Brand Growth, Consumer Trends 22 July 2024

Private Labels Growth: What CPG Brand Owners Need to Know

The development of private labels worldwide varies by region but is consistently outpacing branded products in the consumer-packaged goods sector, driven by a range of factors. Sevendots analyses the growth of private labels and how brands should respond.

Sevendots, Milan

5 minute read

The development of private labels worldwide varies by region but is consistently outpacing branded products in the consumer-packaged goods sector, driven by a range of factors. These include the increasing depth and breadth of ranges, generally underpinned by competitive and lower prices, as well as an emerging extension to premium and specialty product lines. Offering customers great value from store brands has had an impact on the industry already, with greater market share consumed by private label goods.

In the United States, private label products have evolved from being mere budget-friendly alternatives to becoming innovative and competitive products: in the first six months of 2024 private label value share has topped 20%, with a unit share close to 23% and a growth rate twice that of brand name products (1). In addition, more than half of US retailers expect private labels to be their number one growth driver in 2024 (2).

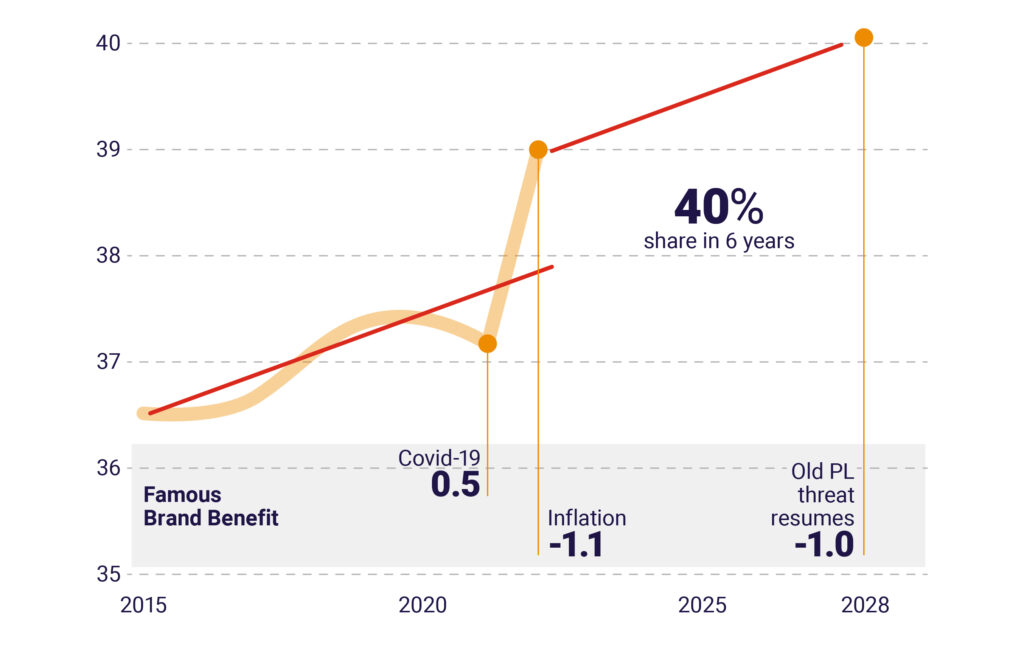

In Europe, private labels continue to strengthen their stronghold, particularly in countries such as UK, Germany and Spain: following a short-lived stall during the Covid period and a strong acceleration during the recent period of high inflation, the growth trajectory is expected to resume its previous pace and top a 40% value share in the CPG industry by 2028. (3) The position of private labels is so consolidated that 60% of consumers in Europe now state that private labels are as good as national brands, and 25% are better than national brands in terms of Innovation, Quality, Delivering on claims and Sustainability. (4)

It is worth noting that the development of private label business is the combined result of a growing share of space and sales within mainstream grocery stores such as Tesco or Walmart, as well as the strong expansion of hard discount retailers, such as Aldi and Lidl, who specialize in providing best value for money by generally excluding branded products from their assortments.

In the UK, Aldi and Lidl now represent 18% of grocery sales, compared to 11% just 7 years ago (5), while in the US, Aldi opened more stores in 2022 and 2023 than any other grocery chain and is now closing in on the national share of Target (6). This is not only thanks to price: in a recent report from the Environmental Investigation Agency, Aldi scored 74% in terms of climate-friendly refrigeration functionality, far ahead of the 2nd and 3rd retailers, with Whole Foods at 55% and Target at 44% (7).

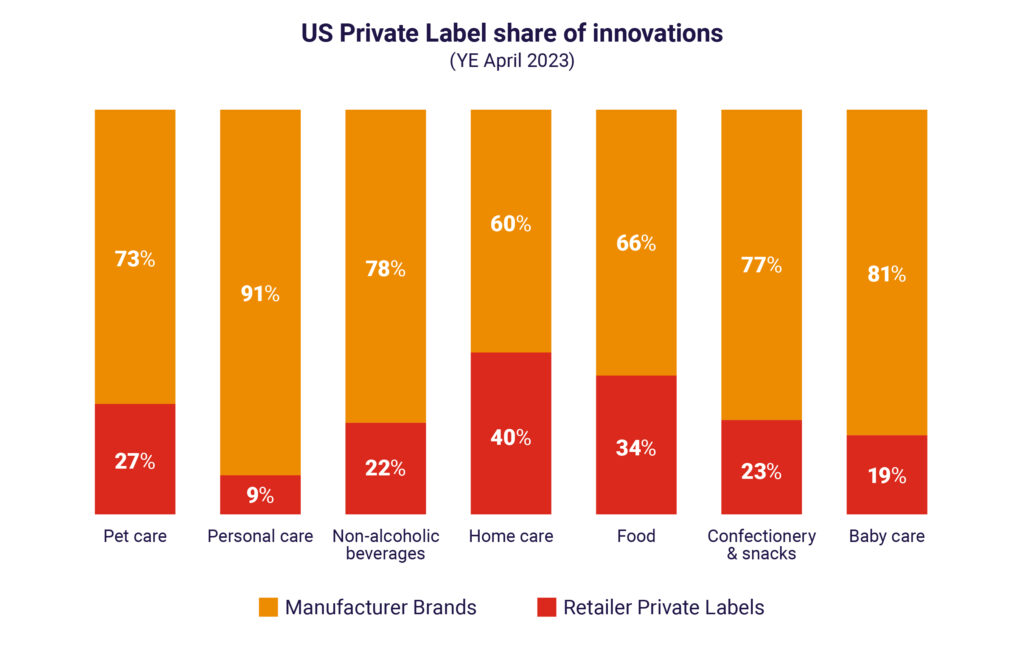

Leadership in Innovation

An often-overlooked factor behind private label growth that should be a matter of concern for major brands, is the level of innovation they bring to their shoppers. In the year ending April 2023 in the US, market research suggests that the private label brand share of innovations from new products was far above their share of sales across diverse product categories. In fact, it was notably close to 40% in Home Care and 35% in Food. (8)

To further aggravate the outlook for major brands, the 2024 New Product Pacesetter Report from Circana highlighted that in 2023, 59% of successful new branded product launches in the US came from small businesses ($100-500m in turnover) and ultra-small businesses ($100m), compared to 41% in 2022 and 35% in 2021 (9). In other words, big brands appear to have lost the innovation plot while struggling to keep their profit margins and financials in order, due to spiralling cost of goods increases and supply chain challenges. Is this a dark cloud hanging over their future?

Extending to Premium offers

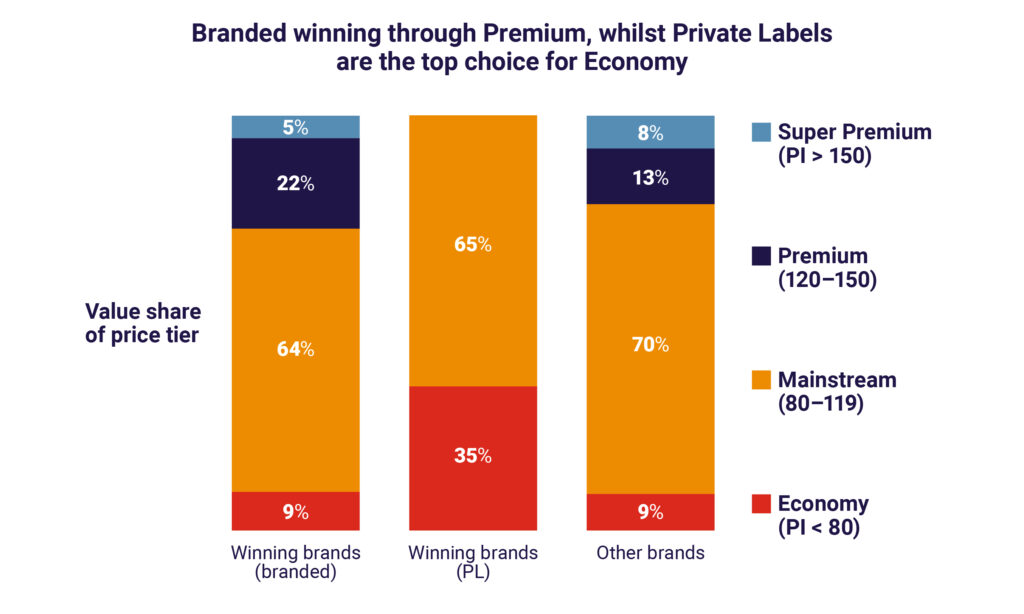

To add to the challenges from private labels, that branded products are destined to face, there is the recent move by a number of retailers into the premium space of many product categories. Up to mid-2023, branded products in the US were winning through premiumization, while private labels were dominating in economy choices by shoppers. It’s worth noting, however, that more than 60% of winning private labels were already playing in a space with a price index of 80-119, a similar proportion to branded products (10). Nevertheless, higher quality products and premium offerings continue to push the boundaries of what a private label manufacturer can offer in this category.

While major name brands should continue to strengthen elements of differentiation from their own products that can tap into the more premium segment of the categories they operate in, they should be aware that leading retailers have also started to shift their focus into this space. For instance:

- In April 2024, Walmart in the US announced their largest private brand food launch in 20 years with the ‘bettergoods’ line of 300 items, tapping into the trends of plant-based, made-without and culinary experiences, and providing affordable premium to their shoppers (11) via their own private label.

- In May 2024, Asda in the UK announced the launch of ‘Exceptional by Asda’, a new, premium, own-brand set to elevate the supermarket’s premium tier offering with over 500 products included in the range, combining high-quality ingredients, flavors, and recipes curated by experts.

- In mid-2023, Coop Italia introduced 8 different types of special premium beers on top of the 7 representing the base range, providing a broader set of options to an extended target of shoppers.

What next?

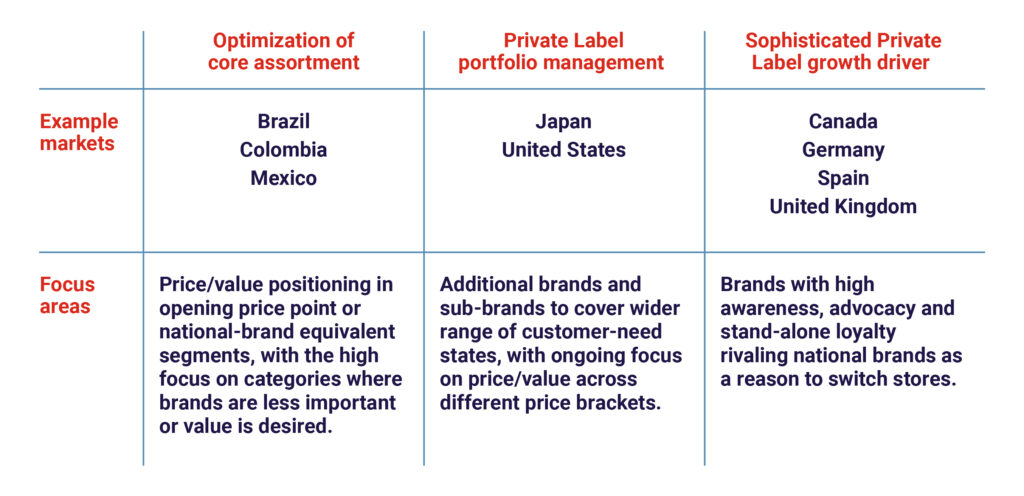

Retailers are progressively seeing private label brands as a strategic component of their business model, progressing from margin enhancement to customer loyalty driver. Private-label maturity differs by region, but the anticipated trend is towards an increasing sophistication of the offer (12)

Manufactures of branded products are running the risk of losing control of their destiny. While continuing to consolidate strategic partnerships with retailers, they must consider alternative avenues of growth – DTC and ecommerce solutions, for example – and regain the leadership they’ve been losing in terms of significant consumer-led innovation.

For more of our thoughts on how to bolster innovation opportunities, read our report here.