Business Strategy, Innovation 20 February 2026

Strategic Innovation Pathways: How CPG Leaders Are Navigating Growth

Consumer Packaged Goods companies face a defining challenge: delivering continuous innovation while managing costs and complexity.

In 2025, leading CPG firms are pursuing contract manufacturing partnerships as well as strategic brand collaborations as viable alternatives to traditional M&A.

This article examines why these approaches are gaining momentum, explores three distinct execution pathways for innovation, and provides guidance on aligning tactical choices with long-term brand strategy.

The Innovation Imperative

A major beverage company recently spent 18 months and substantial capital building capacity for a new product line, only to watch consumer preferences shift before launch. Meanwhile, a competitor tested a similar concept through contract manufacturing, adjusted based on market response, and captured the opportunity in half the time.

This scenario plays out repeatedly across the CPG industry. Innovation remains the fundamental driver of sustainable growth, yet the path to bringing new products to market has grown more complex. Consumer expectations evolve rapidly, commodity costs fluctuate, and supply chain constraints persist across global markets.

Standing still is not an option. However, the traditional playbook for innovation through internal development or acquisitions carries significant trade-offs that many organizations are reassessing.

One type of innovation which CPG companies are Increasingly embracing is strategic brand collaborations as a deliberate mechanism to unlock growth, differentiation, and consumer engagement.

Brand collaborations represent strategic agility in a marketplace where consumer loyalty is fluid, innovation cycles are accelerating and controlled experimentation has become a competitive necessity.

When done well, co-branded experiences help companies break through saturated markets while delivering fresh relevance in categories that struggle with commoditization.

This trend has sparked broader industry activity: Trolli with Mountain Dew, Miller Lite with Pringles, and Reese’s with Oreo in 2025. Each pairing illustrates a shift from transactional marketing to strategic symbiosis, combining distinct brand equities to co-create value.

When Coca-Cola and Oreo joined forces in 2024 to launch a limited-edition product, both brands leveraged borrowed equity, cross-pollinating audiences without the capital investment or uncertainty of launching entirely new product lines.

Choosing the right pathway for brand collaborations becomes crucial to make sure the approach is executed in the best possible way.

From Strategy to Execution: Choosing Your Manufacturing Path

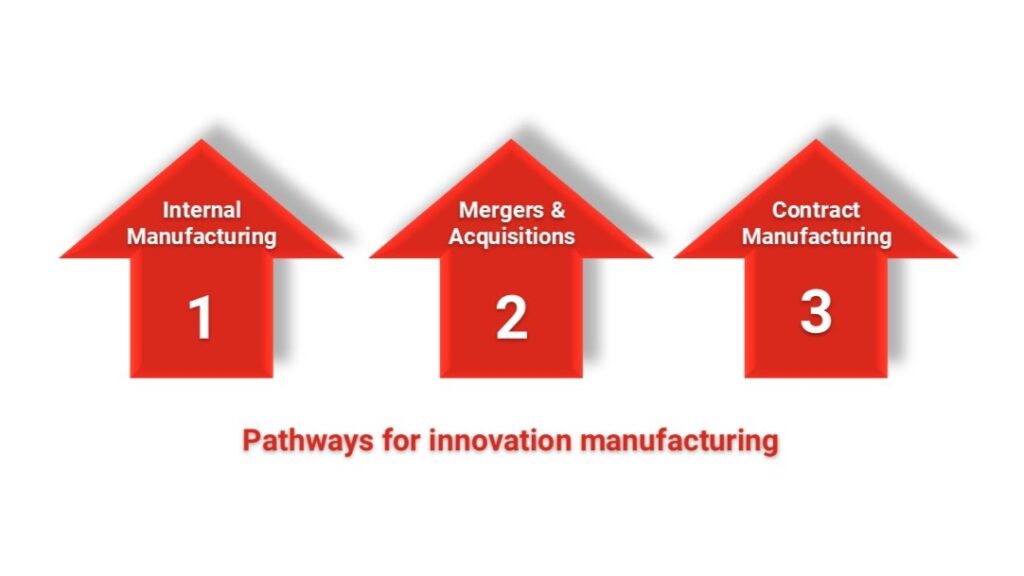

CPG leaders face a critical question: how to produce innovations efficiently. Supply Chain and Operations teams must choose from three distinct pathways, each with clear advantages and inherent limitations.

Pathway 1: Internal Manufacturing

Developing manufacturing capabilities in-house allows companies to retain full control over production processes, quality standards, and intellectual property. Internal production typically delivers lower unit costs and higher gross margins as the facilities reach optimal capacity. Companies with established manufacturing operations often see unit cost advantages of 15-25% compared to contract manufacturing.

The trade-off is time and capital. Building or retrofitting manufacturing facilities can take 6 to 36 months, delaying market entry and exposing companies to opportunity costs. In fast-moving categories, this delay can prove decisive. Capital requirements range from moderate investments for line extensions to nine-figure commitments for entirely new categories.

This pathway makes strategic sense when innovation aligns with core competencies and when the company anticipates sustained demand sufficient to justify capital deployment. It works best for products expected to become permanent portfolio additions with predictable volume trajectories.

Pathway 2: Mergers and Acquisitions

Acquisitions offer a path to bring new capabilities and product portfolios into the organization rapidly. M&A can deliver inorganic growth and provide immediate access to established brands, distribution networks, and technical expertise.

Yet the CPG industry has experienced a notable decline in M&A activity. Deal volume dropped 30% in 2024, while deal value fell 19% compared to the previous year. This decline reflects multiple factors: economic uncertainty, elevated interest rates, regulatory scrutiny, and the sobering reality that M&A failure rates can reach 70%.

Why do so many deals fail? Poor strategic fit, overvaluation, and integration complexity top the list. The resources required for successful integration are substantial. Cultural alignment, systems integration, and organizational restructuring demand focused leadership attention and can distract from core business operations for 12 to 24 months. For strategic portfolio expansion where synergies are clear and integration capabilities are proven, M&A remains viable. Companies with strong track records in post-merger integration and clear strategic rationale continue to pursue this path.

Pathway 3: Contract Manufacturing

Contract manufacturing has emerged as a third pathway, offering speed to market and minimal capital requirements. The contract manufacturing market has grown at approximately 10% annually over the past five years, with 67% of CPG brands planning to maintain or increase their use of these partnerships.

External manufacturing allows companies to test innovations, enter new categories, and respond to market opportunities without committing to fixed assets. Speed advantages are substantial: companies can often move from concept to market in 3 to 6 months, compared to 12 to 36 months for internal builds. This approach proves particularly valuable for limited editions, regional pilots, and products where demand remains uncertain.

The trade-offs are equally clear. Contract manufacturing typically results in gross margins 10-20 percentage points lower than internal production due to the manufacturer’s markup. Companies also cede some control over production processes and timing.

Production slots may be limited during peak seasons, and critical expertise remains outside the organization. For products that transition into core portfolio offerings, these factors create long-term margin pressure. Contract manufacturing delivers maximum value when speed and flexibility outweigh margin considerations, when capital is constrained, or when testing new concepts where long-term demand is uncertain.

A landmark example of successful Contract Manufacturing has been that of P&G’s partnership with HAYCO in 2021.

At the time P&G was facing a critical innovation challenge within its Home Care division.

Consumer research revealed that more than half of households still relied on traditional mops and buckets, believing this was the only method to achieve a deep clean. P&G had developed the Swiffer PowerMop concept, an all-in-one wet cleaning system designed to deliver mop-and-bucket performance in half the time, but the product required specialized manufacturing capabilities that would take 18-24 months to build internally.

To capture the market opportunity quickly, P&G partnered with HAYCO Manufacturing, a Hong Kong-based contract manufacturer with specialized expertise in injection molding, product design, and assembly of fast-moving consumer goods. The partnership leveraged HAYCO’s vertically integrated capabilities across three manufacturing facilities in China and the Dominican Republic, providing P&G with immediate access to the production capacity and technical expertise needed for the complex product design.

From a strategic standpoint, this partnership exemplified contract manufacturing at its best.

- P&G gained speed to market, launching Swiffer PowerMop in 2023 rather than waiting years for internal capacity development.

- The company avoided substantial capital expenditure on specialized equipment and tooling while accessing HAYCO’s world-class injection molding and assembly capabilities.

This approach proved particularly valuable given the product’s complexity: the PowerMop features a 360-degree swivel head, battery-powered spray mechanism, and sophisticated mop pads with 300+ scrubbing strips, all requiring precise engineering and quality control.

The results validated the partnership strategy decisively. Swiffer PowerMop became the largest product launch in Swiffer’s history, contributing 40% of the brand’s portfolio growth and driving 35% of category growth, making it the number one growth driver in floor cleaning. The product achieved exceptional consumer acceptance and quickly became a permanent fixture in retail channels nationwide.

Beyond immediate sales success, the partnership allowed P&G to test market response and refine the product without committing to fixed assets, demonstrating how contract manufacturing enables CPG leaders to innovate with agility while preserving capital for strategic investments.

A Framework for Decision-Making

The choice among the identified pathways should flow directly from strategic objectives and market realities. Consider this framework:

- For rapid deployment and experimentation, contract manufacturing offers the optimal balance of speed, flexibility, and capital efficiency. When brands need to capitalize on consumer trends quickly, test market response to innovations, or deliver limited-edition collaborations, external manufacturing partnerships minimize risk while maximizing responsiveness. This approach allows companies to experiment, learn, and adjust without the burden of stranded assets.

Ask yourself:

- Is this innovation primarily a market test?

- Is time to market critical?

- Can we accept lower margins in exchange for speed and flexibility?

If the answer is yes, contract manufacturing is likely your best path.

- For strategic portfolio expansion, the decision between M&A and internal capital investment requires rigorous analysis. Examine expected volume trajectories, competitive positioning, technical complexity, available capital, integration capabilities, and risk tolerance. Neither pathway should be selected by default.

Key questions include:

- Does this innovation represent a core competency we need to own?

- Do we have the capital and patience for internal development?

- (for M&A specifically) Can we identify the right target?

- (for M&A specifically) Do we have proven integration capabilities?

- (for M&A specifically) Are the strategic synergies clear and quantifiable?

If the answer is yes, then internal manufacturing or M&A is likely your best path.

The distinction matters because execution pathways that work well for tactical innovation may prove inadequate for transformational growth, and vice versa. A collaboration that works beautifully as a limited release may fail if forced into permanent production without the right manufacturing infrastructure.

The path forward

CPG companies that navigate these choices successfully share common characteristics. They maintain clarity about which innovations serve tactical purposes and which represent strategic bets. They build relationships with contract manufacturers before urgent needs arise. They develop repeatable processes for evaluating execution pathways. And they recognize that innovation strategy and execution strategy must align.

The proliferation of brand collaborations and the growth in contract manufacturing signal an industry recalibrating its approach to innovation. These trends do not replace internal capabilities or eliminate the role of M&A. Rather; they expand the strategic options available to CPG leaders.

As consumer expectations continue to evolve and market dynamics shift, the companies that thrive will be those that match innovation ambitions with appropriate execution pathways. This requires judgment, analytical rigor, and willingness to challenge conventional assumptions about how growth should be pursued.

Sevendots specializes in helping CPG companies navigate strategic portfolio decisions and innovation management. We bring deep industry expertise and analytical frameworks that capture the full complexity of these choices, from identifying emerging consumer trends to evaluating execution pathways and building innovation strategies aligned with long-term brand objectives.

Contact Sevendots to explore how we can support your strategic innovation initiatives.