Category Growth, Innovation 07 November 2025

Will whole-body deodorants pass the smell test?

These days, whether you’re watching social media, scrolling Reddit, or browsing your local drugstore, you might think the world is facing an epidemic of body odor. Pioneered by start-ups and quickly followed by multinational leaders, nearly every major deodorant brand has now launched a so-called “whole-body” variant. The deodorant shelf — already crowded with underarm products — must now make room for all-over freshness.

Is this just a post-COVID fad, or the start of a meaningful new category? And more importantly, is there enough consumer demand for all these offerings to succeed? Will these launches drive incremental spend or simply substitute existing deodorant and fragrance use?

Is there a real long term consumer need?

The “whole-body deodorant” segment might be more accurately described as “other-body-part deodorants,” since it includes both multi-use sprays and specialized products designed for areas like the groin, feet, and thighs.

According to Unilever research, only about 2% (1) of consumers currently use whole-body deodorants. However, this number is difficult to interpret as many people already spray products like Lynx or Impulse on parts of the body beyond the underarms. While it’s debatable how necessary whole-body deodorants are — after all, odor-causing apocrine glands are concentrated mainly in the armpits and groin — the category is undeniably gaining traction.

The same Unilever study revealed that 76% of consumers expressed interest in trying such a product (1), while Google searches for “whole-body deodorant” grew over 1,000% between March 2023 and March 2024(2). Mintel data supports this momentum: 39% of U.S. consumers say they would be interested in a deodorant usable on multiple body parts (3,4), and 19% already apply deodorant to areas other than underarms, up from 16% the previous year (3,4). Younger consumers are leading the charge since 26% of those aged 18–34 apply beyond the pits, versus just 9% of those over 55 (3,4).

Circana further reports that the U.S. body spray market nearly tripled in 2023, partly because shoppers sought lower-cost alternatives to fine fragrances (5).

As the Sure brand says in its marketing materials, “FOBO” (fear of body odor) is real for many consumers.

Pioneered by start-ups, followed by leading brands

The modern wave of whole-body deodorants was pioneered by Lume in 2018, a challenger brand built on a simple, clinical promise: odor control for “pits, privates, and beyond.” Importantly, it positioned itself as less harmful than traditional underarm deodorants: free of baking soda, aluminum or dyes, using vegan natural antimicrobial ingredients such as mandelic acid to reduce the bacteria that causes odor, thus setting the tone for the “less chemical” claims of this new segment.

Once the consumer conversation began, legacy players like Unilever and P&G moved swiftly to bring the concept into the mainstream. With brands such as Dove, Sure, Secret and Old Spice, the giants bring scale, trust, and distribution that help normalize the idea of all-over freshness. Their strength lies in credibility and reach, but their challenge is making the concept feel new, not just an extension of existing deodorant lines, and real, rather than a gimmick. Meanwhile, challenger brands like Lume and Native (acquired by P&G in 2017), continue to lead with authenticity by educating consumers about odor beyond the underarms, tackling taboo zones with transparency and purpose. Their communication is direct and often playful, but their limitations lie in scale, retail presence, and pricing power.

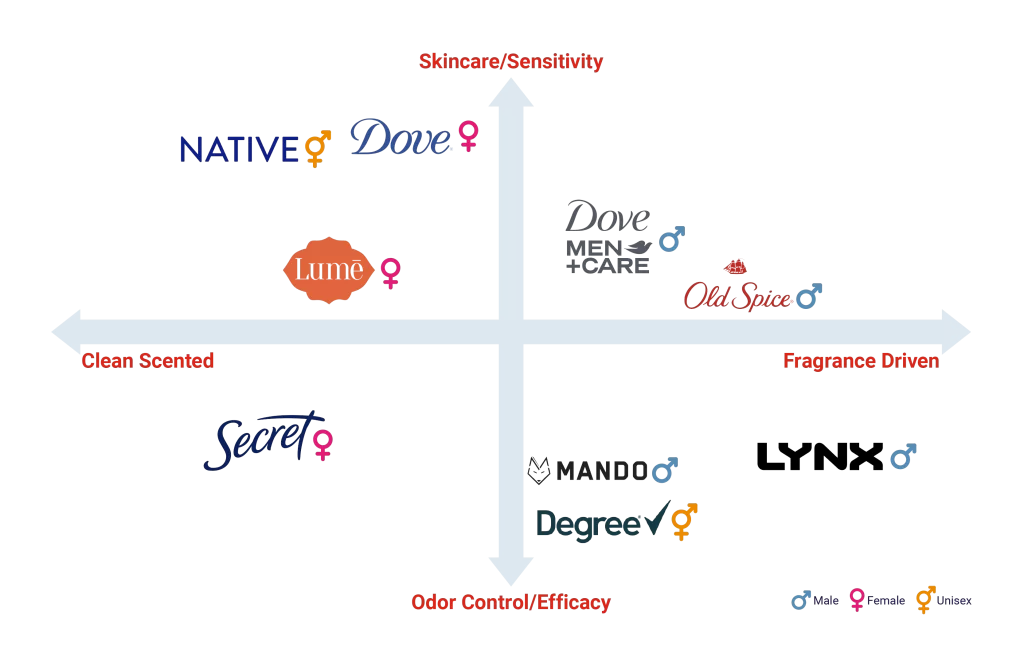

So far, however, differentiation has been limited. Most brands lean on the strength of their master brand, whether that’s Dove’s care, Lynx’s fragrance, or Old Spice’s humor and swagger. They also tend to respect their parent brand’s gender positioning (for women, men or both). To stand out as the category matures, brands with whole body offerings will need to evolve from awareness-building to meaningful positioning that connects freshness to emotional and social confidence.

Dove (Unilever) – This brand builds on its skincare equity, extending into whole-body deodorants with a focus on “body confidence and care.” While there is a strong fit with its overall gentle, inclusive positioning, it is still perceived primarily as an underarm brand. The Dove Men+ Care flanker leans more directly into odor protection efficacy in different areas of the body vs. the more skincare focus of the original version for women.

Degree / Sure (Unilever) – Known for performance and protection, Sure / Degree’s “whole-body odor control” adds scientific credibility and is one of the few brands that successfully straddles both female and male usage. The challenge lies in changing entrenched underarm-only habits.

Lynx / Axe (Unilever) – A fragrance-first brand appealing to younger men, Lynx/Axe normalizes body spraying beyond the pits but risks being seen as more about scent than real odor control given that it only offers a whole body spray. Interestingly, rather than competing with their traditional underarm focused spray, they position their whole body offering as “lower body”.

Secret (P&G) – A trusted, feminine, and familiar brand, Secret needs to move from antiperspirant protection toward emotional freshness and comfort benefits in order to win in this space.

Old Spice (P&G) – A heritage men’s brand now expanding with “Total Body” products, humor and a self-confident attitude keep this brand relevant, though its classic image may limit usage in intimate areas.

Lume – The category pioneer — pH-balanced, doctor-developed, and clinically credible – it leads with education and authenticity but faces scale and distribution challenges. Mammoth Brands, the owner of Lume, also launched an equivalent a male targeted deodorant line called Mando.

Native (P&G) – A clean, natural challenger transitioning from underarm to whole-body formats. Wins on ingredient trust and simplicity.

The advertising approaches across these brands share a familiar formula: light humor, colloquial language, straightforward education, and a touch of music or social-media-style candor. Campaigns focus on where to apply the product and how to make whole-body use feel natural, in order to build usage of a new category. Longer term, will it be enough for them stand out and survive among a new crowd of competitors?

Breaking Barriers

Building the whole-body deodorant category requires navigating a set of challenges:

- First, there’s the overlap with perfume usage: consumers, especially women, who already wear fragrance may hesitate to use a whole-body deodorant spray, fearing scent conflicts or redundancy in their routine.

- Second, format loyalty can create real barriers to trial. Many consumers have a strong attachment to their preferred deodorant form — spray, stick, roll-on or cream — and are unlikely to switch, even if another format is more suitable for different body areas. Moreover, certain formats can feel less appropriate for sensitive zones like feet or the groin, adding another layer of hesitation.

- Finally, sustaining growth in an emerging category demands internal organizational commitment. Because category-building efforts typically need to be resourced within existing portfolio P&Ls, without additional funding, management must balance the investment in education and awareness with the realities of limited budgets and competing priorities.

Conclusions

As the whole-body deodorant category evolves from niche to mainstream, to succeed brands must define their role within a rapidly changing landscape beyond just a functional claim. They must clarify the why behind whole-body use — whether it’s about confidence, comfort, or care — and connect that message authentically to their existing equity. For legacy players, this means reframing established deodorant codes without diluting credibility; for challengers, it means scaling beyond niche education into cultural relevance and routine adoption.

The long-term winners will be those who can make the behavior stick: helping consumers see whole-body deodorant not as a novelty, but as a natural extension of personal care. Innovation in format, fragrance layering, and skin-beneficial formulations will all play a role, but so will language, storytelling, and trust.

Growing a category often means expanding usage occasions and entering adjacent territories to stretch where a brand can find new relevance and grow. At Sevendots, we help brands identify and unlock such whitespace opportunities. Our strategic approach connects cultural insight with portfolio planning to identify where your brand can credibly play, how to build distinct propositions, and what it takes to sustain growth in emerging spaces.

To learn more about how we approach category growth, request our Growth Series paper “Category Growth: The New Path to Long-Term Success.”