoption of Trends

Australian consumers are trend-driven and brand-aware, making them an ideal market for innovation.

Key CPG Trends in Australia

Health & Wellness – ~55% of Australians purchase organic or natural products.

Sustainability – 80% of Australians consider sustainability when making purchases.

Premiumization – Rising demand for high-quality, ethically sourced products.

Validate premium pricing – Australians are willing to pay for premium offerings.

Test sustainable products – Eco-packaging and ethical sourcing resonate well.

Assess demand for functional foods – Plant-based, keto, and gut-health products are growing rapidly.

5. Geographic Isolation & Controlled Market Size

Australia’s small, isolated market (~26.5 million people) makes it a cost-effective, low-risk test bed.

Low Reputational Risk – Failed product trials don’t impact global reputation.

Controlled Environment – Isolation reduces external influences, ensuring cleaner test results.

6. Challenges for CPG Testing in Australia

High Competition – Woolworths & Coles dominate the market.

Higher Costs – Labor, logistics, and compliance costs are above average.

Strict Regulations – Packaging, labeling, and health claims require compliance.

7. Best CPG Categories for Testing

Health & Wellness – Organic, plant-based, functional CPG.

Sustainability – Eco-friendly, ethically produced products.

Premium Offerings – High-quality, luxury products in food & personal care.

Conclusion: Why Australia is Ideal for CPG Testing

Australia presents an ideal market for consumer packaged goods (CPG) testing due to its diverse consumer base, which acts as a miniature global market. With a strong middle class, the country ensures stable demand for both mass-market and premium products, making it a reliable testing ground. Additionally, Australia’s advanced retail sector, including well-developed e-commerce channels, facilitates seamless product tracking and data collection, enabling companies to make informed decisions.

Beyond these advantages, Australia offers a low-risk testing environment, providing a safe and controlled space for innovation. For CPG companies, this structured, data-rich, and trend-forward market serves as an excellent launchpad to refine products and strategies before expanding globally.

See below for examples of CPG test launches in Australia.

Case Studies: CPG Products First Tested in Australia

Multinational Brands That Used Australia as a Test Market

Australia is strategic for U.S. CPG brands due to:

- Sophisticated consumers with high disposable income.

- Market similarities to the U.S.

- Small, controlled environment – Low-risk testing.

However, it is important to recognize that the Australian CPG landscape is evolving in 2025. With increasing Asian migration, brands must adapt their offerings to cater to a wider range of diverse tastes and preferences. Additionally, the shift toward omni-channel retail presents opportunities to test digital-first strategies before global rollout.

Case Studies: eCommerce platforms

1. Market Entry via E-Commerce:

Cost-Effective Expansion: Launching exclusively online enables brands to enter the Australian market with reduced overhead costs associated with brick-and-mortar stores.

Digital Savvy Consumers: Australians are known for their high internet usage and comfort with online shopping, making the market conducive for e-commerce ventures.

2. Leveraging Established Online Platforms:

Partnerships with E-Retailers: Brands can collaborate with established online retailers like Amazon to access a wide customer base.

3. Focus on Niche Markets:

Targeted Product Offerings: Brands can cater to specific consumer segments, such as sustainable fashion or tech gadgets, which are popular among Australian online shoppers.

Localized Marketing: Tailoring marketing strategies to resonate with Australian values and culture can enhance brand acceptance and loyalty.

By adopting an online-only approach, brands can effectively test the Australian market, build brand awareness, and establish a customer base with lower financial risk. This strategy also provides flexibility to adapt offerings based on consumer feedback and market trends.

In the Consumer Packaged Goods (CPG) sector, launching products exclusively online in Australia has become a strategic approach for both international and local brands. This method allows companies to enter the market with reduced overhead costs and the ability to directly engage with tech-savvy Australian consumers.

Case Study: Freshippo’s Online-Only Launch in Australia

In 2024, Alibaba’s retail label, Freshippo, announced its plans to introduce its private-label products to the Australian market. This move marks the first time a Chinese-headquartered supermarket has begun large-scale exports of its own-brand products abroad. Freshippo’s private-label products, such as Freshippo Daily Fresh, Freshippo Kitchen, and Difresco, have been well-received by customers since their launch in 2017. The company intends to provide these products in Australia, Singapore, South Korea, and other markets this year.

Advantages of Online-Only CPG Launches:

1. Cost Efficiency: Bypassing the expenses associated with physical storefronts, brands can allocate resources to digital marketing and supply chain optimization.

2. Market Testing: An online launch allows companies to gauge consumer interest and gather feedback before considering broader distribution strategies.

3. Scalability: Successful online operations can be scaled rapidly to meet increasing demand without the constraints of physical retail space.

By leveraging e-commerce platforms, CPG brands can effectively tap into the Australian market, catering to consumers’ preferences for convenience and direct access to products.

Contact Sevendots today to discover more.