Sustainability 22 October 2021

What do consumers want from Alternative Proteins?

Both demand for and investment in Alternative Proteins is growing. In this article, we unpack the demands of consumers that can help bring alternative proteins into the mainstream.

Sevendots, Rome

9 minute read

The demand for protein from wealthy nations across the world is enormous – and growing. Awareness is spreading around the impacts of our habits as human beings, and how this affects the future of our planet. However, the demand for protein outpaces the future of our supply. It’s been projected that demand will double by 2050, from 200 billion tons to 400 billion tons. How can we possibly match this requirement when the earth is already suffering from the demands of human appetites? Whether we like it or not, we will require sources of alternative proteins.

Naturally enough, alternative proteins comprise a growing CPG market that responds to consumers’ desire to be more sustainable, as well as the practical need for protein that doesn’t depend on existing agricultural practices.

In this article we will cover:

- Understanding the world’s demand for protein

- Factors contributing to the growth in alternative protein sources

- What are the top consumer concerns?

- Approaches to increasing the uptake of alternative proteins

- The future of alternative proteins: Where are we, and what comes next?

- The takeaways

Understanding the world’s demand for protein

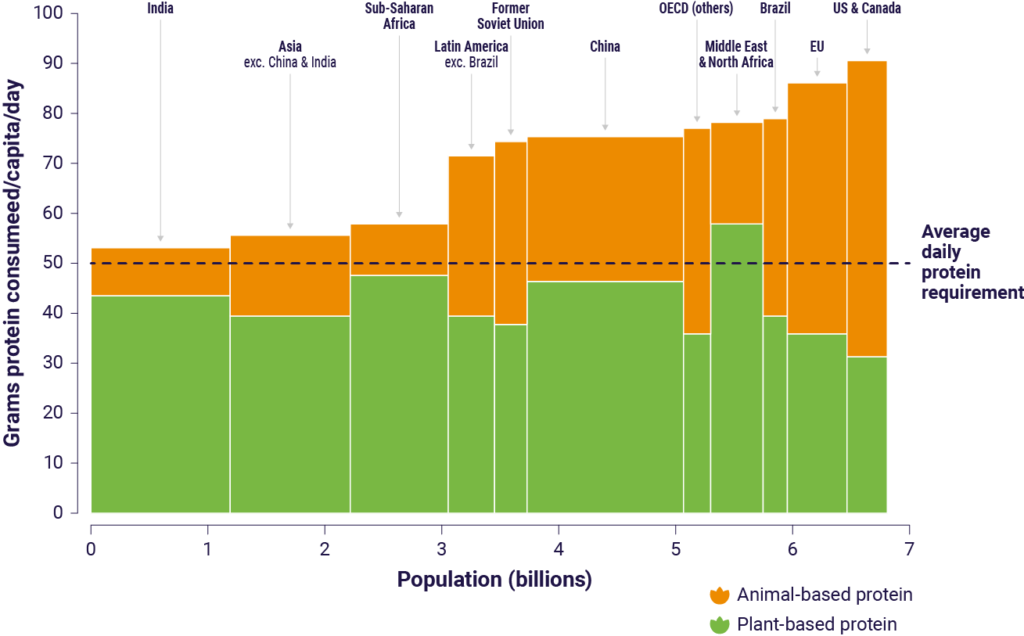

Humans love to eat protein. So much so, that we are eating much more protein today than we need. With global consumption at 68 grams of protein a day on average, this is over a third higher than the average daily adult requirement. As developing nations grow in wealth and population, they join the ranks of protein-lovers worldwide.

To understand what drives this demand, we can see three key contributing factors:

1. Global population increase

With more people comes more mouths to feed! The global population was 1.6 billion in 1900. In the last century, humans had the largest increase in known history to over 6 billion people in the year 2000. It doesn’t stop there: the global population is expected to reach 10 billion by 2050. That’s a 26% increase compared with today.

2. Increased spending power

Protein, especially meat products, has always been a costly part of our diets. However, we’ve seen a combination of increased spending power reaching more regions, and farming practices that have helped to push costs down. This combination has made protein more accessible to more people. The middle classes are expected to expand by 3 billion people by 2050, putting even more people in the position to buy and consume protein.

3. An aging population

With an aging population comes increased pressure on good nutrition – we want to live better for longer! Studies suggest that a high protein intake may improve muscle health, maintain energy balance, weight management and cardiovascular function.

Protein is therefore an essential component of a healthy diet and is particularly associated with aging well. Meat and dairy represent obvious and accessible ways to integrate this protein in our diet.

Why is alternative protein important?

With consumer demand unlikely to fall, combined with these three key factors, meat alternatives are going to become essential. With the undeniable environmental impact and animal welfare impacts of animal-based food products, new products are required as part of the effort to fight climate change.

Factors contributing to the growth in alternative protein sources

We can’t keep relying on animal products. There are several key factors that contribute to the growth of the alternative protein market within the food industry:

1. Sustainability and ethics

Despite the protein obsession, we already know there are hard limits to what we can produce and consume. If demand is to double by 2050, how can we possibly double animal protein production in the next 30 years?

At present, livestock farming produces 14.5% of the world’s carbon emissions. The land required to enable this production is enormous. If we compare livestock and dairy emissions to plant-based alternatives, the gap is clear.

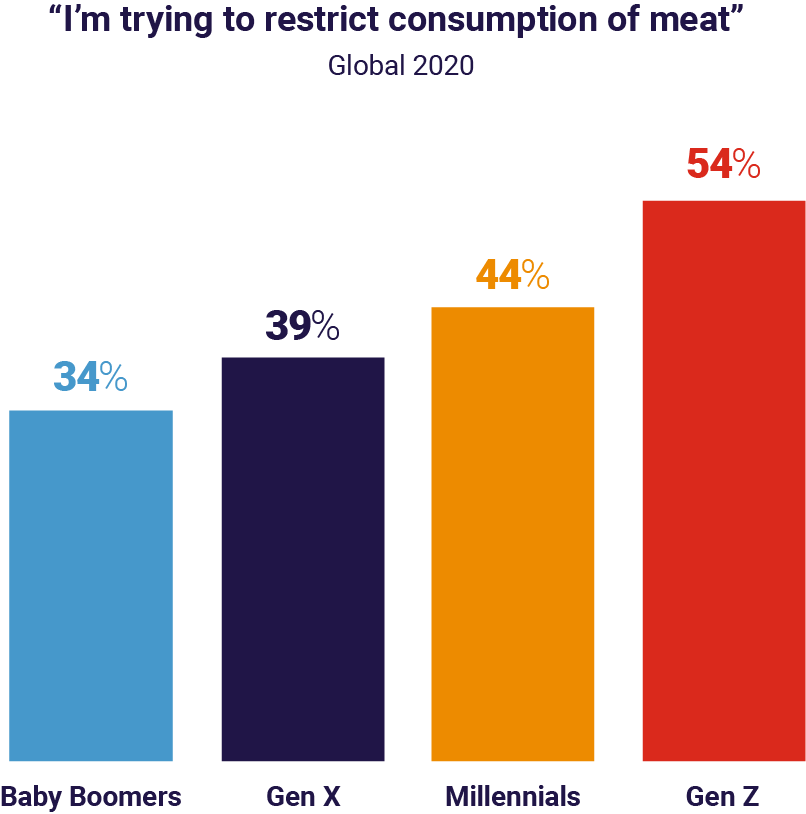

An estimated 50 billion chickens and 300 million cows are slaughtered for food each year. A third of the world’s grain is already used to feed livestock. Overfishing has depleted wild fish stocks. The impacts of our protein demand are felt across land utilization, emissions, water consumption, and more. It’s hard to imagine how a growing human population can sustain these rates of consumption. Consumers area already asking themselves this very question. They are interested in food that is more ethical, especially in younger generations.

2. Nutrition and food safety concerns

There are a variety of nutritional issues related to eating animals. Over-consuming meat has been shown to contribute to higher cholesterol and growing rates of obesity. Consumers are increasingly interested in making healthier choices as awareness of the link between animal-based proteins and health concerns rises.

Meat presents a higher risk for non-communicable diseases, such as campylobacter, salmonella, e-coli and more. These cause a reported 9.4 million episodes of food-borne illnesses in the US each year. They continue to pose a risk as no intervention has eliminated these diseases from animal-based foods so far.

Fish have also been found to contain microplastics, both in farmed and wild-caught fish. Contaminants have been discovered in farmed salmon. There’s been a rise in allergies, with over 50% of consumers reporting this as the most important nutritional factor in their decision to purchase dairy-free.

In response to all this, consumers are interested in the health benefits of alternative proteins.

3. A youthful desire for change

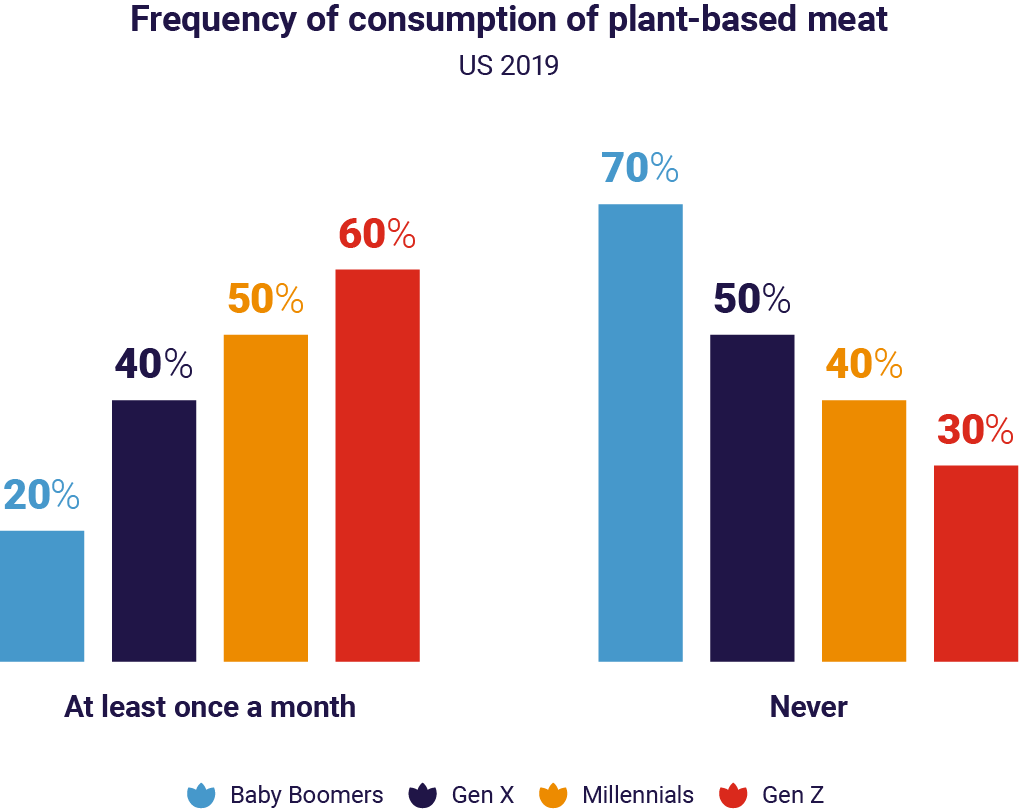

Consumer interest in substitutes for animal products is growing, with younger people increasingly aware of their individual contribution to climate change. For this reason, Generation Z are far more likely to limit their meat intake than previous generations. They lead the way in the consumption of plant-based meats. One study showed that 54% of Gen Z respondents were already trying to restrict their consumption of meat.

With all these considerations in play, the future is looking more ‘alternative’ than ever. The demand for new ways to enjoy and consume protein is on the rise.

What are the top consumer concerns?

As we start to think about the future of the alternative proteins market, it helps to start to understand what consumers care about when making the switch. We’ve identified a few key concerns that consumers have to what’s out there in the market, so far:

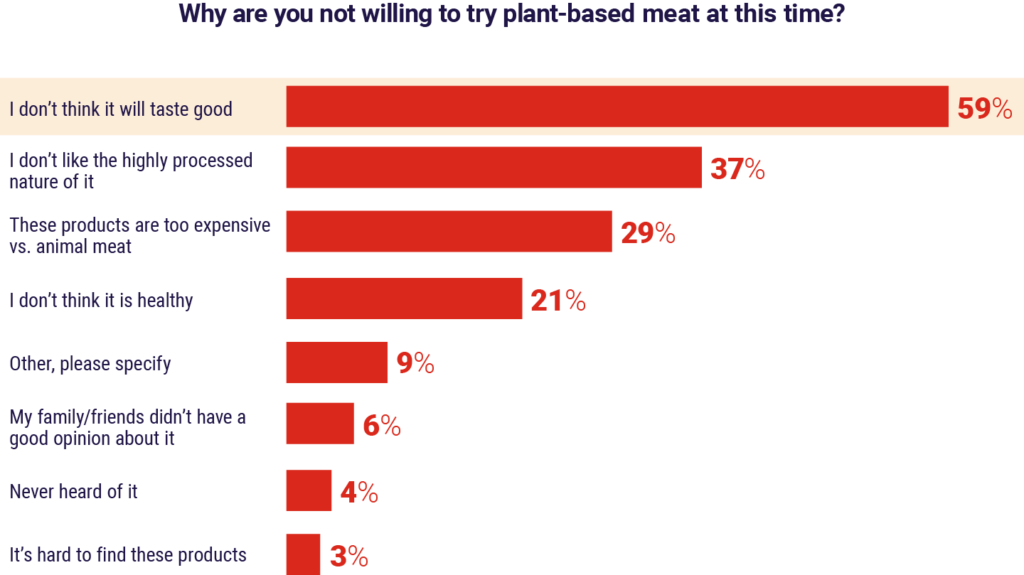

1. Is the taste or texture wrong?

Taste is a big barrier for consumers. Especially those who haven’t tried alternative proteins before.

And even those who already eat alternative proteins are looking for ‘better tasting products’ in the plant-based category (over 30%, in fact!). There’s plenty of room for improvement in taste and texture.

“Good taste is paramount. If product taste can continue to improve based on the ingredients that go into these, this will drive the success of the Plant-based sector.”

Siow Ying Tan – External Innovation R&D Senior Manager, PepsiCo

2. Is the price right?

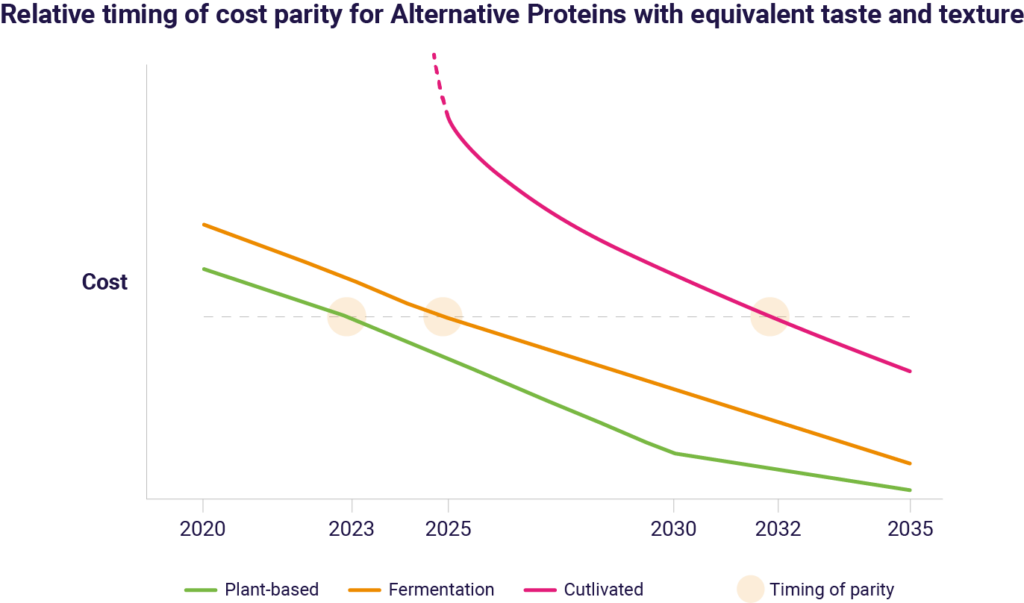

Price is one of the biggest obstacles to mass consumption of alternative proteins. Prices in the US suggest that plant-based products average $9.87 per pound – twice the price of beef and four times the price of chicken per pound.

Though the literal price is a concern, there is a growing sense of the sustainability cost as well. An awareness of environmental cost would place price in a different context for consumers.

3. Is the nutrition up to scratch?

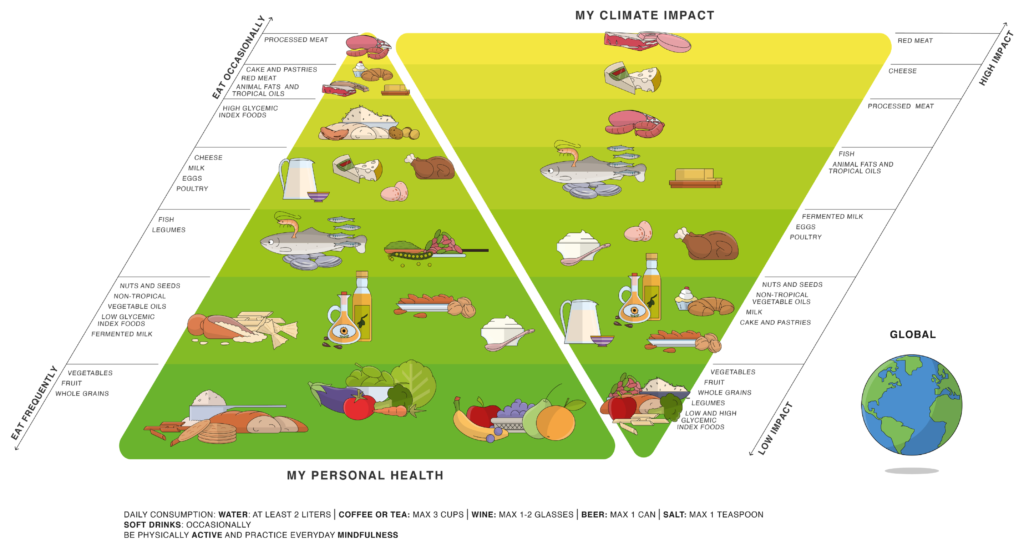

The ‘Double Pyramid’ is starting to be more visible, linking personal health with climate impact.

There are challenges to recreating the nutritional density of animal products. Cow’s milk, for instance:

“[Cow’s milk is naturally rich in protein, calcium, potassium and B vitamins] Usually, these beverages do not include all of the necessary nutrients needed to replace dairy foods.”

Jackie Haven – Deputy Administrator for the US Department of Agriculture’s Centre for Nutrition Policy and Promotion

Big players in the industry are already focused on nutritional parity. Nestle, for instance, reformulated Awesome Burger with hemp and fava beans and pea protein to achieve greater nutritional performance.

Approaches to increasing the uptake of alternative proteins

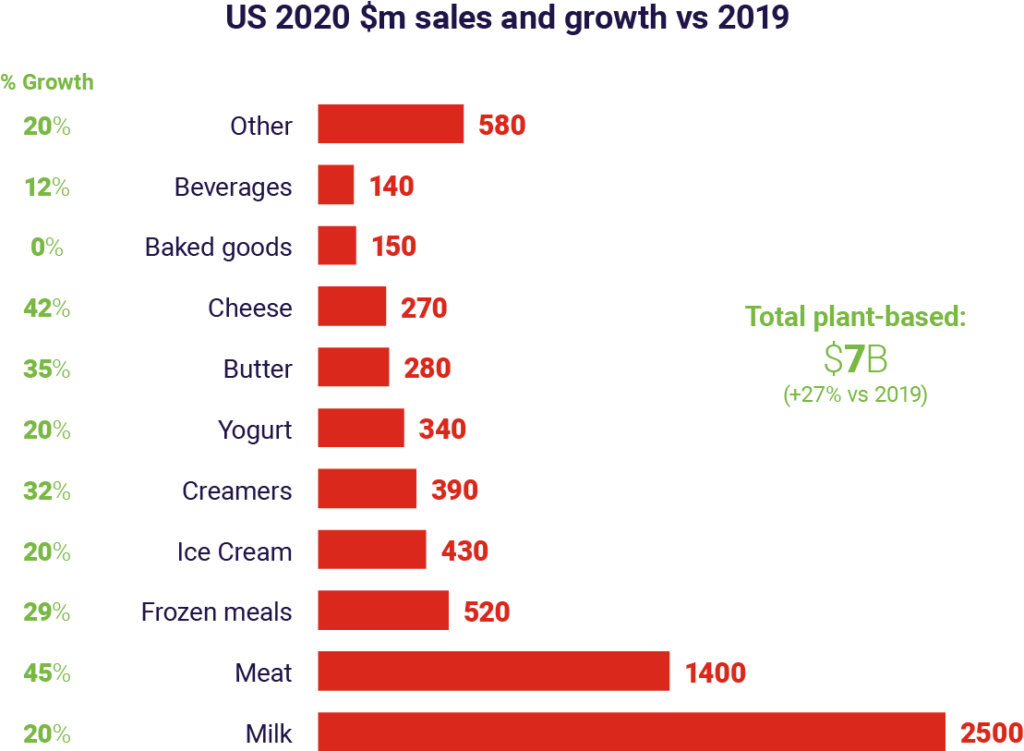

Different alternatives have begun to emerge, offering consumers more options to reduce their animal protein consumption. In fact, 42% of people chose to go meat and dairy-free on a ‘more regular basis’ in 2020 than in 2019.

We can categorize what already exists in emerging alternative proteins into three key types.

Plant-based

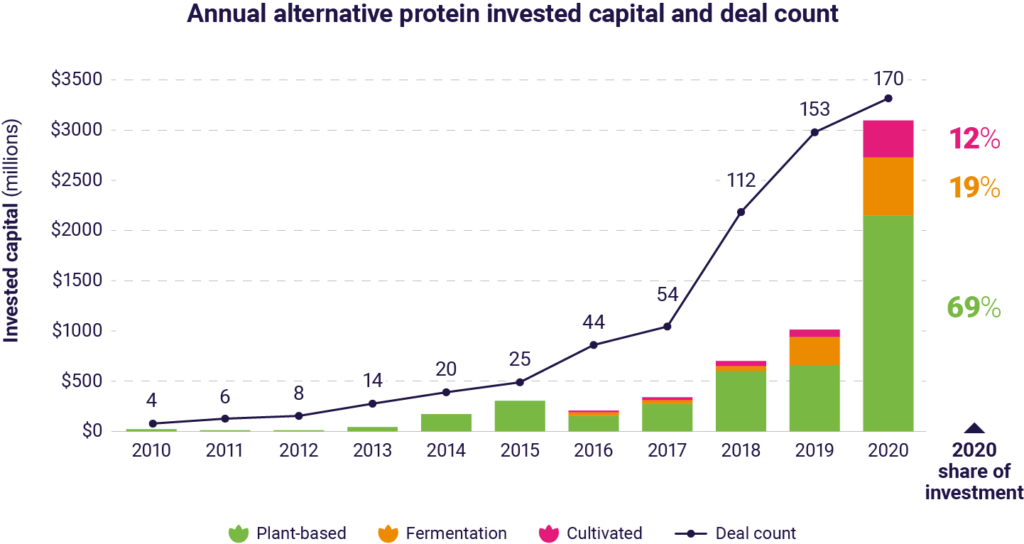

The plant-based alternative proteins market is forecasted to be worth $74 billion by 2027, with an expected growth at a CAGR of 12%. This growth is driven by increasing intolerance of animal proteins and gluten, increasing nutritional benefits in alternatives, and a growing vegan population.

These products are the best known, and include substitutes made of things like chickpeas, oats, soybeans and other plants.

Fermentation

This includes cultivating microbial organisms like mycoprotein. This can be used to process a foodstuff, as a primary source of protein or to help derive specialized food ingredients like flavorings, enzymes and fats. These can be incorporated into other plant-based or cultivated products.

Cultivated

While this is still quite a small proportion of the market today, it includes laboratory-derived meat, dairy, fish and egg alternatives. Insect-derived ingredients form part of this type.

This type of alternative protein is forecasted to be worth $5 billion by 2027. Insect-based protein has a high level of sustainability versus livestock. Insects also offer a high protein content per kilogram.

Cell-based alternatives could represent 35% of all meat consumed globally by 2040. This is where animal cells are mimicked with lab-grown alternatives. The rate of investment in this method is also surging.

With these categories of alternative proteins in mind, what is the industry doing to appeal to consumers?

The future of alternative proteins: Where are we, and what comes next?

Opportunities to address consumer concerns are well underway. With milk and dairy alternatives leading the way, followed by chicken and seafood, alternative proteins could claim as much as 22% of the overall protein market by 2035.

Alongside rising investment, we have noticed several ways in which the alternative proteins market is creating a food revolution:

The price and consumer relationship are shifting

Impossible Foods, the biggest player in the main alternative protein market, has cut prices to make their products more accessible to the masses. Retailers are following suit, with Co-op UK reducing prices across its vegan range. Large CPG brands are demonstrating their commitment to providing alternative protein options.

“It appears that Nestlé is positioning itself to be the first global food giant to market with a hybrid plant-based and cultivated meat product.”

Bruce Friedrich –Founder & President, the Good Food Institute

As larger companies continue to invest, alternative proteins become more and more accessible to consumers. Price parity is likely to become possible within a few years.

We’re moving beyond mimicry

Small companies and startups have been leading the charge of providing innovative new alternative protein products. They’ve done this through early stage technologies and strong storytelling. However, established multinationals are also working to acquire small players, reformulate current offerings and innovate internally.

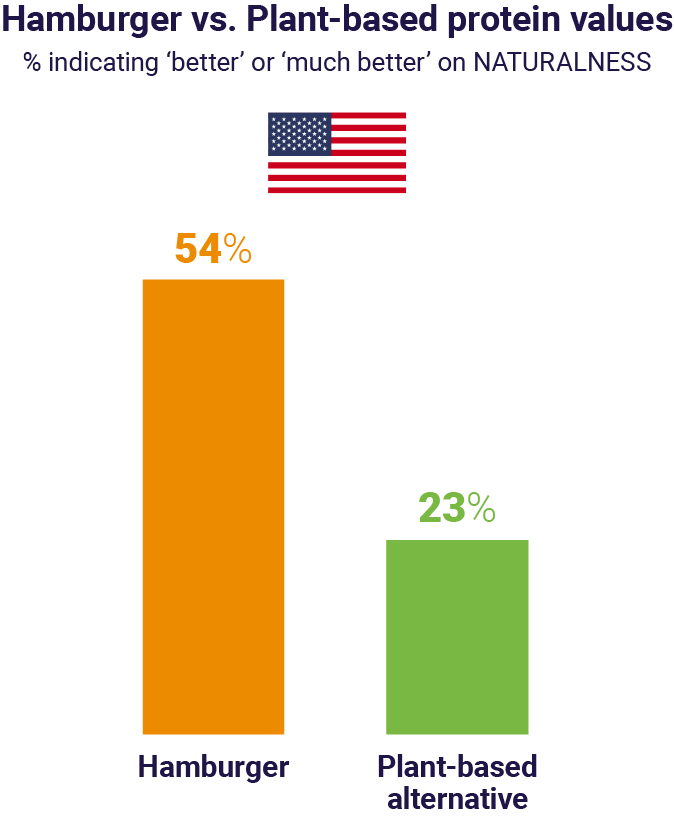

Consumers have been concerned with the perceived ‘naturalness’ of alternative proteins. This problem in perception appears linked to ‘over processing’. Dealing with this perception appears as a major challenge for brand owners.

Over the last couple of years… mimicking has been the main strategy. Mimicking milk, mimicking minced beef, and so on. But now that the audience and target market is so big, it is time for Plant-based to move on from mimicking to create its own category.”

Stefan Uhlmann – Head of Cereals (Cereals, Nuts and Pulses), Döhler

Legislative pressure is ramping up

In October 2020 the European Parliament voted to ban dairy-related terms for plant-based alternatives. The terminology “Veggie Burgers” is still allowed, but “Vegan Cheese” is not. Plant-based ‘mimics’ face new scrutiny around nutrition and their ‘ultra-processed’ nature.

The Takeaways

The consumption of alternative proteins is rising. In the quest for more sustainable food, many consumers are aligning their nutritional choices with their climate impact. This figure is set to rise, with younger generations leading the way.

CPG brand owners need to investigate:

- Healthier alternatives that mimic meat and dairy in taste, texture and nutritional value

- Curated alternative proteins that offer better environmental and welfare impacts

- Autonomous plant-based products from fermentation that may assist with other forms of alternative protein ingredients

Given the pressure for alternatives from consumers, on ethical, environmental, health and safety grounds, it’s time for innovation – change is now inevitable, and brands will have to adapt. The protein industry is ripe with opportunity to give consumers what they want without sacrificing the planet. What contribution are you making to meet consumer demand?

Read more of our work on sustainable consumption models here.