Business Strategy, Consumer Trends 14 October 2025

Q2 2025 CPG Results: A Timid Recovery, a Clearer Divide

Sevendots, Rome

7 minute read

While Q2 showed a modest rebound in average volume growth across 11 of the top CPG companies, only a few are truly winning back purchasing acts.

Offer fragmentation, rising consumer price sensitivity, and geographic disparities are key drivers behind volume growth struggles.

Portfolio focus at category, brand, and SKU level, combined with disciplined execution and relentless drive for penetration, remains the most powerful and sustainable lever for long-term volume growth in CPG.

1. Setting the Scene

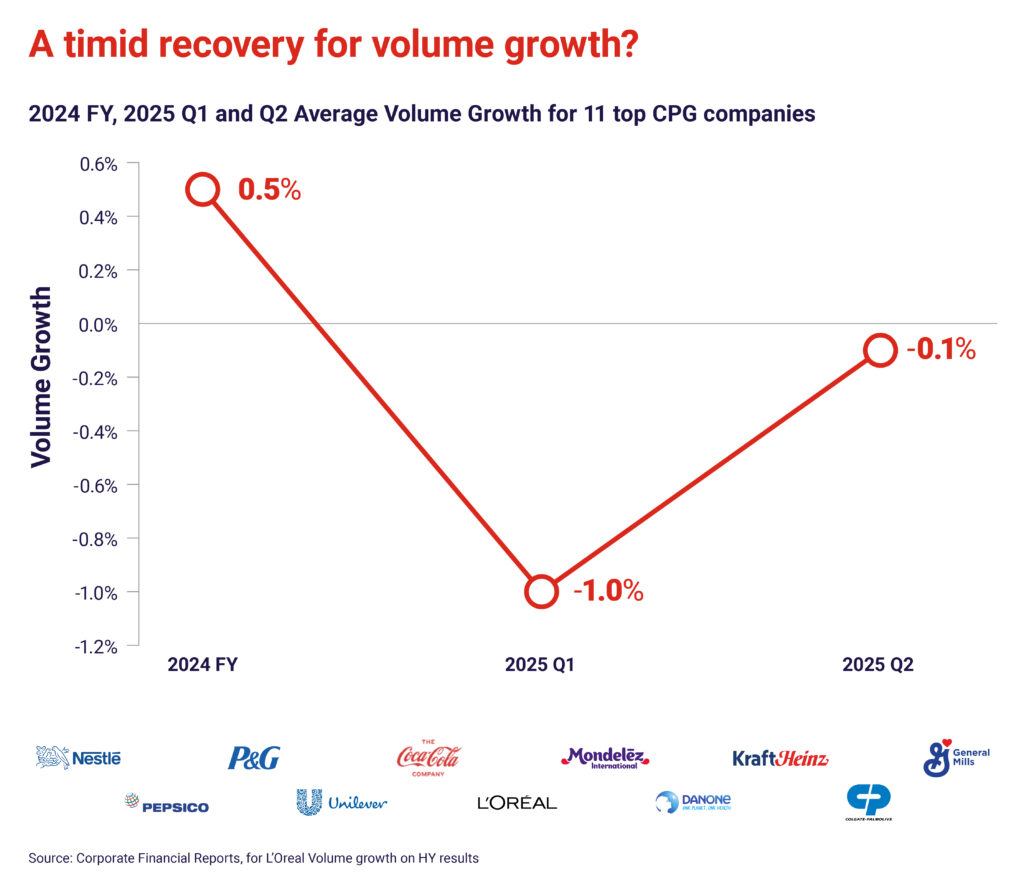

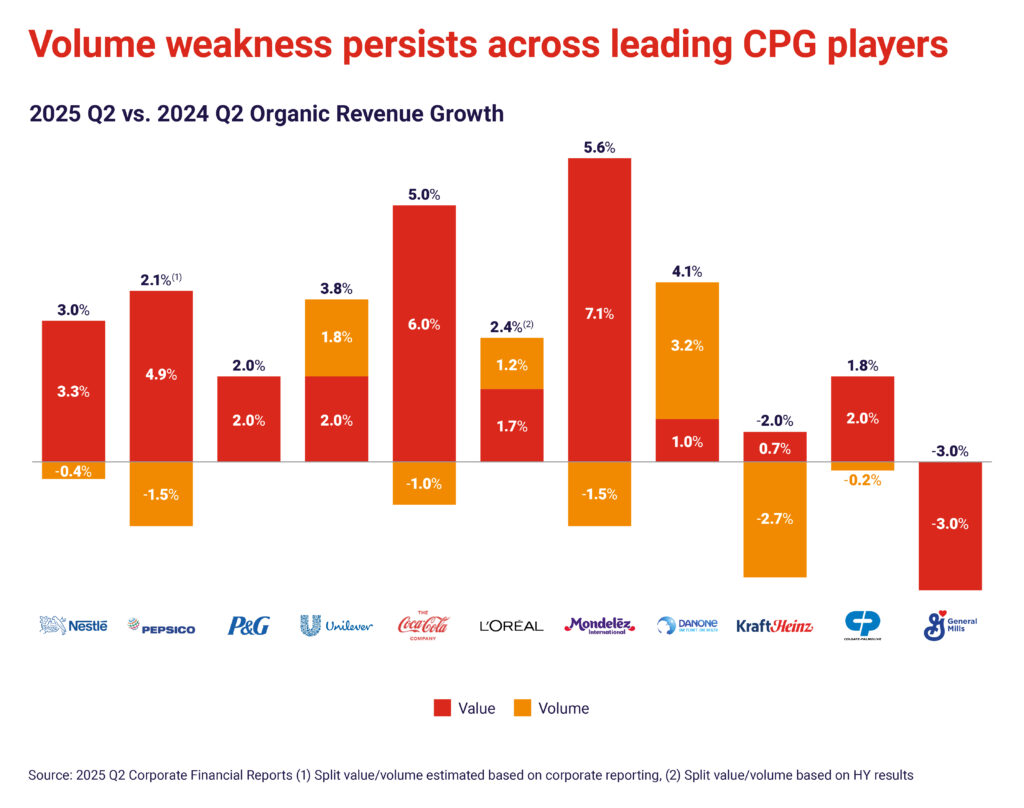

After a slow start to the year, Q2 2025 offered some relief for 11 of the top multinational CPG companies. Organic growth improved to +2.3%, up from +1.5% in Q1, though still far from the +3.9% seen in full-year 2024. When compared to broader market benchmarks, likely growing at nearly double that pace, the sector’s performance remains underwhelming.

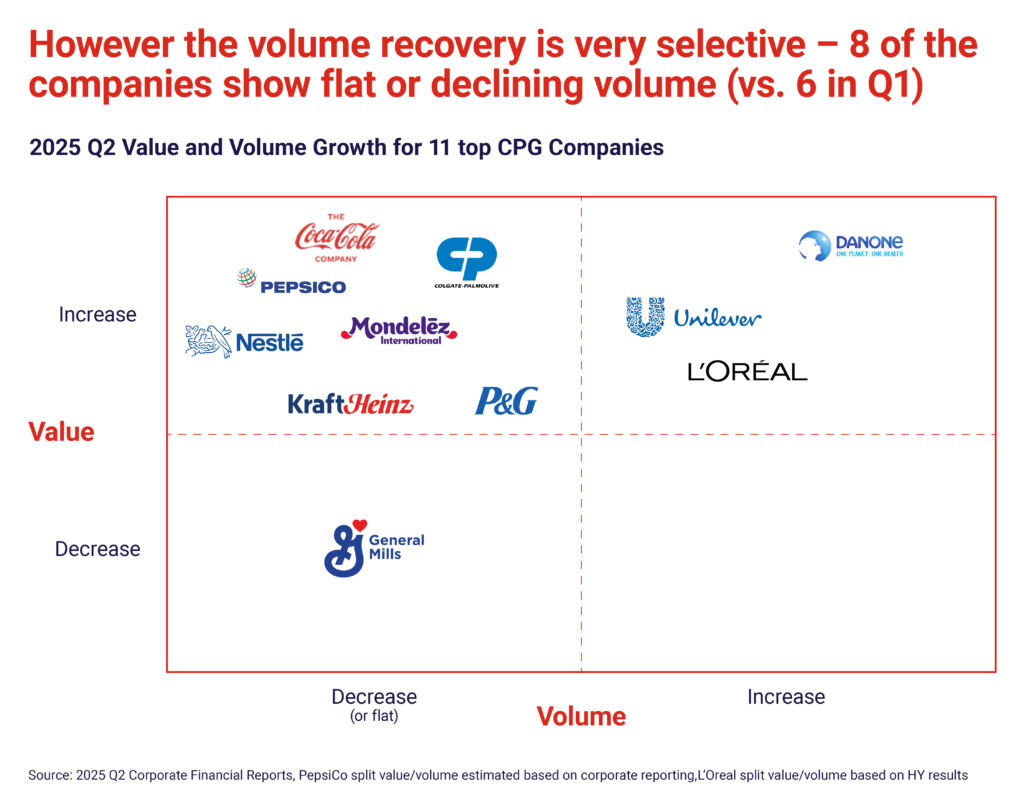

Critically, most of this growth continues to be value-driven, with pricing and mix effects doing the heavy lifting. However, volume trends showed a timid recovery: the average volume decline narrowed from –1.0% in Q1 to –0.1% in Q2.

Yet this modest improvement masks a deepening divide: while the average volume improved, the number of companies not growing in volume actually increased, from 6 in Q1 to 8 in Q2. This signals that volume recovery is no longer broad-based but concentrated in a few outperformers, those that are actively winning back consumer purchasing acts.

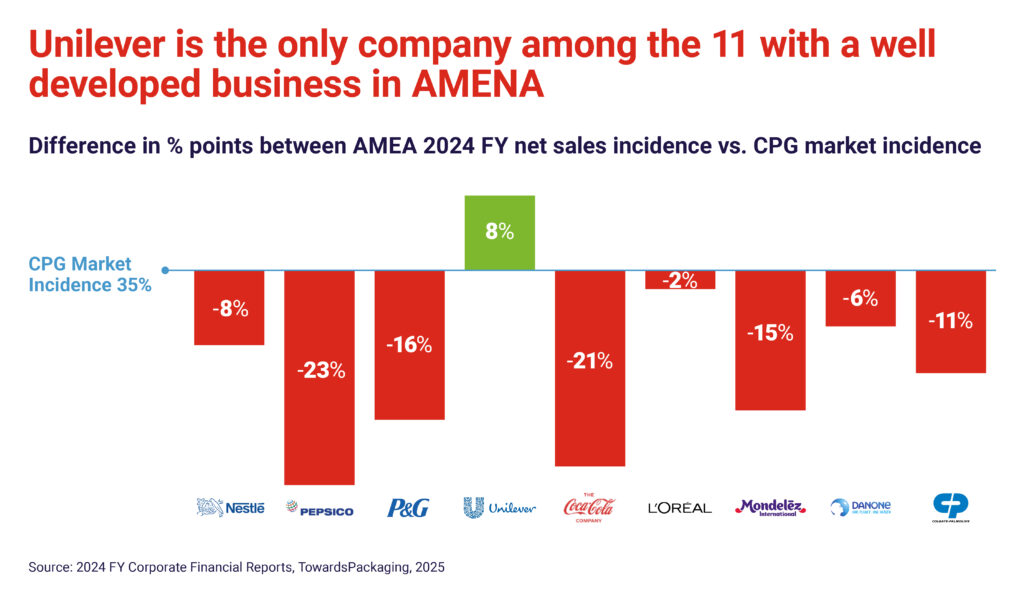

Market trends further complicate the picture. North America remains weak, with softening demand and more price-sensitive consumers. Better-for-you demand in food and beverage is rising, putting pressure on companies’ portfolios and innovation. Offer fragmentation is on the rise with the numbers of options in front of consumers continuing to grow. From a geographical perspective Asia-Pacific (together with Middle East and Africa) is under-leveraged for many global players.

Against this backdrop, the strategic management of portfolios, across categories, brands, and SKUs, becomes central to sustaining volume and market penetration.

2. Understanding Volume Growth: A Strategic Engine

Volume growth is not just a quarterly performance metric, it’s a core engine of long-term shareholder value in the CPG industry. Volume growth, much more than value growth, is in fact structurally linked to the ability to sustain and grow shareholders’ return.

At the heart of volume lies penetration: the ability to reach more consumers and expand the brand territory. Only reaching more people and HHs can ensure a sustained volume increase and provide better returns from scale.

For decades, the most successful CPG companies have been those relentlessly focused on penetration. But today, gaining penetration is harder than ever. The path to purchase is less linear, consumer needs are more fragmented, and loyalty is increasingly transient.

This is why penetration must be re-anchored as the foundation of strategic planning. To do this effectively, companies must make decisive calls in three areas:

- Portfolio: Ensure brands and SKUs are designed to recruit and re-recruit users and leveraging those categories that offer relevant growth appeal while building real differentiating innovation.

- Geography: Align offerings with high-potential and underdeveloped markets and consider the overall geographical footprint.

- Cultural Relevance: Tailor propositions to the evolving expectations of different consumer groups uplifting the empathy of their brands.

3. Why Volume Growth Remains Elusive for Many

Most of the analyzed companies are struggling with volume growth and are somehow losing traction among consumers.

While structural shifts in consumer behavior make volume harder to sustain, company disclosures point to a common set of immediate barriers. Among the most cited in Q2 2025:

- Consumer Price Sensitivity

High inflation has led shoppers to trade down or reduce purchase quantities. In response, some companies are rethinking their packaging and pricing architecture, offering smaller packs and more accessible formats to re-engage cost-conscious shoppers. - Retailer Inventory Rebalancing

Post-promotional restocking strategies and tariff-related uncertainty led retailers to cut back on inventory for certain categories, especially in North America, temporarily dampening manufacturer volumes. - Elasticity from Past Price Increases

Even where pricing growth has slowed, the lagged effects of prior hikes are still depressing volumes, a common theme across both food and non-food categories. - Portfolio Rationalization

Several companies continued SKU simplification to focus on higher-margin or higher-velocity products. While positive long-term, this has created short-term volume headwinds. - Geographic Imbalances

Specific geographies (and sometimes categories) are claimed to have dragged down performance due to economic or RTM issues. For example, developed markets, particularly North America, are under pressure due to value seeking behavior and flat categories.

The result is clear: while the average volume picture may be stabilizing, the distribution of that growth is narrowing, and many companies remain in negative or flat territory.

4. The Virtuous Ones: Volume-Led Winners

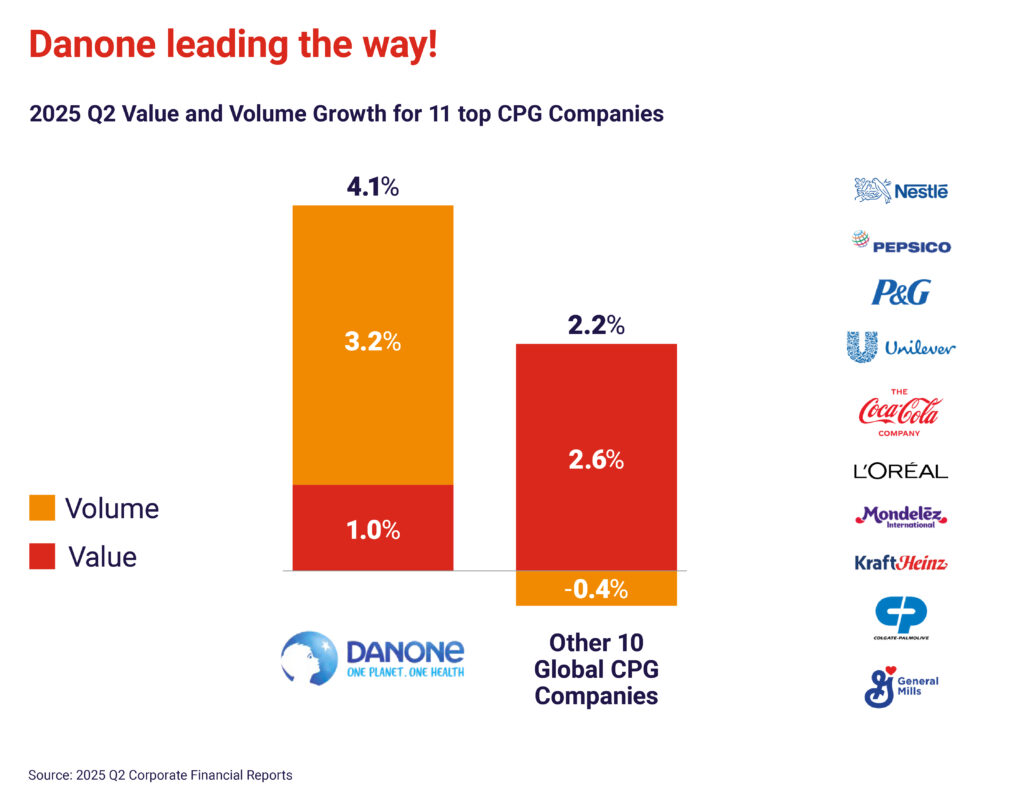

In this difficult context, only three companies among the eleven analyzed reported volume growth in Q2, and just one of them delivered volume growth that outpaced value growth: Danone.

The best-performing companies attribute volume growth to strategic focus and execution across two key dimensions: portfolio choices at the category, brand, and SKU level and targeted geographic expansion, both aimed at penetration-led strategies.

Danone

The company is showing growth both on value and volume but the second is much stronger than the first and is strongly outpacing the peers.

Danone attributes its 3.2% volume growth to disciplined portfolio management and more disciplined execution. They focus on reinforcing and expanding their winning platforms including:

Specialized nutrition and specifically the Aptamil offer following the premiumization strategy of the brand.

High Protein – benefiting from growing consumer awareness of the health benefit it brings from proactive health like fitness and performance to reactive health like weight management and wellness. Danone claims that “Our fast-growing range with a focus on strong product superiority and unique functional benefits is helping to further drive penetration, especially across the Americas, Europe and Japan.”

Essential Dairy and Plant-Based with strong growth driven by mainstream brands like Activia and Oikos and an ongoing attempt to build “category shapers” while, as stated by Danone, “transforming Alpro from an ingredient-led alternative to dairy to a benefit-led plant-powered nutritional complement to dairy.”

Also, geographic performance is impacting the growth with China, North Asia & Oceania showing a 13.2% volume growth.

On top of the commercial side, Danone claims to benefit from learning to operate with greater agility and speed, improving its supply chain performance.

Unilever

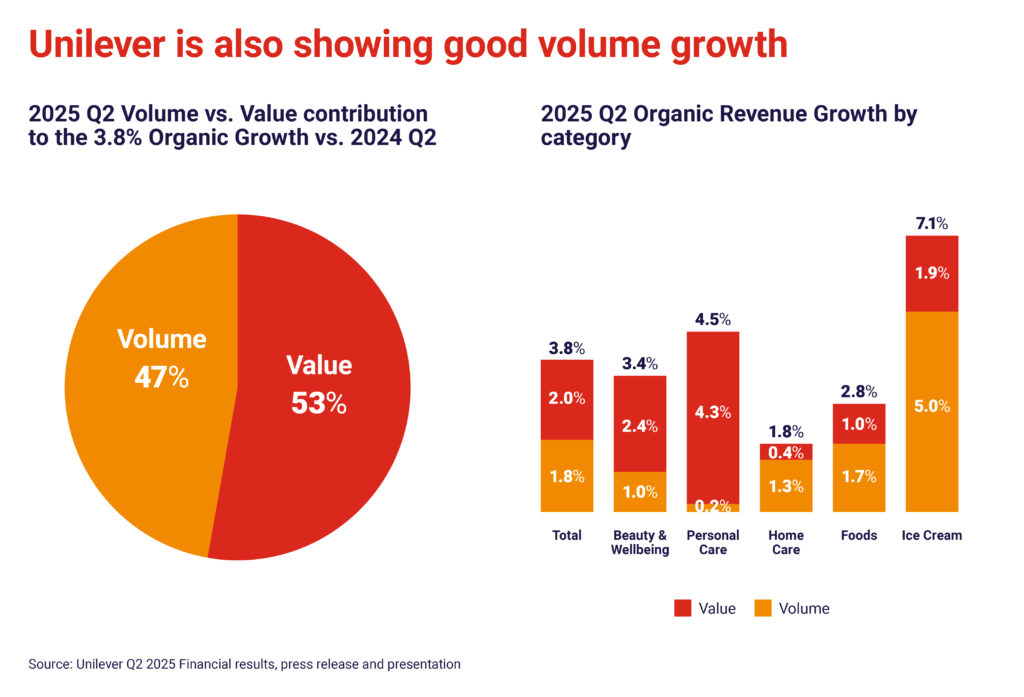

The company also shows a good volume growth which is just slightly below the value growth.

Unilever’s +1.8% volume growth was supported by the contribution of all categories. The main reasons for the growth mentioned are linked to portfolio choices at category and brand level and they are specifically:

- Power Brands performance showing a +2% volume growth (up from 1.2% in Q1), highlighting a focus on brand strength and relevance.

- Innovation, renovation and line extensions across the different power brands able to sustain and develop differentiation.

Unilever claims the introduction of new products and line extensions contributed to the volume growth across its different categories.

- Increased growth and penetration of some specific categories or sub-categories (like supplements and full body deodorants).

Unilever is mentioning that Wellbeing delivered strong double digit growth for the 21st consecutive quarter with performance led by Liquid I.V. and Nutrafol, as both brands continued to expand HH penetration and deliver successful multi-year innovation.

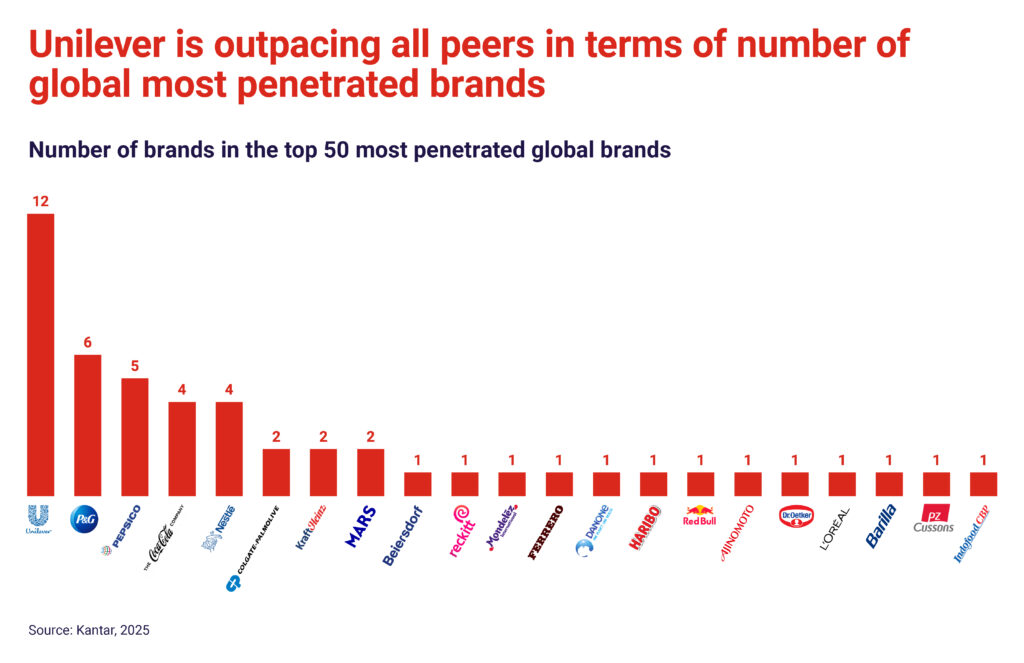

Speaking about penetration, Unilever is the only company having 12 brands in the globally most penetrated ones strongly outpacing all the peers.

They also have the best exposure/incidence in APAC/Africa and Middle East taking advantage of the strong middle class development in these countries. Volume growth for Asia Pacific and Africa in Q2 has been 1.9%.

These companies demonstrate that volume growth is not only possible, but achievable, if powered by deliberate, consumer-first decisions.

5. The Path Forward: Refocusing on Volume

The current environment makes one thing clear: volume must be a conscious, central priority.

This requires focus and choices. The levers to do so are within reach and are linked to the ability to push penetration.

- Rigorous portfolio management at the category, brand, and SKU level and an alignment with emerging demand spaces such as BFY and functional offerings. Also, improved affordability as a core principle, not just a short-term promotional tool. Plus adapting the offer to fit the requirements of evolving RTM channels.

- Leveraging innovation and renovation not only to maintain long-term brand differentiation but also to effectively capture and scale emerging consumer trends.

- Geographic precision, by prioritizing investments in under-penetrated markets and accelerating the scale of brand assets where growth potential remains strong.

- Cultural relevance as a driver of consumer empathy, supported by tailored messaging and activation strategies that resonate deeply within specific contexts and communities.

6. A Final Perspective

From a distance, the numbers speak clearly. But through the lens of category insight, consumer dynamics, and strategic foresight, it becomes evident that not all companies are struggling equally, nor are they recovering equally.

At Sevendots we have the privilege of observing these shifts with both objectivity and depth, drawing on a global perspective shaped by close knowledge of consumers, channels, and the structures of success. And what we see is that in a world where pricing will inevitably plateau, penetration will define the next wave of winners.

Contact Sevendots to explore how we can help you drive volume growth by optimizing your portfolio and boosting brand penetration.