Brand Growth, Consumer Trends 15 July 2025

Breaking Through the Growth Ceiling: A Strategic Roadmap for Multinational CPG Companies

Sevendots, Rome

4 minute read

The Challenge with Growth

Large multinational Consumer Packaged Goods (CPG) companies face a challenging landscape. Despite robust overall market growth of nearly 8% in 2024, 11 among the largest CPG multinationals achieved on average less than half that figure.

The discrepancy in performance stems primarily from a significant market share shift towards three distinct types of competitors: emerging brands, local competitors, and private labels.

- Emerging brands leverage innovation and agility, swiftly addressing evolving consumer needs.

- Local competitors capitalize on deep market knowledge, offering tailored solutions closely aligned with regional tastes and preferences and leveraging a higher cultural relevance and a stronger presence in certain geographies.

- Private labels, increasingly managed as genuine brands and positioned across multiple price tiers (including premium and super-premium segments) thrive by combining affordability with strong retailer brand association, offering consumers appealing, value-oriented alternatives.

Each of these competitor types uniquely exploits vulnerabilities in the scale-driven strategies of large multinational brands.

The Challenge with Volume

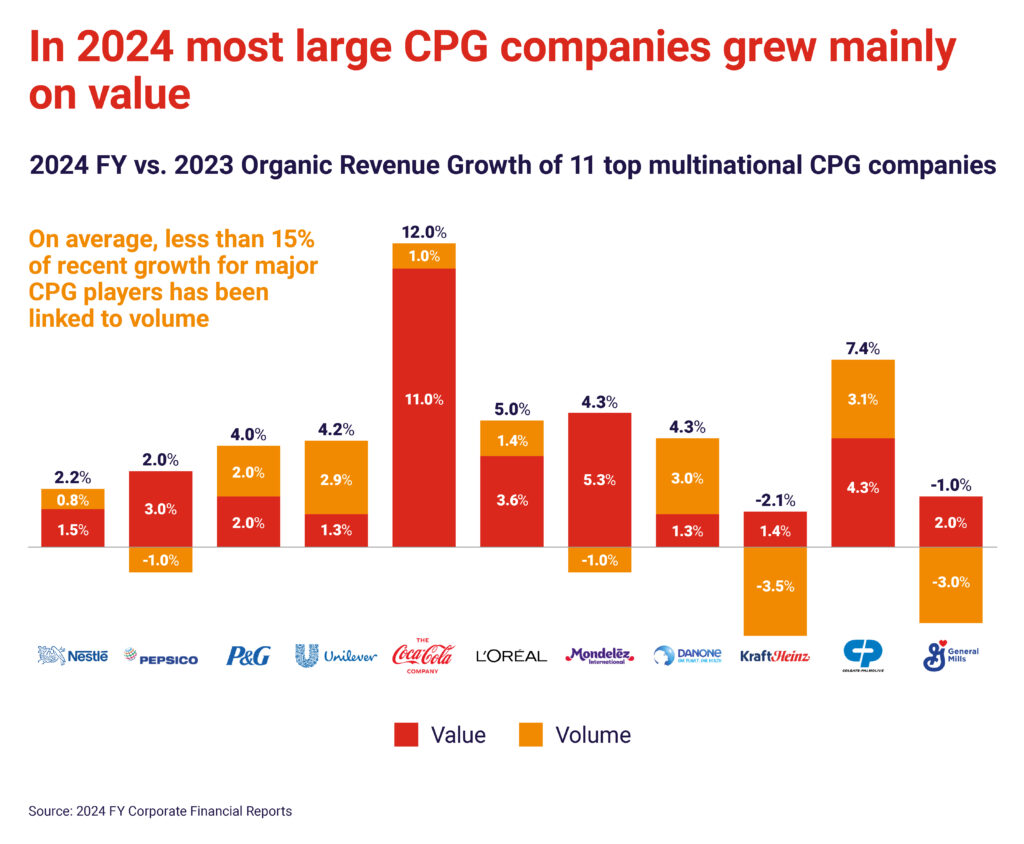

If we look at 2024 growth dynamics, the primary struggle revolves around driving sustainable volume growth.

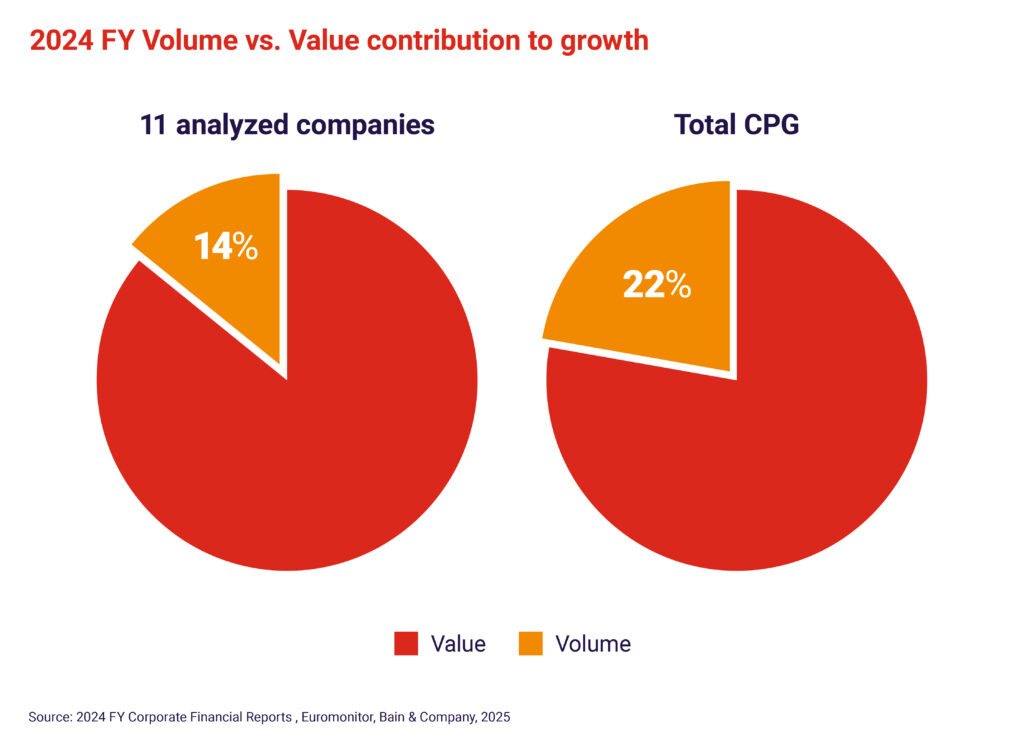

In fact, only 15% of the growth of the 11 analyzed companies came from increased volume while the rest was all value linked to premiumization and higher prices. Also in this case, the overall market had a better performance with volume contributing to the overall growth with a 22%.

If we look at the first quarter of 2025 the situation becomes even more critical with 6 of the 11 companies analyzed having either no volume growth or a declining trend.

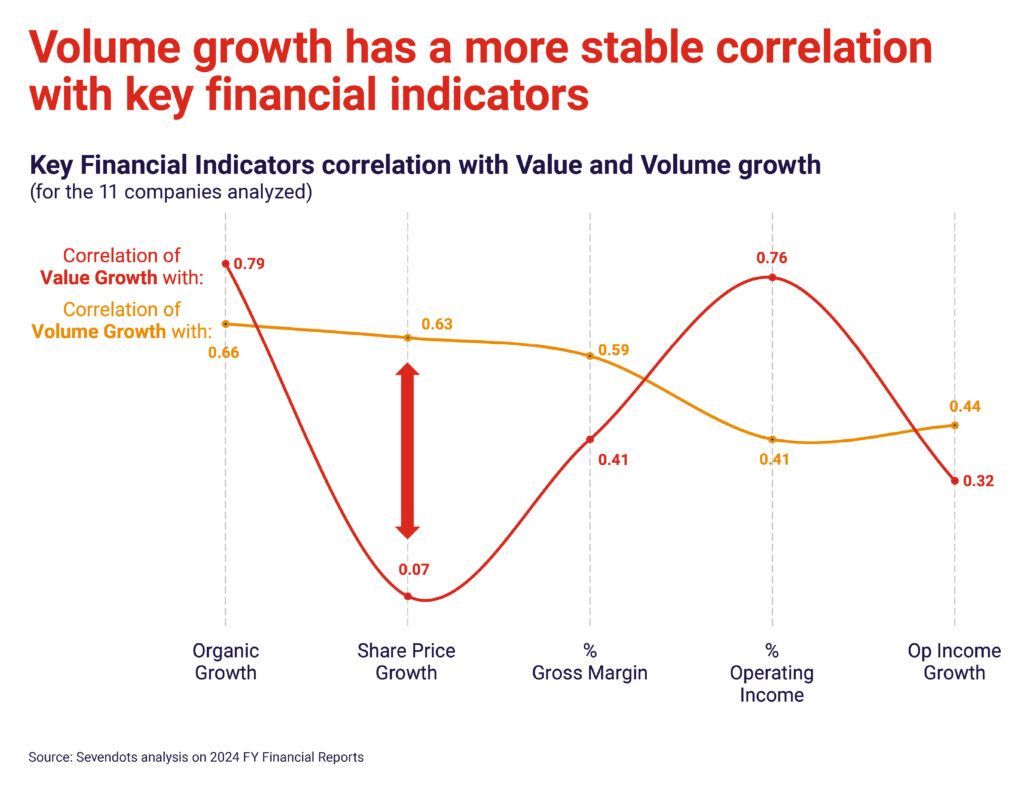

The problem with volume growth is impacting on the ability of the companies to sustain value production in the long term. In fact, volume growth shows a high correlation to Total Shareholders Return.

Understanding the Volume Challenge

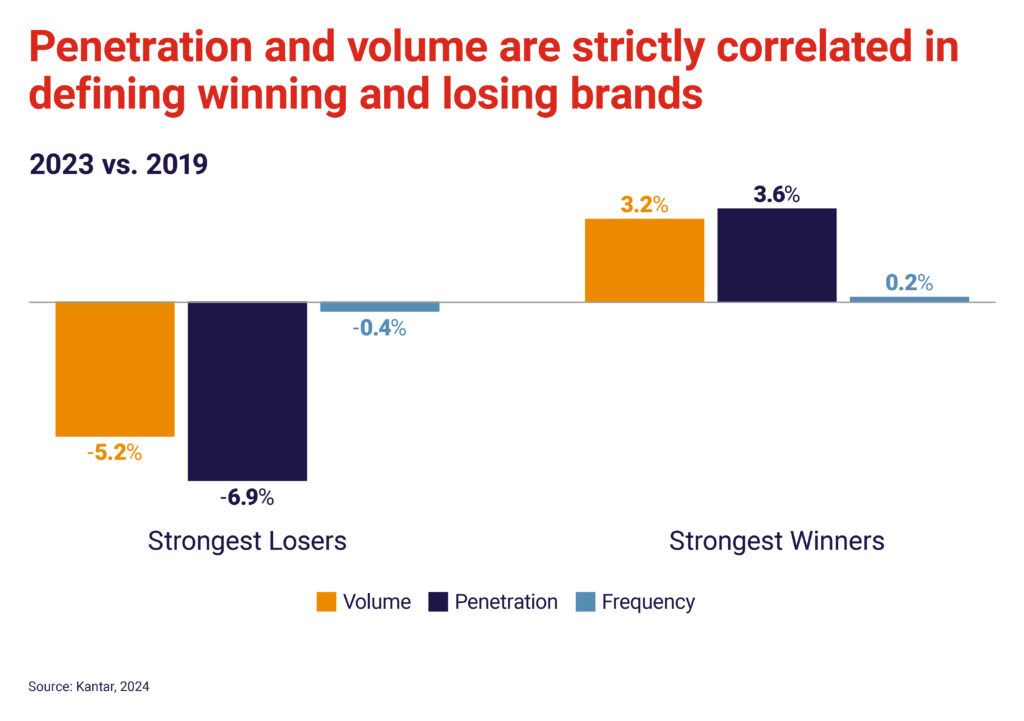

The struggle with volume growth isn’t merely a competitive issue, it’s fundamentally a penetration issue.

Volume and penetration are strictly correlated. To increase volume, you need to increase penetration. Penetration, far from being a legacy KPI, is actually the most reliable and sustainable lever to grow volume. Bringing more buyers into the brand, exposing more HHs to the brand and enlarging the consumer base is what makes the difference.

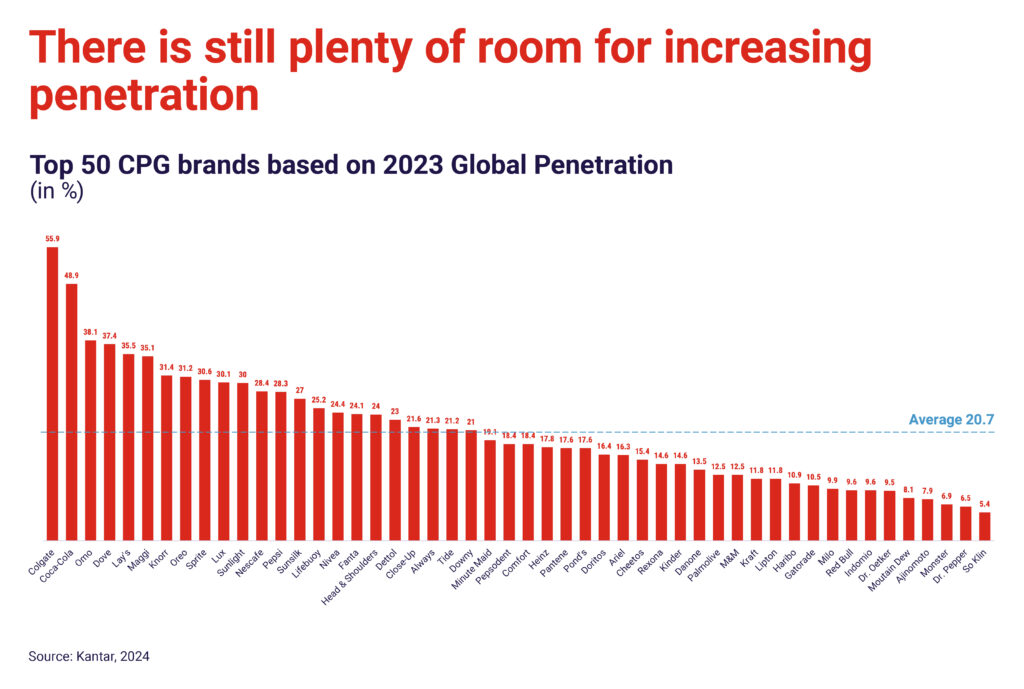

However, if we look at the average penetration of the Top 50 global brands in 2023 this was just 20.7%, and flat vs. 2022. Most so-called global brands in reality still reach only a small fraction of their potential buyers. This limited penetration underscores an immense, untapped opportunity to drive significant and sustainable volume growth.

The Geography of Growth

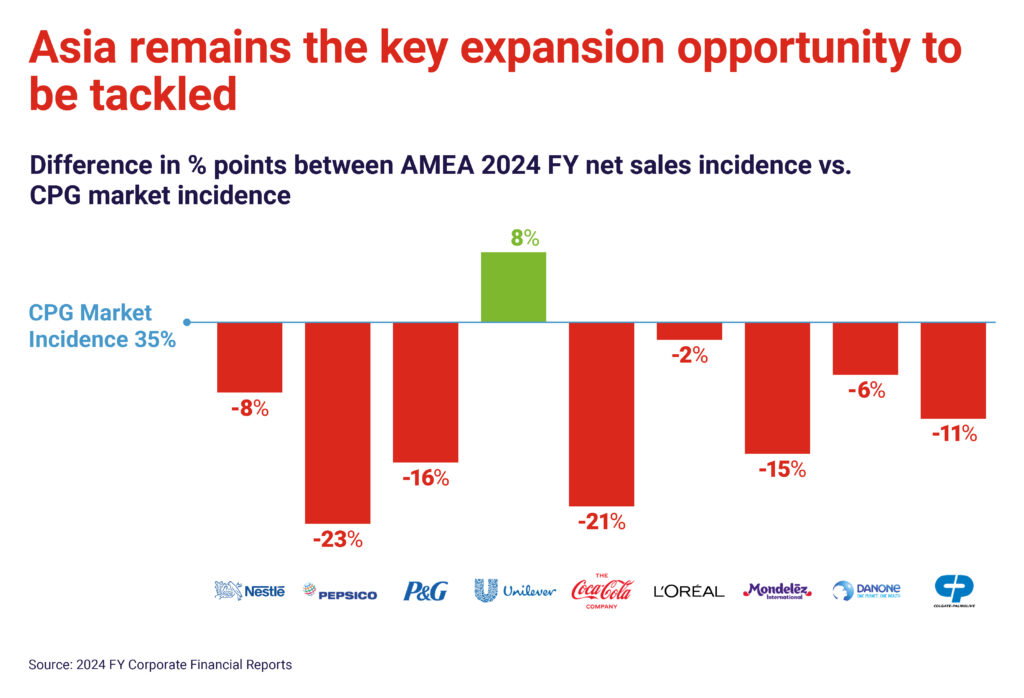

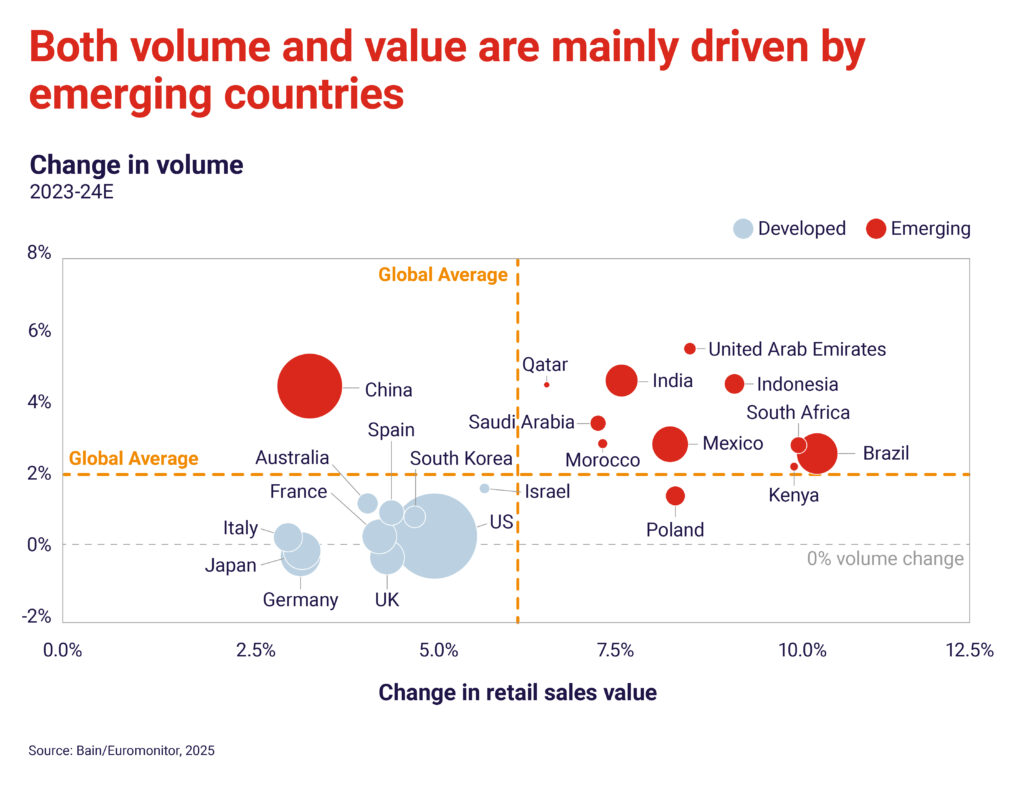

Geographic analysis provides valuable insights. Multinational giants maintain strongholds in mature markets and Latin America but significantly lag in high-growth regions such as Asia, Africa, and the Middle East.

These regions promise dual growth engines; a rapidly growing population coupled with expanding middle-class consumers increasingly demanding branded goods. This translates into a much higher growth rate both in value and volume.

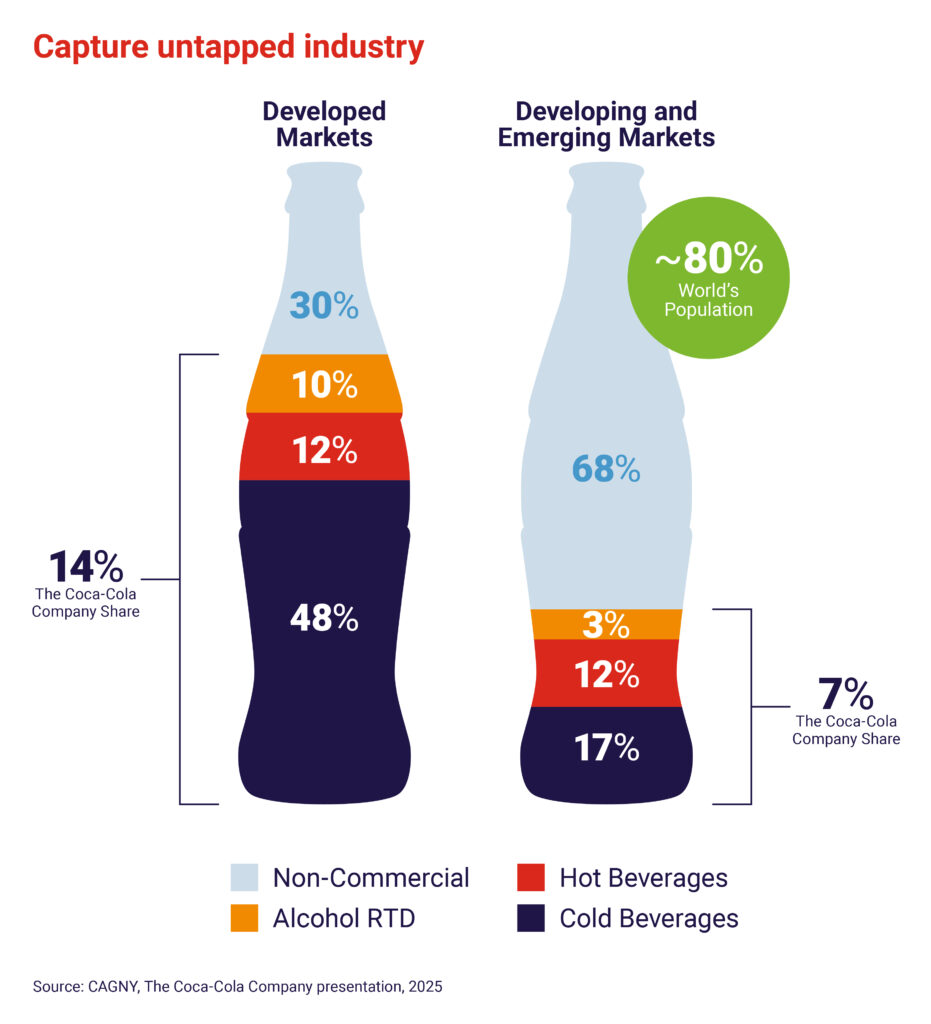

The Coca-Cola Company strategic pivot articulated during its 2025 CAGNY presentation exemplifies this trend. The company has explicitly prioritized emerging countries, recognizing their potential for both market share expansion and category development.

Four Strategic Growth Imperatives

To sustainably enhance volume growth and shareholder returns, multinational CPG companies must strategically allocate investments across four critical areas:

- Growing Market Share in Developed Countries

Quick-win strategies leveraging targeted marketing, sophisticated pricing, and promotional activities. - Developing Categories in Developed Countries

Innovation and category expansion tailored to evolving consumer preferences, creating durable brand resilience. - Growing Market Share in Emerging Countries

Capitalizing on surging consumer demand through optimized distribution and brand visibility. - Developing Categories in Emerging Countries

Adapting products for affordability, local relevance, and resilient Route-to-Market (RTM) models.

Where is the invested dollar providing the best return? This depends largely on the strategic timeframe. Investing in Area 1 (Growing Market Share in Developed Countries) generally offers rapid returns, satisfying short-term shareholder expectations but sometime providing only temporary performance boosts i.e. through promotional activities. In contrast, investing in Area 4 (Developing Categories in Emerging Countries), while demanding patience and a longer investment horizon, can build a strong, resilient platform that delivers sustained value and substantial long-term returns.

Conclusion

Multinational CPG companies face a pivotal moment. Overcoming stagnant volume growth and ensuring long-term shareholder returns necessitates strategically prioritizing penetration-driven, geographically informed growth initiatives. Companies balancing immediate opportunities with long-term strategic growth will achieve sustained market success and superior shareholder value.

At Sevendots we’re advising CPG companies on how to win in this environment, reach out to us to learn more about how we can help you.

Contact Sevendots today to discover more.