Consumer Trends 24 July 2025

The return of Private Labels: Why retailer brands are reclaiming growth in the global CPG market

The challenge with growth

In 2024 the overall CPG market grew by 7.6% while 11 among the top global CPG companies advanced only 3.9%. This widening gap is more than a short-term divergence as it points to a structural shift in consumer preference and retailer strategy. In this scenario, Private Labels (PL), along with local and insurgent brands, are increasingly gaining ground, reshaping competitive dynamics across regions and categories. So, after a period where their momentum seemed to plateau, private labels made a notable comeback on the global stage.

From European stronghold to global force

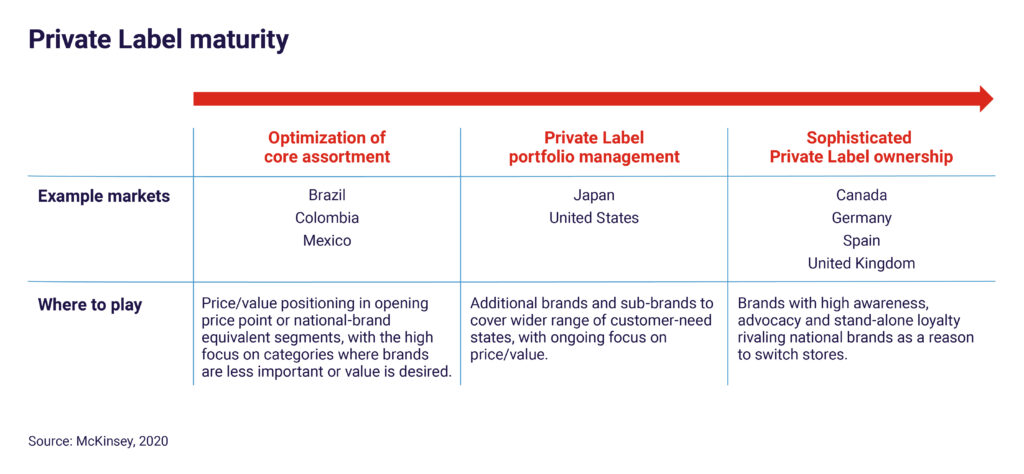

Private Labels have long had a stronghold in Europe, but they are now scaling globally and now account for more than 20% of global Consumer Packaged Goods (CPG) value sales, with a 1.4 percentage point increase in 2024 alone.

In Europe the PL value share has reached 38%, according to IRI, maintaining its status as the most mature PL market. In the United States the share has climbed to 21%, supported by rising consumer acceptance and retailer focus.

However, while growth surged in the immediate post-COVID period, it has begun to normalize, particularly in Europe, where it decelerated from 12% in 2023 to just under 4% in 2024.

Yet the global outlook remains positive, driven by deeper consumer shifts and more sophisticated PL strategies.

Recent consumer research highlights that this isn’t just a cyclical or price-led adjustment: 53% of global consumers say they are increasingly buying more PL products and 60% claim they would purchase even more if retailers broadened the variety available.

Not all categories are equal

Private Label performance is highly category dependent. Generally Private Labels have been gaining share in Household Products, where perceived differentiation is lower, and in the more commoditized Food and Personal Care Products where brand equity is weak or losing ground (e.g. canned food, everyday bakery and snacks).

Conversely, categories more connected to consumer identity, emotional engagement or ritual (like coffee, pet care, and personal care) tend to favor brands. Yet even these are no longer immune. Premium and functional PL ranges are eroding the boundaries, especially as consumers redefine quality through perceived value rather than heritage branding.

Price, quality and equity

The historic trade-off between price and quality is still relevant but less intense than in the past.

On one side 69 % of global consumers (75 % in the U.S.) believe PL offers good value. Moreover, many consumers think that the quality of PL is the same or even better than the one of branded products. This has been supported also by the introduction of premium ranges of PL and by high-end supermarkets like i.e. Waitrose and Mark&Spencer in the UK, La Grande Epicerie in France or Eataly in a few countries around the world, which were established as premium food and beverage retailers offering superior quality from the start, often leveraging local sourcing.

On the other side NIQ finds that branded products carry, on average, a 26% price premium over PL alternatives across global categories.

While brands can absorb recent cost-of-goods (COGS) pressures through margins, PLs, often operating on thinner margins, have had to pass cost increases onto consumers.

Also, the growing trust in retailer brands allows PLs to ride on the retailers’ broader value perception, transferring equity across categories and products.

As consumers grow more confident in the quality and value of private label products, they are more likely to associate positive attributes with the retailer itself. This can lead to increased brand loyalty, higher store traffic, and ultimately, improved sales.

A generational shift

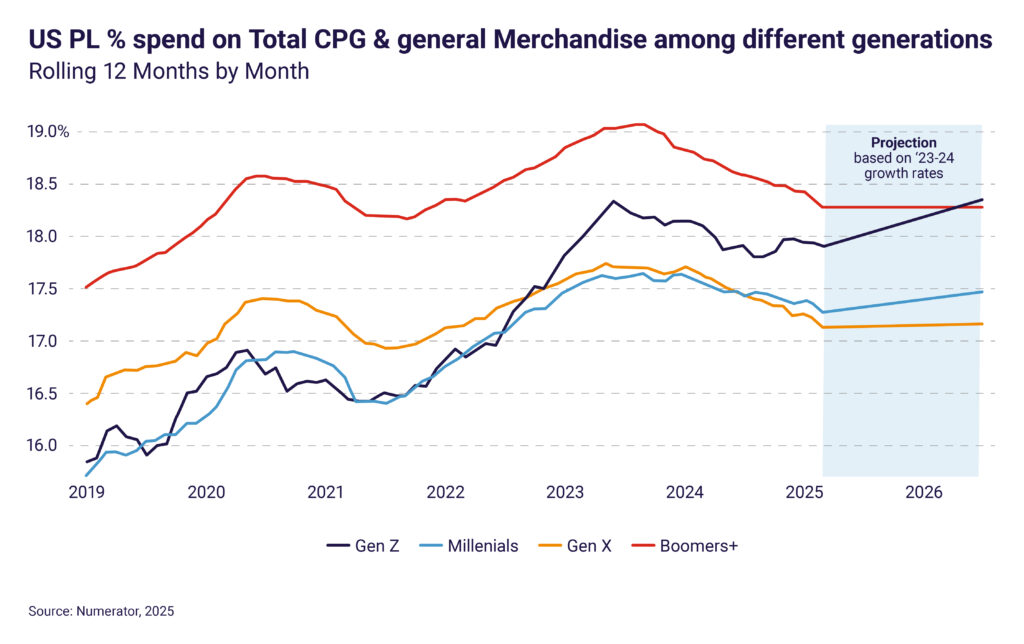

The generational divide adds another layer of momentum: 46% of Gen Z respondents globally are willing to spend more on PL products, twice the share of Boomers (23%).

Younger shoppers, less loyal to legacy brands, increasingly seek value, transparency, and experimentation, all areas where modern PLs can compete effectively.

In the US, a Numerator study indicated that GenZ are more likely to diverge from other generations on different dimensions where PL play an active role. These include discovery through social media platforms, packaging design, transparent labelling, trendy and innovative perception and sustainability and BFY claims. All areas where PL have become much more active and dynamic.

For GenZ in the US store labels like Ulta Beauty, Wild Fable, Cat & Jack, Costco’s Kirkland Signature, and Trader Joe’s are purposeful choices that blend style, value, and identity covering the role traditional brands had for other generations.

Retailers are no longer just distributors—they are brand owners

The biggest internal driver of PL resurgence is a strategic shift by retailers as they progressively see them no longer as just a margin enhancement vehicle but as a loyalty building lever.

As a consequence, they are no longer treating private labels as low-cost alternatives, they now manage them as brands in their own right. This includes:

1. Tiered portfolio architecture

Entry-level value options sit alongside premium and even super-premium lines. Retailers like Carrefour, Target, and Tesco offer well-segmented PL architectures that span the full price-value spectrum.

North American retailers are moving fast and bold on premium and super-premium

Private labels are no longer just about value. Across the U.S. and Canada, retailers are aggressively expanding into the premium and super-premium tiers of their private label portfolios, leveraging attributes like health & wellness, sustainability, and carefully selected premium ingredients to elevate their offer.

This shift is not subtle. Programs like Bettergoods by Walmart are designed specifically to appeal to more affluent and quality-conscious consumers, repositioning Walmart’s image and creating credible alternatives to manufacturers premium brands. Similarly, President’s Choice from Loblaws, remains a long-standing benchmark in elevating private label perception through innovation, storytelling, and quality. The implications for branded players are profound: they now risk being squeezed from both ends with value-tier PL eroding entry-level share and premium PL attacking from above. In this context, the “safe middle” is shrinking fast, making it imperative for brands to sharpen their positioning and reassert their relevance with renewed clarity and innovation.

2. Increased choice

The depth of PL portfolios has sensibly increased, meeting the consumer desire for broader choice and supporting the need to continually attracting more buyers.

Coop Italia expanded the beer offer

Introducing 8 different types of special premium beer on top of the 7 representing the base range.

15 different beer styles offered with the Coop brand.

3. Design and branding

Certain retailers, such as Aldi, have mirrored leading brands so closely that it has triggered legal pushbacks, like the recent lawsuit filed by Mondelez. But the blurred lines are also a sign of PL’s increasing equity and consumer recognition.

Also, in a recent survey in the US from First Insight, 71% of consumers said they knew when they were buying a private-label item – but when shown the PL and name-brand products side by side, 72% could not correctly recognize which was which. This highlights how differences of the past have now blurred thanks also to better retailer executions on their Private Labels.

4. Communication

Retailers have become more active in specifically supporting their PL offer. They are no longer just putting the product on the shelf, they are supporting it proactively. Besides the main retailer brand halo effect and media optimization, in many cases retailers use different touchpoints and sophisticated activations to support their specific products. Leading retailers are now developing brand language on their packaging that not only draws shoppers’ attention but also conveys the functional benefits of the brand. Grocery retailers worldwide are significantly increasing their spending on media communication, particularly within Retail Media Networks (RMNs), which are transforming how they interact with consumers.

Innovation & differentiation

Traditionally the paradigm for PL was to follow what manufacturers were doing. So, maintaining differentiation through innovation was a main lever for brands to hold on to the gap in value perception in the minds of consumers.

However, retailers are becoming quicker at spotting and executing on trends, building meaningful innovation and differentiation and in many cases leading rather than following.

Consider M&S’s “Big Daddy Pistachio” chocolate bar—a fast move to ride the viral wave of Dubai-style chocolate. It went viral on TikTok and Instagram and sold out in record time. This is something a traditional large manufacturers would have had difficulties in doing.

Similarly, the Strawberry Cream Sandwich became a sensation, effectively creating a new snack subsegment almost overnight.

What brands must do to respond

The pressure on branded manufacturers is clear: they are being squeezed from both ends. On one side retailers who copy and scale fast, on the other retailers that innovate with agility and speed.

To sustain differentiation and long-term value, brands must respond in five key areas:

- Reassert meaningful differentiation

Functional parity is no longer enough. Brands need to reinforce emotional connection and further tap into aspirations, provenance, and cultural relevance, especially in categories vulnerable to PL erosion. Linking to heritage and ownable deep human truths can help maintain the differentiation towards more recent PL offers. - Accelerate innovation cycles

Brands can no longer afford 18-month development timelines. Retailers are testing and launching in months, not years. Speed and agility have become essential. Also, activating brands in meaningful and impactful ways across consumer touchpoints builds a relationship that extends to both in-store and out of store. - Working on disruptive innovation

The need for long term sustainable differentiation is becoming critical, identifying disruptive innovations that can redefine traditional categories. - Win on value, while managing price

Optimizing price-pack architecture based on consumer needs and occasions (e.g., trial sizes, family formats) and communicating visible value (e.g., enhanced functionality, sustainability) is key to competing beyond price points. - Partner smarter with retailers

Where possible, co-develop exclusive SKUs, bundles, or in-store activations and digital shelf execution that give brands a distinct role in the retailer’s ecosystem. - Protect IP and distinctiveness

Design, trademarks, and packaging cues must be distinctive, ownable and defensible, both legally and perceptually.

Looking ahead: from plateau to platform

The PL resurgence is not a passing trend, it’s a strategic reconfiguration of the retail-brand dynamic. As retailers gain confidence and capabilities, and as consumers become more open-minded and value-conscious, the private label universe will only expand.

For branded CPG companies, the challenge is clear: how to remain essential in a world where your biggest customer is also your most credible competitor. The brands that win will not be the ones shouting louder, but the ones that move faster, connect deeper, and differentiate smarter.

At Sevendots we help manufacturers shape their strategies and optimize their portfolio.

Contact Sevendots today to learn how we can help.