Business Strategy 12 February 2026

The Collaboration Dividend: The secret sauce CPG leaders use to drive volume and profitability

Why retailer collaboration is the hidden driver of sustainable growth in CPG, backed by new research and real-world case studies.

Sevendots, Singapore

9 minute read

Introduction

In the consumer-packaged goods (CPG), also commonly referred to as fast-moving consumer goods (FMCG), many companies fixate on pricing and cost-cutting as the primary levers to boost profitability. While trimming costs or raising prices can improve margins in the short term, sustainable profit growth ultimately depends on growing sales volume in a healthy way.

Without volume, price increases eventually hit a ceiling, especially when consumers are feeling financially strapped and retailers are under increasing pressure to deliver value and efficiency.

The challenge is that many traditional volume-driving strategies are expensive or complex.

Expanding into new markets, launching new brands, or opening direct-to-consumer channels can certainly drive growth, but they often require heavy investment and carry significant risk.

One often-overlooked avenue for growth is strengthening the business you already have, more specifically, building deeper supplier-retailer engagement and collaboration with the retailers who already stock your brands.

These existing retail partners are the gateway to your consumers, and maximizing those relationships can unlock incremental sales more efficiently than many flashy new initiatives. Instead of solely pouring funds into new channels or costly price promotions, leading CPG firms are finding that investing in retailer relationships yields resilient volume growth and improved profitability.

New research supports this idea: supplier companies that make customer-centricity – in this context, treating retail customers as true partners – a centerpiece of their strategy are outperforming their peers on both the top and bottom line.

In the sections below, we explore the evidence behind this claim and how some of the world’s biggest CPG multinationals have embraced retailer-centric strategies to drive success.

New Research: How Retailer Engagement Drives Superior

Growth in CPG

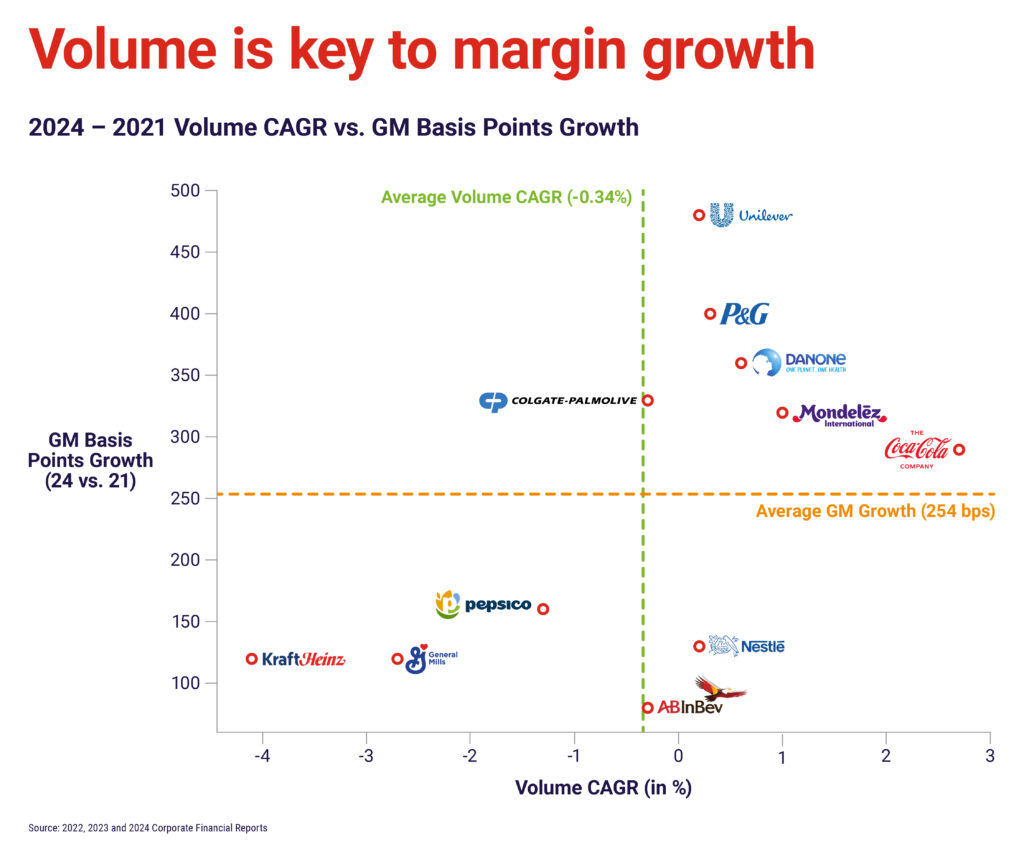

A recent analysis by Sevendots of 11 top CPG companies over the past 3 years reveals a compelling pattern: the companies that excelled at volume growth whilst still improving margins tended to be the ones most focused on strengthening relationships with their existing retailers.

As the chart shows, out of the 11 companies studied, 6 were able to grow both sales volume and profit margins above industry norms in this period – a clear sign of healthy, sustainable growth.

When we examined what set these 6 outperformers apart from the others, 3 striking differences emerged:

- Higher retailer relationship ratings: The 6 winners had an average Advantage Group International (AGI) relationship score across all measured dimensions of 40 points, 6 points higher than the rest of the pack. A company’s Advantage Group score is derived from anonymous retailer feedback, providing a benchmark of how suppliers are viewed by their customers in areas like collaboration, service, and value creation. In other words, the best-performing suppliers were rated significantly better to do business with by their retailers. This isn’t a trivial gap – in Advantage surveys, a few points can separate the top-tier from the middle of the road. The data suggests that being more collaborative pays off with real commercial results.

- Greater commitment to understanding customer needs: The six winning companies on average only spend a tiny fraction (< 0.1%) of their annual turnover on services from Advantage Group; however that percentage is roughly 50% more than the others’ average relative spend. This metric is a proxy for how much each company invests in formally measuring, benchmarking, and improving retail partner relationships. While the percentage sounds small, for a large CPG firm it can translate into hundreds of thousands of dollars dedicated to listening to structured retailer feedback and engagement measurement. The leaders’ higher spend demonstrates a clear commitment to retailer-centric analytics and continuous improvement.

- Retailer collaboration as a sustainable strategy: Importantly, this investment has been ramping up over time: collectively, these firms increased their spend on retailer feedback and engagement programs by 89% over three years, significantly higher than the 49% increase seen among the other companies. These companies are doubling down on customer-centricity and scaling those principles across markets and channels, while less successful peers have been slower to expand similar efforts.

Excellence in key collaboration capabilities

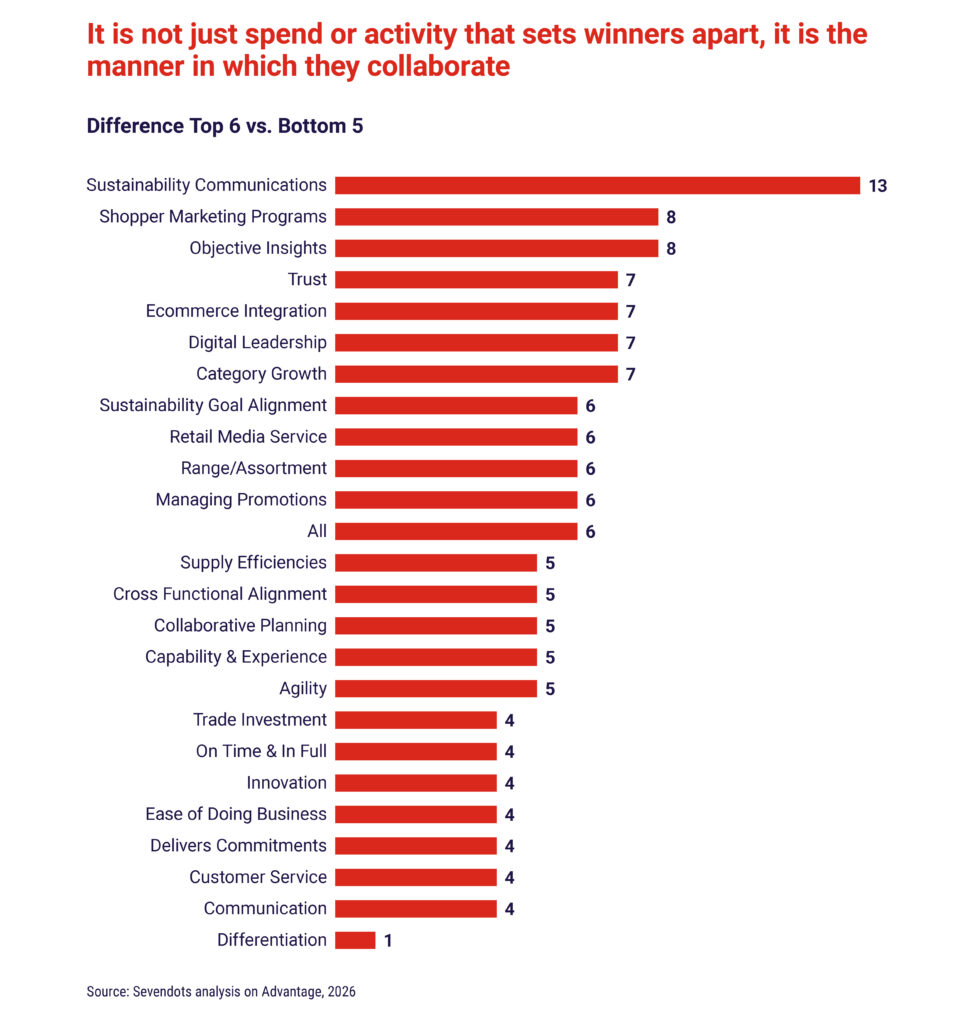

Digging further into the data, the successful group particularly out-performed others on specific aspects of the manufacturer–retailer relationship. In Advantage Report (and other qualitative assessments), they scored especially high in areas such as “Capability & Experience” of their teams, “Sharing Objective Insights”, “Shopper Marketing Programs” and “Sustainability Commitments”.

In practice, this means the winning companies have highly competent, experienced account teams and processes; they build trust by sharing data and category insights objectively with their retailers; they co-create effective shopper marketing initiatives in stores and online; and they collaborate with retailers on sustainability goals and ethical commitments. These are all value-adding, partnership-oriented behaviors.

By contrast, the analysis showed less advantage for the winners on dimensions like product innovation, brand differentiation, or even trade spending levels. In other words, what set the top performers apart was how they partnered, not simply what products they sold or how much they spent on trade promotions. They did not win by simply having more blockbuster new products or by outspending rivals on price discounts; they won by being better partners in the eyes of the customer.

The following chart shows the difference in Advantage scores between the companies that drove volume and profit above industry norms, compared to those that did not.

Why Strong Retailer Relationships Drive Volume and Profit

These findings align with a growing body of evidence that strong, collaborative retailer relationships are a leading indicator of business success in CPG. When a manufacturer consistently delights its retail partners, the benefits flow both to the retailer and back to the manufacturer in a virtuous cycle. A recent global study by Advantage Group International quantified this effect: companies ranked in the top tier by their retail customers achieved significantly higher revenue growth than those in the bottom tier. Specifically, top-rated suppliers enjoyed about 26.9% higher annualized revenue growth. This analysis underscores that prioritizing collaborative, mutually beneficial relationships with key retail partners is not just “nice to have”; it is strongly associated with superior financial performance.

We term this “The Collaboration Dividend”, and there are several mechanisms through which

strong relationships drive sustainable volume and margin:

- Improved execution at the shelf: Retailer-aligned suppliers secure better availability, shelf placement, and promotional execution. Joint business planning (JBP) enables more effective promotions, fewer stockouts, and higher on-shelf conversion – lifting volume efficiently. Higher-impact joint marketing: Trusted partners are invited to co-create shopper marketing programs rather than simply fund promotions. These collaborative initiatives tend to outperform traditional trade spend because they are rooted in shared objectives and retailer insight.

- Credibility as a category partner: Retailers value manufacturers who share objective, data-driven insights rather than brand-biased narratives. Suppliers that play a category leadership role influence assortment, space allocation, and growth strategies – directly impacting volume.

- Alignment on strategic priorities: Collaboration on sustainability, supply chain efficiency, and omnichannel execution builds trust and creates incremental growth opportunities. These initiatives often unlock retailer support that would not be available through transactional relationships.

Notably, the research shows that the outperforming companies did not meaningfully exceed peers on innovation output or trade spend levels. Their advantage came from capability, collaboration, and execution. In short, they earned volume rather than buying it – making profitability more durable over time.

Customer-Centric Strategies in Action: Lessons from Top CPG Players

Leading CPG multinationals have institutionalized retailer-centricity by embedding it into their governance, operating models, and commercial processes. While approaches differ, the underlying principle is consistent: treat retailers as strategic partners, not transactional customers. Across organizations, this shows up not through heavier trade spend or innovation alone, but through stronger commercial capability, deeper collaboration, and disciplined execution at scale.

- Procter & Gamble – Partnership built on transparency and execution discipline

Procter & Gamble (P&G) has long positioned customer partnership at the core of its commercial model.

Through senior leadership roles dedicated to customer development and a culture of radical transparency, P&G works with retailers to co-design growth strategies rather than simply sell into them. Its emphasis on superior retail execution – from shelf simplification to omnichannel collaboration – reflects a belief that volume growth starts with making retailers more successful.

- Unilever — Joint business planning as a growth discipline

Unilever explicitly frames customers as the “gateway to shoppers and consumers”. The company systematically deploys joint business planning with key retailers, aligning on growth objectives, investments, and service levels. Unilever brings discipline and consistency to how it partners with retailers. This approach allows Unilever to strengthen existing channels while selectively expanding into new ones, rather than treating the two as competing priorities.

- The Coca-Cola Company — Collaborative business planning as a strategic reset

The Coca-Cola Company has redefined account planning by replacing supplier-led selling with Collaborative Business Planning built around shared strategic agendas. By developing plans jointly with retailers, Coca-Cola improves execution quality, accelerates decision-making, and ensures its brands are embedded in retailer growth strategies rather than positioned alongside them.

- Mondelēz International — Sustained investment in partnership quality

Mondelēz International provides a clear example of how sustained investment in customer engagement pays off. Its repeated top rankings in Advantage Report reflect a consistent focus on partnership quality, execution excellence, and long-term vision – particularly in channels like travel retail, where collaboration is critical to growth.

- Danone — Customer centricity anchored in shared values

Danone has elevated customer centricity to the executive level through Chief Customer Officer roles and by linking retailer collaboration with its sustainability agenda. Joint initiatives with retailers have demonstrated that aligning on shared values can deliver both societal impact and measurable sales uplift.

- Colgate-Palmolive — Operationalizing retailer partnership at scale

Colgate-Palmolive operationalizes retailer partnership through widespread joint business planning, shopper marketing collaboration, and disciplined data sharing. This approach has supported strong shelf velocity and category leadership in highly mature markets.

Across these examples, the common thread is not superior innovation pipelines or heavier trade investment, but stronger commercial capability, deeper collaboration, and a sustained commitment to understanding and serving retailer needs.

Conclusion: Grow Where You Already Play

In an era of fierce competition and rapid channel evolution, from e-commerce to hard discounters, it’s understandable that CPG companies are hunting for the next big growth opportunity. However, this research and the accompanying examples make a persuasive case for not overlooking the growth potential sitting right in front of you: your existing retail channels. Strengthening engagement and collaboration with the retailers who already carry your brands can be one of the most efficient and effective ways to drive incremental volume and improve profitability. It is a classic case of making the most of your current assets before stretching yourself thin in new arenas.

Focusing on volume through existing customers does not mean abandoning innovation or new channels. Rather, it means ensuring a solid foundation on which those other growth initiatives can succeed. Strong retailer partnerships amplify innovation by securing better launches and shelf placement, make pricing strategies more sustainable through joint value creation instead of unilateral increases, and can even facilitate expansion as trusted retailers support entry into new stores or try omnichannel pilots. Just as importantly, collaboration also guards against downside risk – retailers are less likely to drop your products or push for extreme discounts if the relationship is truly win-win.

In summary, the path to sustainable growth in CPG seems to run through the customer. By investing in retailer relationships – measuring them, prioritizing them, and innovating within them – manufacturers can unlock growth in places they might have assumed were mature or maxed out.

The data shows and executives confirm that this approach works: suppliers who are rated highly by their retailers tend to grow faster, and the initiatives that improve those ratings, including capability-building, joint planning, and insight sharing, are within any company’s reach.

It does however require a mindset shift from “How can we get retailers to push more of our product?” to “How can we become the supplier of choice for our retail partners?” The former yields transactional gains; the latter yields strategic, long-term gains.

“How can we become the supplier of choice for our retail partners?”

As leaders plan for the next quarter or fiscal year, customer engagement should be considered as a strategic objective alongside your sales and profit targets. Relationship metrics, such as those captured through Advantage Group International or your own customer satisfaction surveys, should be viewed as key performance indicators, just as important as market share or innovation pipeline. Teams should be encouraged to approach retailers not just as negotiators, but as collaborators who bring solutions to the table. Resources – people, time, and budget – should be intentionally allocated to initiatives that strengthen partnerships, whether through joint business planning sessions, retailer-specific insights research, or collaborative training programs.

The takeaway from our research is clear: CPG companies that strengthen where they already play are winning the game. By building on the base of trust and cooperation with existing retailers, organizations create a launchpad for volume growth that is profitable and enduring.

In a business environment that often fixates on the next new technology, market, or trend, there is real competitive advantage in doubling down on the fundamentals of partnership. The proof is in the numbers – and on the shelves.

At Sevendots, we help brands unlock pathways to margin enhancing volume growth by developing and assessing alternative growth plays. A key component includes advising on the optimal channel and retailer plays that will deliver the greatest return. Reach out to us if you’re looking for support to drive out-sized growth in 2026.