Business Strategy, Category Growth 19 January 2026

Volume, Penetration and the Growing Gap Between Markets and Big CPG Players

For years, volume has been treated as a residual outcome in the CPG industry, something expected to follow pricing, innovation or distribution decisions. Our ongoing analysis of the performance of some of the largest global CPG companies shows the opposite: volume is the most reliable driver of long-term value creation, and when it weakens, the entire growth engine becomes structurally fragile.

This is not only visible in company results, but even more clearly when comparing large CPG players to the broader market.

Sevendots, Milan

5 minute read

Volume: the missing engine of value creation

In 2025, so far the average volume growth of the world’s largest CPG companies remains negative. Among the top 11 global players, volume is down on average by –0.6%, while across the broader group of the top 34 companies the decline deepens to around –1%.

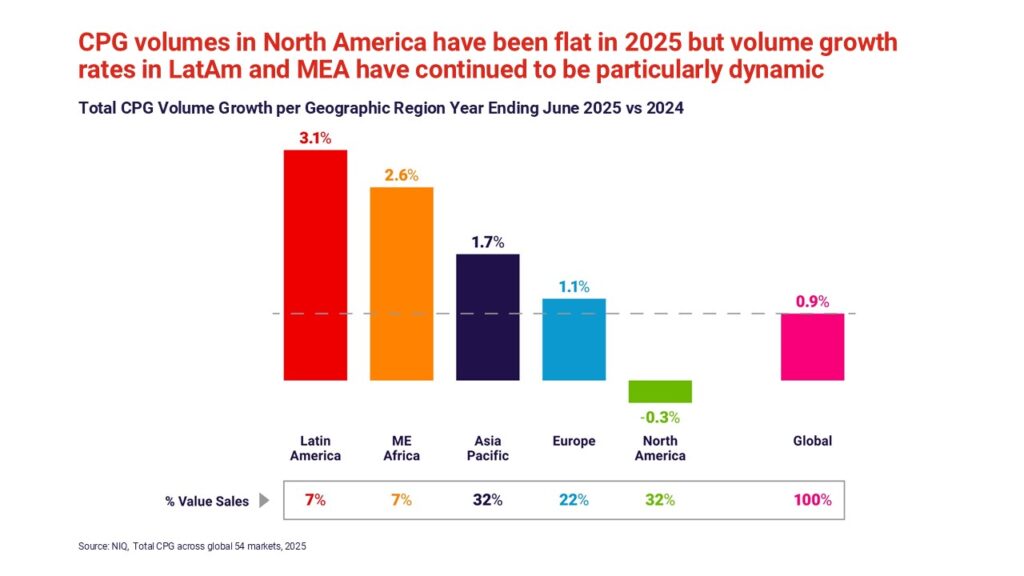

By contrast, NIQ data shows that the overall CPG market is still growing in volume by +0.9% globally, highlighting a persistent and structural gap between market dynamics and the performance of the largest manufacturers.

This gap is not cyclical. It reflects a progressive loss of penetration and relevance of large brands versus local players, insurgent brands and, most importantly, Private Labels. After a period of stagnation, Private Labels has started to grow again in many geographies, benefiting from affordability, sharper value propositions and faster adaptation to local needs. In parallel, a number of retailers whose business model is not reliant on major branded products – Aldi & Lidl for example – have been gaining ground with consumers.

The crucial role for penetration

If volume is the outcome, penetration is the mechanism. Sustained volume growth can only be achieved by reaching more households, expanding usage occasions and scaling brand assets across geographies, channels and categories.

This requires deliberate trade-offs. Scaling a brand is not about doing more everywhere, but about making clear choices on:

- where a brand has the right to win,

- which channels genuinely expand reach rather than dilute focus,

- and which categories allow the brand to stretch its territory without losing meaning.

At Sevendots, we have developed a Penetration Growth Framework precisely to address this challenge. It helps brands understand how penetration drivers evolve at different stages of brand development, and how to arbitrate between focus and expansion, scale and relevance, short-term gains and long-term value creation.

Geography matters: a tale of diverging consumers

NIQ data, based on comparing Year End June 2025 with 2024 on 54 markets, shows stark contrasts across regions.

North America volumes are essentially flat at –0.3%, confirming a deep structural challenge. Affordability is becoming a dominant decision factor for a growing share of consumers.

As Susan Morris, CEO of Albertsons, recently stated: “In Q3 shoppers traded down to smaller packages and private labels, used more coupons and stuck to lists.”

This behavior directly penalizes brands that rely on premiumization and pricing rather than penetration and accessibility.

Latin America, on the contrary, stands out with +3.1% volume growth, the strongest performance globally.

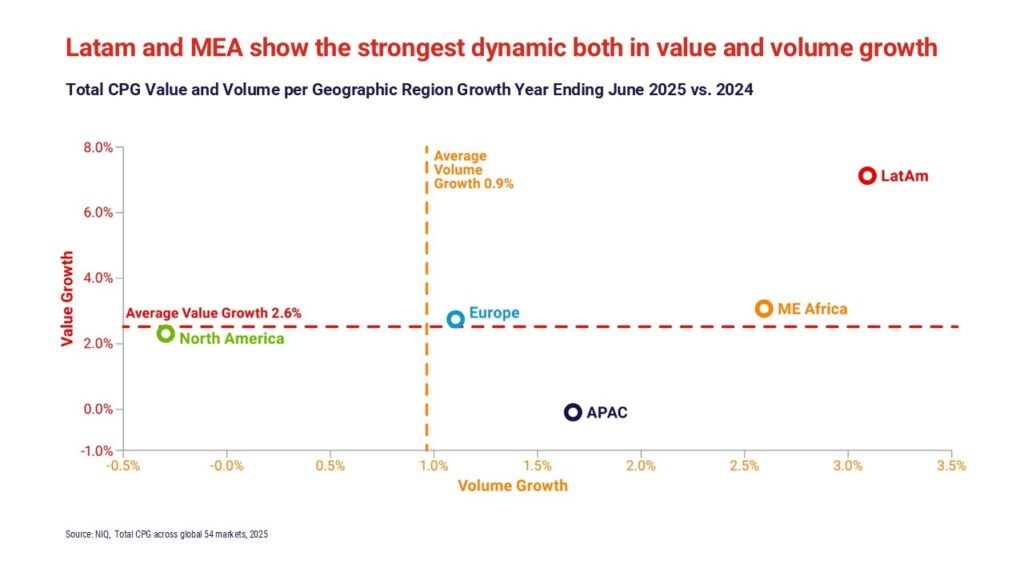

Importantly, large CPG multinationals tend to be relatively strong in this region in terms of revenue incidence, meaning they are well placed to benefit from this dynamic. Notably, LatAm combines strong volume growth with strong price growth, showing that affordability does not automatically mean margin dilution when propositions are well calibrated.

Middle East & Africa also show solid momentum on both volume and value, while Europe and Asia-Pacific sit in between, with more heterogeneous patterns.

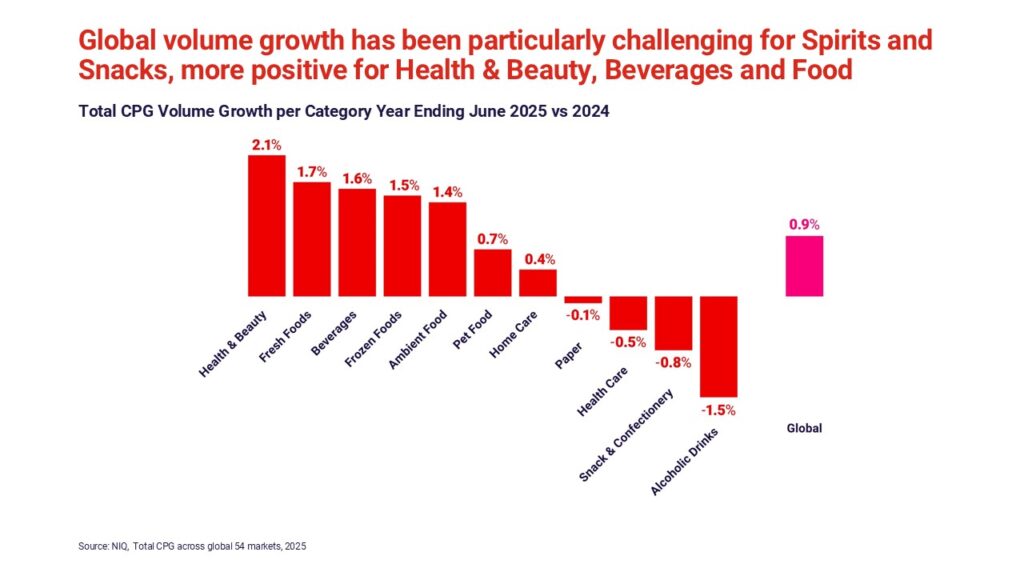

Alcoholic Drinks are among the most impacted, with volumes down –1.5%. This decline is structural, driven by changing consumption habits, particularly among younger consumers who drink less and drink differently. Large players are reacting by reshaping portfolios around premium-and-less-occasions strategies, while accelerating investments in non-alcoholic beer, fermented drinks and adjacent soft drink categories.

Snacks & Confectionery volumes are down –0.8%, heavily affected by cocoa cost inflation. Over the past years, companies have passed these costs on to consumers through pricing, boosting value growth but eroding volume and frequency. Big manufacturers need to rethink their over-reliance on cocoa trying to rebalance their portfolios from chocolate-based products to other recipes still able to sustain a good price per kg.

Health & Beauty clearly stands out, with +2.1% volume growth, reflecting rising consumer attention to wellbeing, personal care and preventive health. This is one of the few categories where large CPG companies are, in some cases, keeping pace with the market. Unilever, for example, delivered +1.9% volume growth in Beauty & Wellbeing in Q3 2025, almost fully aligned with the segment’s underlying growth.

Value grows, but often at the expense of volume

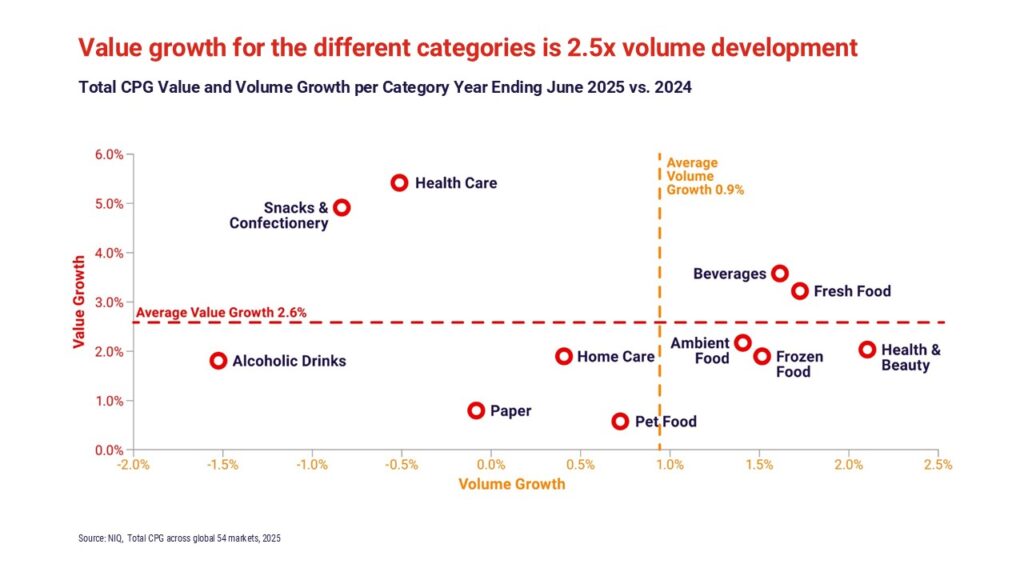

Across categories, NIQ data shows that value growth averages 2.6%, roughly 2.5 times volume growth.

Health & Beauty is again the most balanced category, with value and volume contributing equally to its 4.2% overall growth. At the opposite end, Snacks & Confectionery and Health Care show the strongest imbalance, with pricing increases compensating, and arguably impacting, volume decline. Alcoholic Drinks sit in the middle, where value barely offsets volume losses, resulting in a marginal +0.2% overall growth.

Geographically, Latin America and MEA are the only regions where value and volume grow in tandem, reinforcing the idea that penetration, affordability and relevance can coexist with healthy value creation.

The strategic implication: scale needs to be earned again

The evidence is consistent and increasingly hard to ignore: volume is the key engine of sustained value generation in the CPG industry, and penetration is the primary lever through which volume can be rebuilt and defended.

Price and mix can support growth for a time but without expanding or at least maintaining reach, scale advantages erode, brand relevance weakens and long-term value creation is structurally compromised.

Re-anchoring growth strategies on volume requires large CPG companies to fundamentally rethink how and where they compete. This means aligning strategic priorities more closely with category and geographic dynamics, rather than applying uniform global playbooks.

Different categories are being shaped by very different consumer needs, from wellbeing and functionality to indulgence, moderation and affordability, and growth strategies must reflect these realities as well as reconsidering category boundaries to answer consumers’ higher level needs.

Similarly, geographic performance is diverging sharply, with regions such as Latin America MEA, and parts of APAC offering structurally stronger volume opportunities than mature markets under acute affordability pressure.

At the core of this realignment sits a deeper understanding of evolving consumer needs, expectations and behaviors. Consumers are not simply trading down; they are redefining value, reassessing occasions and becoming more selective about where brands truly add meaning. Penetration growth therefore depends on brands’ ability to remain relevant, accessible and credible across different consumer segments, channels and usage moments.

Finally, volume-led strategies cannot be disconnected from sourcing, supply chain and broader value-chain realities. Input cost volatility, constrained commodities, geopolitical disruptions and sustainability requirements are no longer just external factors: they directly shape what can be offered, at what price, and at what scale.

Winning companies will be those able to integrate portfolio choices,

penetration ambitions and value-chain design into a coherent system,

balancing affordability, resilience and profitability.

In a market that is still growing in volume, losing volume shouldn’t be seen as inevitable. But restoring it requires making penetration a deliberate strategic priority and aligning categories, geographies, consumers and valuechain choices around that objective.

At Sevendots, we help CPG companies put volume back at the center of sustainable value creation.

We support leadership teams in making deliberate portfolio, category and geographic choices that strengthen penetration and scale brand assets over time. Our work combines deep industry expertise with robust analytical and penetration-focused frameworks, enabling companies to align growth strategies with evolving consumer needs, channel dynamics and value-chain constraints.

Contact Sevendots to explore how we can support you in building volume-led growth strategies and restoring longterm value creation.