Business Strategy 24 December 2025

Q3 2025 CPG Results: Why is volume declining?

Organic growth remains stable, but volume pressure intensifies across the CPG sector.

Consumer price sensitivity is intensifying while commodity costs move upward.

Retailers are destocking to manage cash under economic volatility.

Consumer behavior and expectations are shifting.

Sustaining growth now requires structural change and bold leadership: deliberate choices on

categories where to invest.

Sevendots, Querétaro

8 minute read

In our previous article “Sevendots-Q3 2025 CPG Results: Persistent Volume Pressure and a Growing Divide”, the performance for the top global 11 CPG companies was analyzed.

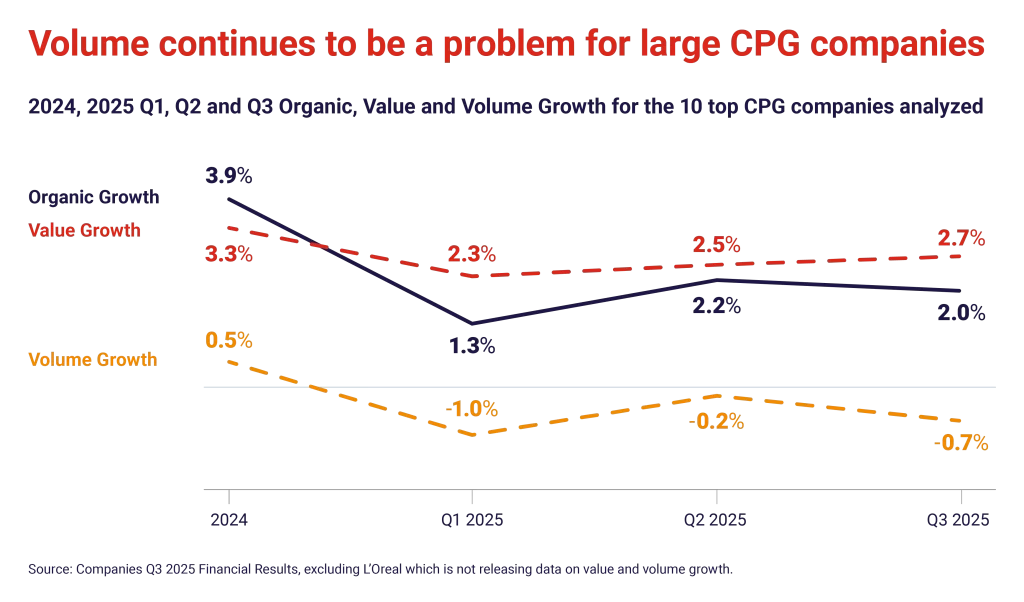

The picture shows more continuity rather than recovery. Overall year-to-date organic growth remains stable at +2.2%, still far below the 2024 full-year level of +3.9%, indicating an ongoing difficulty to sustain topline performance.

This weakness continues to be driven by volume pressure. After a brief pause in Q2, average volume growth deteriorated again to –0.7%.

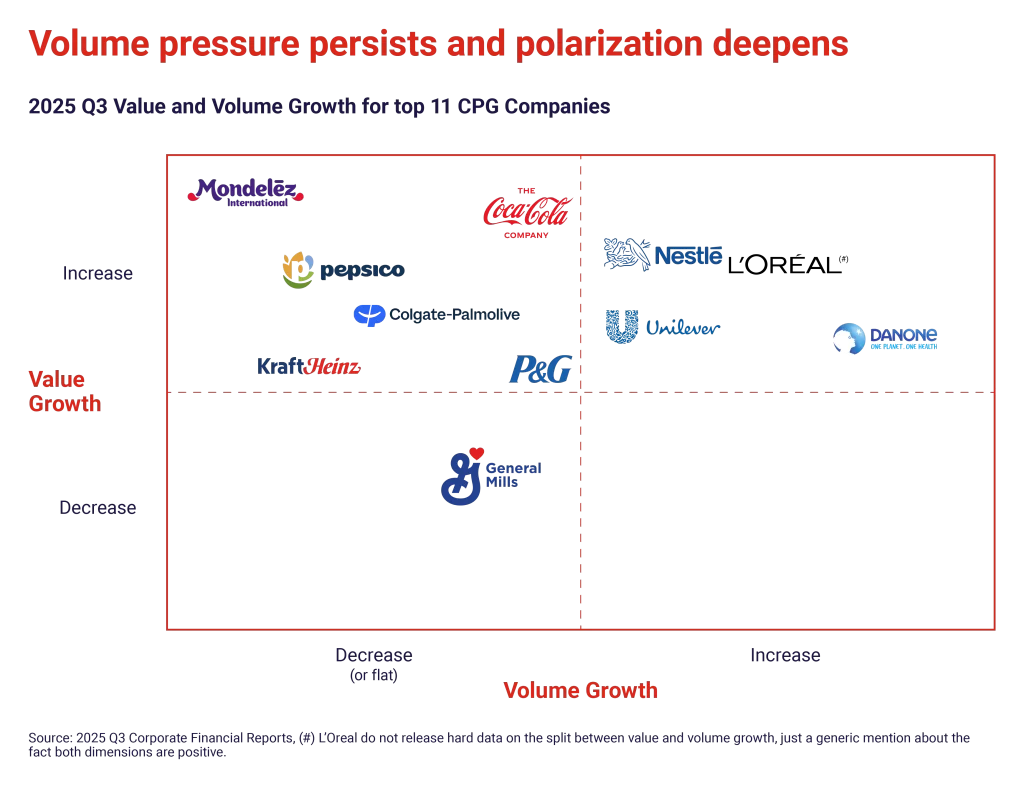

Within this average, the contrast between companies has become sharper. In Q3, four companies managed to deliver positive volume growth. Their average growth remained unchanged at +2.1%, while the other companies saw their performance worsen, with an average decline of –1.9% vs. –0.9% in Q2.

The main levers behind the companies which are growing volume are:

Portfolio: Clarifying the categories to play in and the brands to support. Companies that continuously assess and refocus their portfolios react faster to shifting consumer preferences. Bearing in mind the permissible spaces for each company, current overall volume growth in Home Care is a fifth of Personal Care, with Food categories mostly in the middle of the growth range.

Geography: Leveraging a truly global footprint is essential. While most CPGs source and manufacture globally, their go-to-market strategies remain geographically narrow. In other words, they buy globally but sell selectively, limiting the ability to fully leverage assets and scale. Expanding commercial reach and activation beyond current strongholds can unlock meaningful growth. In geographic terms, a strong company presence in Latin America is currently providing far greater opportunities for volume growth than North America, with APAC and Europe in the middle of the range.

Channel: Recognizing where growth is possible at a channel level is fundamental. Adapting the offer to the channel is essential. For some companies, the level of growth in e-com is more than 4x the overall retail growth.

In this article the focus in understanding what is preventing the 60% of the top CPG companies from growing volume.

The structural volume drop

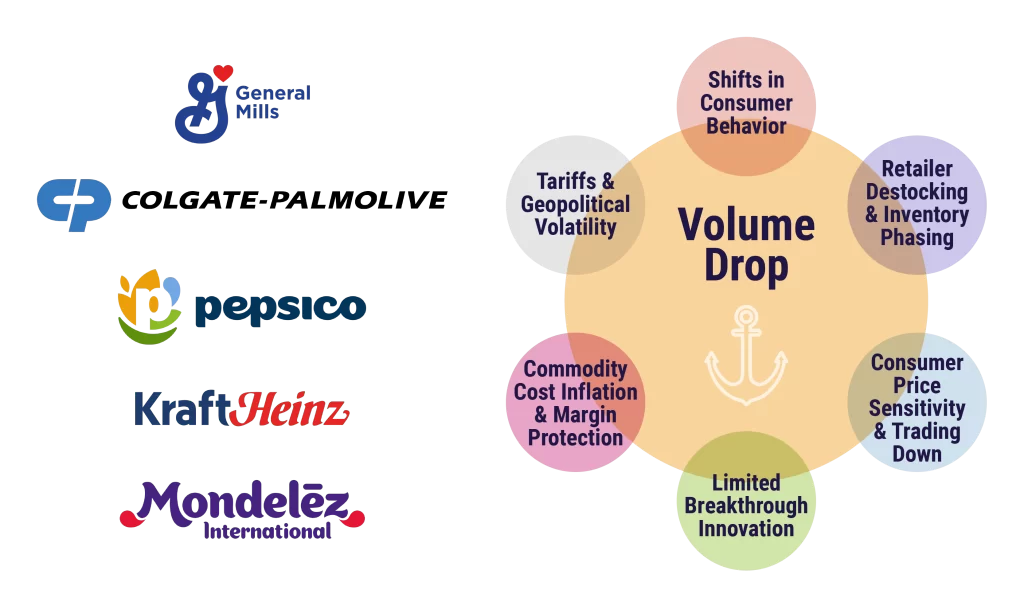

CPG inability to grow on volume is a multi-factor problem. Analyzing the five companies with the lesser volume performance there are six common factors behind this issue.

Persistent Consumer Price Sensitivity and Trading Down

Across all five companies, aggressive pricing actions to offset inflation and tariffs have hit a ceiling. Consumers in developed markets, especially North America and Europe, are increasingly trading down to private labels or value channels.

For instance, Kraft Heinz in North America suffered a 4.2% decrease in volume/mix mainly driven by increased price elasticity in cold cuts and coffee categories where consumers adopted a trade-down behavior.

Commodity Cost Inflation and Margin Protection

Record-high input costs forced companies to lean on pricing and cost-cutting, which further suppressed volumes.

As example of this situation, Colgate saw gross margin contraction of 190 bps, as raw material inflation outpaced pricing power.

Tariffs and Geopolitical Volatility

Trade disruptions and punitive tariffs have created cost headwinds and uncertainty, limiting flexibility on pricing and sourcing.

P&G flagged $1.0–$1.5B in tariff-related pretax impacts, forcing price hikes and productivity offsets.

Retailers Destocking and Inventory Phasing

Several companies reported retailer inventory reductions and promotional inefficiencies, which dampened shipment volumes despite underlying consumption stability.

Amid economic volatility, retailers are being more cautious in how they manage their cash. One common strategy is to optimize inventory levels. Examples of impacts CPG are dealing with this fact are: Mondelez highlighted U.S. biscuit softness tied to retailer-driven destocking and weak promotional ROI, and Kraft Heinz faced inventory phasing issues in North America, further delaying volume recovery.

Structural Shifts in Consumer Behavior

Longer-term trends are reshaping demand patterns: health-conscious choices, smaller pack sizes, and e-commerce migration. Going from mainstream categories to premium niche is creating a short-term volume drag for the industry.

Food companies are making strong statements about improving their recipes in line with better-for-you consumer demand.

A year ago, Kraft Keinz charged a $1.4 billion non-cash impairment largely attributable to its Lunchables business. Issues impacting this business include negative publicity that has affected consumer perception of the brand, increased competition combined with supply chain issues.

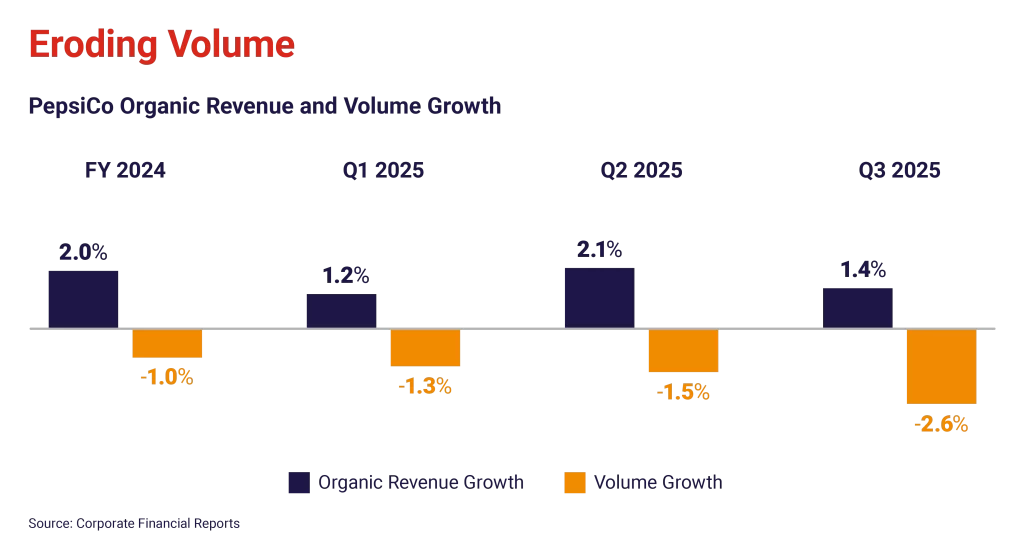

Another example is from PepsiCo: they are pivoting to smaller packs and “permissible snacks,” which lift revenue but hurt reported volume.

Limited Breakthrough Innovation and Weak Incremental Volume Contribution

The industry’s slowdown is also linked to a shortage of meaningful, high-impact innovation capable of creating new demand. Many launches over the past two years have been line extensions or packaging tweaks that add complexity but fail to generate incremental consumption. In a crowded shelf environment, these efforts tend to cannibalize existing SKUs rather than create meaningful volume, limiting the sector’s ability to counteract pricing pressure and softening demand.

NielsenIQ reports that only about half of new CPG products sustain growth into their second year, while brands that increase innovation-driven sales are twice as likely to grow overall.

PwC highlights that the sector is burdened with “too many SKUs and too little real innovation”, and that outperformers are prioritizing fewer but more differentiated bets. These findings show that muted innovation quality is not only failing to contribute volume but is also weakening the industry’s capacity to reignite growth.

A deep dive

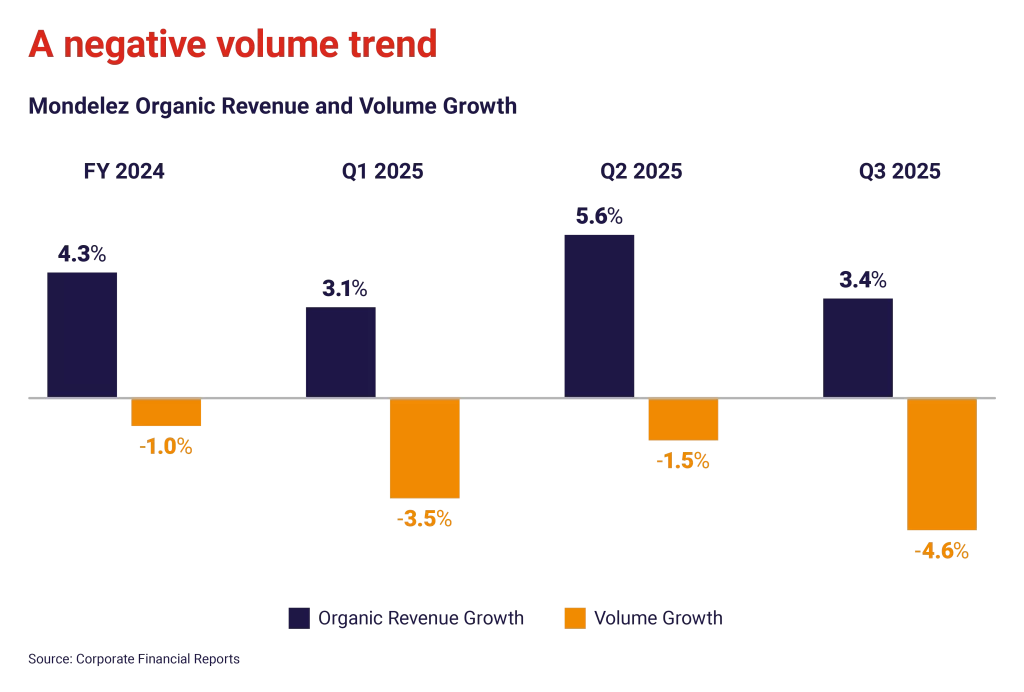

Based on a comprehensive review of Mondelez International Q3 2025 earnings and industry analysis, here are the four key levers that explain the significant volume drop during the quarter:

1. Record-High Cocoa Cost Inflation

Mondelez faced unprecedented input cost inflation, particularly in cocoa, which peaked in Q3. This led to aggressive pricing actions that helped maintain revenue but significantly hurt volume. The company reported an 8% increase in pricing, but this was offset by a 4.6% decline in volume/mix, indicating consumer resistance to higher prices.

2. Consumer Trading Down & Channel Shifts

In North America, economic uncertainty and cost-of-living pressures drove consumers to value channels like discounters and club stores. Mondelez under-indexes in these channels, which contributed to volume losses. Additionally, higher-income consumers shifted toward premium and better-for-you products, further fragmenting demand.

3. Revenue Growth Management & Pack Downsizing

Mondelez implemented strategic pricing and pack size adjustments to manage margins. However, these changes contributed to volume declines. The company acknowledged that pack downsizing alone accounted for more than 1 percentage point of the volume/mix decline.

4. Regional Elasticity & Soft Category Performance

North America: Volume/mix declined 1.8%, with biscuits (Oreo, Chips Ahoy!) hit the hardest due to cocoa inflation and weak consumer sentiment.

Europe: Chocolate volumes dropped due to lingering softness post-summer heat wave and high cocoa costs.

Emerging Markets: While pricing drove revenue growth, volume/mix still declined 4.7%, showing elasticity even in resilient regions. Over the past decade, publicly listed giants have mainly chosen focus. Investors reward simplicity and punish complexity.

The five key contributors behind PepsiCo’s modest Q3 2025 volume performance are:

1. Price-Led Mix and Elasticity

Revenue growth continued to rely heavily on pricing rather than true volume expansion. While price hikes preserved margins, they exposed elasticity across beverages and snacks, particularly in discretionary SKUs. Consumers reacted with reduced purchase frequency and greater trade-down to value packs or private label.

2. Consumer Trade-Down in Key Markets

Demand in the U.S. and China weakened as inflation and cautious spending drove consumers toward cheaper alternatives. North America Foods posted volume declines, and China’s slow recovery in out-of-home channels further weighed on results. This structural down-trading highlights the need for localized value strategies and affordability innovation to reignite demand.

3. Category and Channel Mix Shifts

PepsiCo’s volume performance diverged across categories and channels: some beverage lines held up, but snacks and at-home formats lagged. Reduced impulse purchases and slower foodservice recovery altered consumption patterns, lowering reported volumes even when pricing and mix improved. The company must recalibrate pack architecture and channel execution to restore velocity.

4. Operational and External Disruptions

Weather effects, recall episodes, and uneven service levels constrained availability in certain international markets. These episodic disruptions limited sell-through despite stable underlying demand.

5. Competitive and Structural Pressures

Aggressive promotional activity from rivals and investor scrutiny on portfolio strategy added short-term executional pressure. With resources focused on margin protection and strategic review, promotional intensity softened, affecting share and volumes.

The path forward

The volume crisis is here to stay, and big CPG players must redefine their strategies to address it structurally. Some portfolio splits, such as Kraft Heinz’s or KDP’s, reflect attempts to regain focus, but deeper transformation is required.

Some strategies CPG can use to reignite volume growth:

1. Shift from Price-Led to Volume-Led Growth via Revenue Growth Management (RGM).

After years of inflation-driven price increases, consumers are fatigued and trading down. Companies must pivot from relying on pricing to driving penetration and frequency. Key points for execution: redesign pack-price architecture to offer affordable entry points without diluting margins, use data-driven promotions and AI-enabled RGM tools to target shopper missions and occasions effectively, and align sales and marketing under a unified RGM framework to optimize assortment and channel strategies.

2. Accelerate Innovation and Portfolio Transformation

Volume growth requires to make deliberate choices on categories where to invest and to create new demand spaces and refreshing relevance. Key points for execution: invest in breakthrough innovation according to emerging consumer trends (e.g. wellness, functional products, and premium tiers), leverage generative AI and consumer insights for faster concept testing and localized product development, rationalize underperforming SKUs, double down on power brands and local jewels to strengthen household penetration and innovation which builds long-term brand equity, and ensure high-impact launches with strong activation and flawless in-market execution.

As example, Mondelez with its heavy dependance on cocoa requires a portfolio rebalancing with categories less reliant on this ingredient.

3. Build Omnichannel and Digital-First Ecosystems

Consumers are increasingly shopping online and expecting seamless experiences. Key points for execution: expand direct-to-consumer (D2C) and e-commerce capabilities with personalized AI-driven platforms, integrate omnichannel execution across retail, digital, and social commerce to capture shifting purchase occasions, use real-time data analytics to optimize inventory, pricing, and promotions dynamically.

At Sevendots, we are a global collective of seasoned CPG experts, empowered by AI capabilities, dedicated to helping brands navigate industry transformation and achieve sustainable, long-term growth.

Contact us to get value from our proven methodologies to further build your brand, strategically managed your portfolio and innovation, identify opportunities to boost penetration, better understand your consumer and optimized your end-to-end value chain, and prepare it for Direct-to-Consumer approach.

A full analysis of quarterly performance, covering the top 35 global CPG companies, is available through our subscription service.