Brand Growth, Consumer Trends 24 June 2024

Premiumization vs. Commoditization: Unpacking the Premiumization Trend

In today’s consumer market, brands face a crucial decision between two opposing strategies: premiumization and commoditization. Understanding these dynamics is essential for brands to navigate the competitive landscape effectively. This article delves into the cyclical nature of commoditization, the virtuous cycle of premiumization, and offers strategic frameworks to help brands leverage premiumization to create strong consumer connections and sustain growth.

Sevendots, Rome

5 minute read

Two Opposite Directions: Premiumization vs. Commoditization

In the dynamic landscape of consumer markets, the tension between premiumization and commoditization is often driven by volume versus margin. Promotions and price cuts play a crucial role in this context, with margin linked to brand equity and volume tied to pricing. To understand these opposing forces, we must recognize that while there are categories more commoditized than others, this doesn’t exclude the space for premiumized brands, and these two components are strongly interconnected.

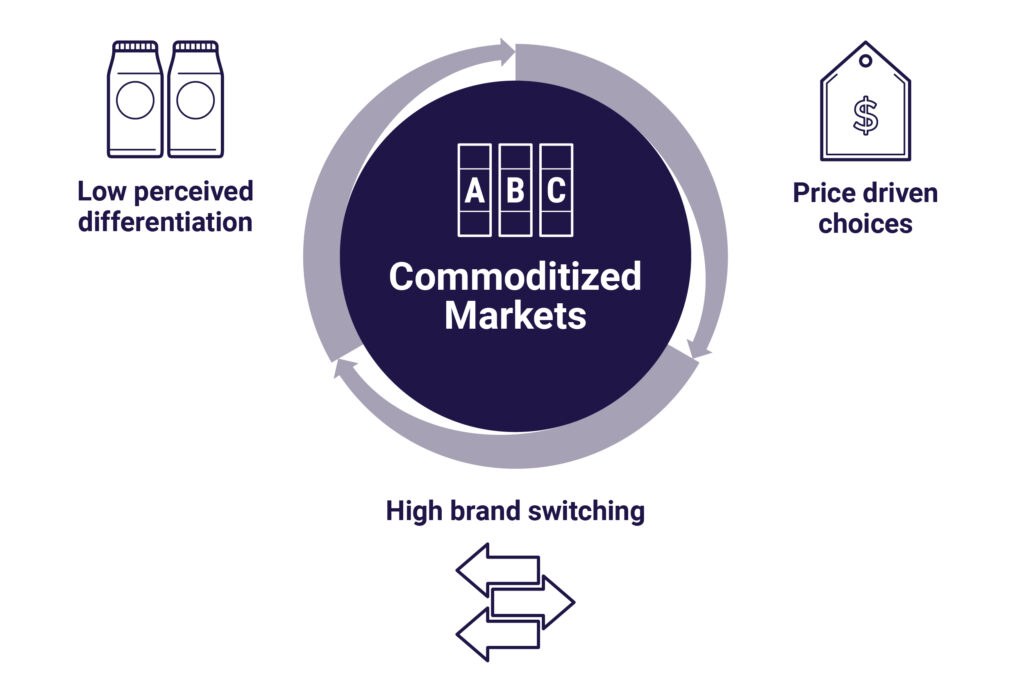

The Vicious Cycle of Commoditization

Commoditized markets are subject to a relentless negative force, that tends to push them further into commoditization. This force stems from low consumer engagement and a perception of undifferentiated offerings impacting the perceived value of products. When consumers believe “they are all the same,” brand interchangeability rises, leading to price point becoming the primary driver of choice behind consumer spending.

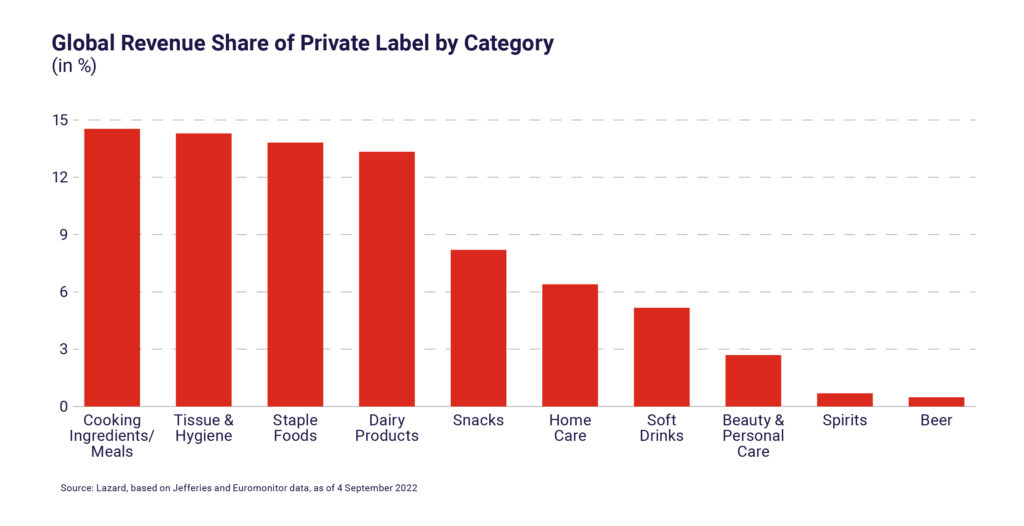

This scenario creates markets with limited price variation among competitors, high promotional intensity, and a significant share held by private labels. For instance, globally, tissue products are more commoditized than beauty products, due to the differing levels of equity and importance for consumers, as well as different, levels of performance and/or intangible traits, whether real or perceived.

Moreover, lack of price differentiation results in increased promotions, progressively eroding margins. This impacts the ability to support brands through marketing and innovation, exacerbating the negative pressure on the category.

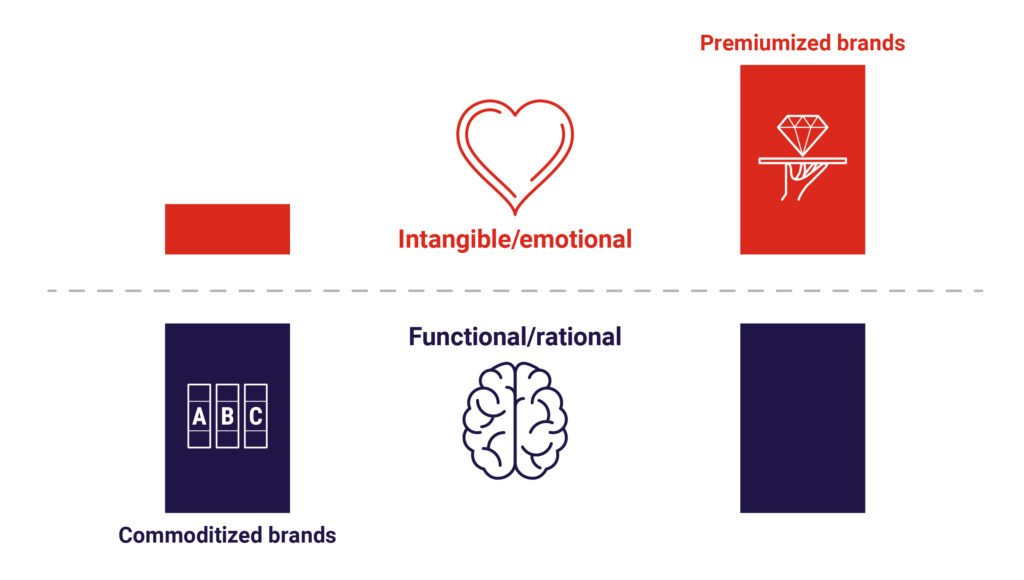

Commoditization vs. Premiumization

Understanding the dynamics of commoditization and resisting this trend involves comparing commoditized categories with premiumized brands. The key difference lies in the level of intangible and emotional elements present. Premiumization is characterized by a strong presence of these elements, enhancing the relevance of premium offerings.

Premium brands not only engage consumers but also elevate the entire category’s perception, making it more relevant. In contrast, commoditized categories often result from poor brand management, with little attempt to enhance category equity.

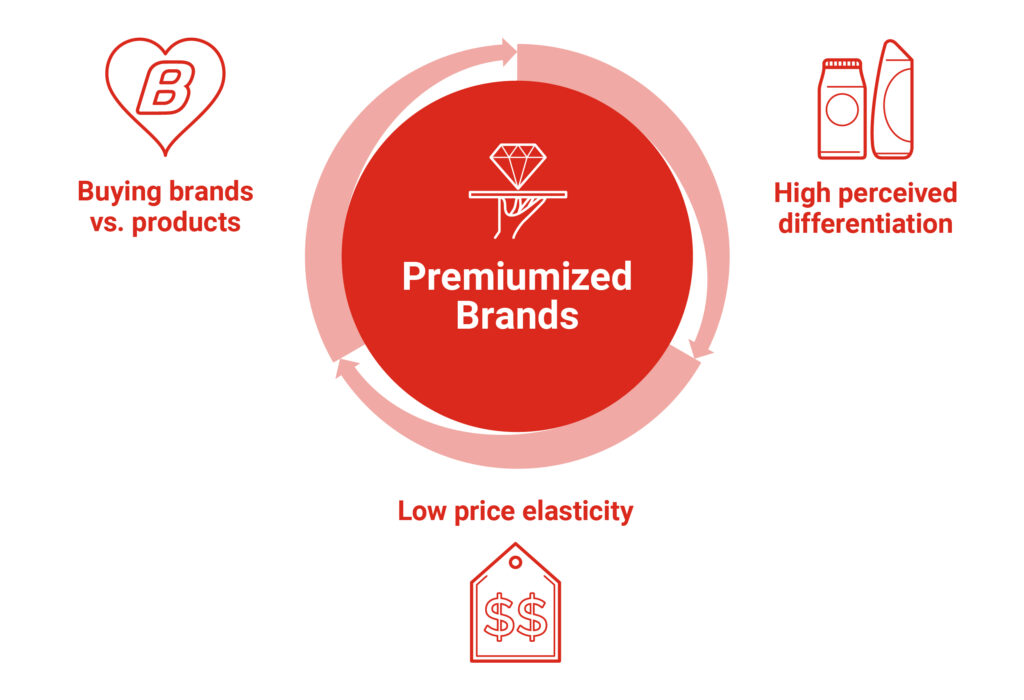

The Virtuous Cycle of Premiumized Brands

Premiumized brands engage consumers through strong brand equity. Purchasing decisions start with the brand, which is perceived as highly differentiated, leading to lower price elasticity. Consumers think, “they are not all the same,” resulting in higher engagement levels.

Premium brands are distinguished by their intangible and emotional elements, starting with a sharp and strong positioning. This clear differentiation translates into an effective brand story, fuelling equity and making the brand stand for something relevant. Effective messaging across multiple touchpoints, from packaging to digital channels, fosters a two-way relationship with consumers, generating substantial user content and maintaining a strong share of voice.

A Strategic Framework for Premiumization

A potential a strategic framework for premiumization is comprising several key steps:

- Consumer Insights and Data Analytics: Utilize data-driven insights to identify premiumization opportunities and understand consumer preferences.

- Brand Story and Positioning: Develop a compelling brand story that highlights differentiation and resonates emotionally with consumers.

- Multi-channel Engagement: Leverage digital channels, e-commerce platforms, and social media to amplify brand presence and engage with consumers.

- Innovation and Quality: Invest in product innovation and maintain high-quality standards to reinforce the premium positioning.

- Sustainability and Ethics: Align premium brands with sustainability and ethical practices to meet growing consumer demand for responsible products.

How do Brands Premiumize?

After establishing the foundational elements as indicated above, premiumization can be implemented in various ways. Here a few examples:

1. Channel Approach

Distributing the brand in specific channels can elevate its equity. For example, San Pellegrino, a Nestlé brand, has developed a strong association internationally with high-end restaurants. This strategic positioning is reinforced by sponsoring the Top100 world restaurant list and supporting new chefs when they decide to open a restaurant. As a result, San Pellegrino maintains a premium price (from 3x to 5x versus the category average) (1), it is almost a billion-dollar brand in revenue and has a 5% share of the global market (2) indicating a strong international presence.

2. Portfolio Approach

Managing a diverse portfolio or more affordable and more premium products to cover different price points is another effective strategy. Lavazza, with a 40% coffee market share in Italy (3), exemplifies this approach. Its portfolio ranges from mainstream to premium segments, with products like Lavazza Suerte, Qualità Rossa and Qualità Oro, catering to different consumer needs.

While Suerte plays in the value segment of the market, Lavazza’s Qualità Rossa is a more mainstream offer presented as “the Passionate Italian Spirit”. The value proposition is based on selected sourcing (but no specific origins are mentioned), a smooth, round, fruity & chocolate aroma coming from a blend of Arabica and Robusta. On the other side Lavazza Oro is presented as the “Blend Excellence” focusing much more on the quality of the product. Beans are 100% Arabica from the finest origin qualified as Central & South America. The aroma is presented as perfect symphony, fruity and floral and under the same sub-brand even more premiumized version are available like Mountain Grown or Gran Riserva.

Lavazza never compares the quality of the two products directly and leverages the overall company equity in a balanced way. We can say that Qualità Rossa is providing good value for money in the category, while Oro is supporting the category equity.

3. Performance approach

This is about strongly reiterating product superiority vs. competition. A good example here is represented by Bounty, the successful paper towel from P&G. Bounty has been the market leader in the US for over 40 years even if Private Labels developed strongly in a commoditized market. However, by consistently focusing its communication on product superiority underlining a superior performance and higher quality vs. the competition and keeping a high share of voice and communication pressure, the brand has thrived.

In 2022, Procter & Gamble spent 111 million U.S. dollars on advertising Bounty(4). The increased product performance, through 2x absorbance and longer duration, translates in a better value for money in the overall brand communication. This balanced approach leverages overall company equity while providing affordability and supporting category equity.

Effectively implementing premiumization

A few important areas should be considered in the implementation of premiumization strategies:

1. Global Market Dynamics and Local Adaptations

Balancing global brand consistency with local market adaptations is critical for multinational CPG companies. Successful premiumization strategies consider regional differences in consumer preferences and market dynamics. For instance, Nestlé’s Nespresso has tailored its product offerings and marketing strategies to fit the unique coffee cultures of various countries.

2. Digital Transformation and E-commerce

Digital transformation and e-commerce play pivotal roles in premiumization. Leveraging these channels enables brands to reach a broader audience, offer personalized experiences, and build stronger consumer relationships. Companies like Unilever have effectively utilized digital campaigns and e-commerce platforms to enhance the premium positioning of their Dove brand.

3. Collaborations and Partnerships

Strategic partnerships and collaborations can significantly boost brand equity and premium positioning. For example, Coca-Cola’s partnership with fashion brand Kith has enhanced its premium appeal through exclusive product lines and high-visibility collaborations.

4. Measurement and ROI

Measuring the success of premiumization initiatives is essential. Key performance indicators (KPIs) such as brand equity scores, price elasticity, market share, and consumer engagement metrics provide valuable insights. Tracking ROI helps demonstrate the value of premiumization efforts to stakeholders, ensuring continued investment and support.

Avoiding Commoditization

Breaking free from the cycle of commoditization and embracing premiumization requires ambition and determination. Successful brands:

- Redefine and support the category perception.

- Clearly define and communicate key positioning elements.

- Consistently reinforce their positioning through high share of voice and diverse touchpoints.

In conclusion, navigating the delicate balance between premiumization and commoditization involves strategic brand management, effective communication, and a strong focus on maintaining and enhancing brand equity. For multinational CPG companies, embracing these strategies is crucial to achieving sustainable growth and differentiation in the global marketplace.