Consumer Trends, Tomorrow Lens 25 April 2025

Longevity as a strategic imperative for CPG companies: Unlocking consumer demand to live healthier for longer

Emerging as the latest consumer must-have, longevity refers to the desire to live not only longer but healthier for longer. Now understood as health span rather than lifespan, longevity has the potential to be a paradigm shift for society’s understanding of and CPG brands’ approach to consumer wellness demands.

Sevendots, Amsterdam

6 minute read

Why is longevity emerging now? The shift in demand is driven by several macro forces, most notably an increasing global senior population and a rise in global life expectancy. Coupled with unparalleled advancements in (health) tech, consumer interest in holistic, proactive well-being is peaking, demanding solutions that are not only anti-ageing or curing but prevent decline before the onset.

For CPG, the opportunity is stark and ranges from nutrition, food and beverage to personal care and supplements. Yet, CPG’s answer should not be as simple as providing a lone vitamin to more senior consumers. Truly unlocking consumers’ demand for longevity should compel brands to develop higher-level value propositions for consumers of all ages.

1. The longevity economy

Numbers from the United Nations reveal that the proportion of senior citizens is growing on a global scale and by 2050, people aged 65+ will outnumber those younger than 12. The percentage of the 65+ population is increasing faster than any other age group, particularly in Asia where it is expected to reach 1.2bn people by 2060. (1, 2) Global ageing, however, is not the only force driving the demographic shift that primes longevity as one of the central trends over the coming years. Indeed, the UN has deemed this a “longevity revolution” considering also the substantial rise in average life expectancy (3).

Global senior populations do not only come in greater numbers of people and years but also hold significant economic power and they are willing to spend it on products that are designed for their age, health and benefit. In Japan for example, a country where one in three consumers is expected to be 65+ already by 2040, 64% of 65+ consumers agree that a food product with health benefits is good value for money, compared to just 30% of consumers aged 18-24 (4). An example of such a product is Yukijirushi Megmilk Mainichi Honebuto Milk with MBP which is high in protein, enriched with calcium and contains vitamins B6 and D, designed for those over 50 (4).

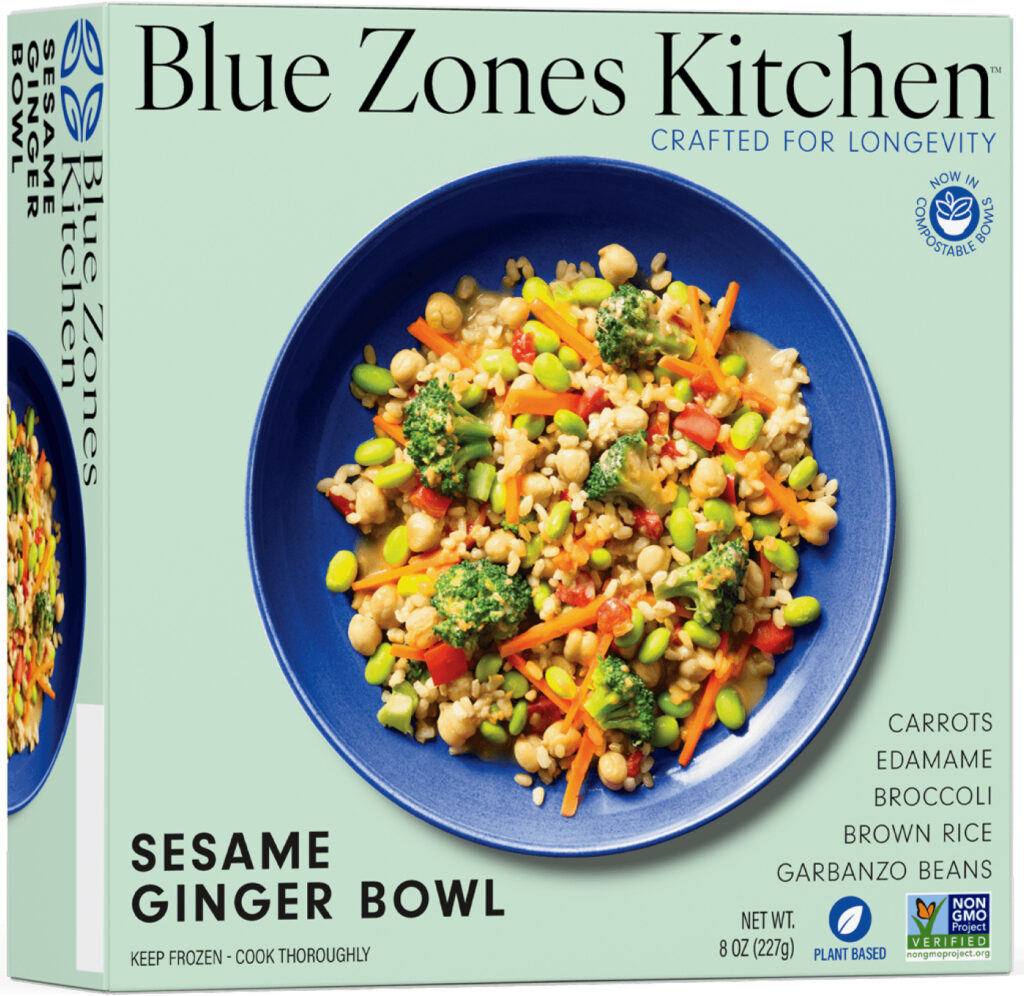

However, it would be remiss not to carefully consider the implications of longevity from the perspective of younger generations as well. Generation Z and Millennials are generations at the forefront of holistic wellness, notably where mental and spiritual well-being are concerned. Spearheading a more open discussion around mental health stigmas, they are equally drawn to healthy food science and nutrition, addressing different dietary concerns, preferences and restrictions. This leaves the field wide open for CPG brands to consider longevity solutions for teens, adults and seniors across different life stages. For example, brands could design products targeted at adolescents who have very specific nutritional needs as they are growing, supporting their overall well-being, and “form a basis for lifelong healthy habits and lasting health” (4). An example of a brand that embodies longevity as a lifestyle across generations is Blue Zones Kitchen, offering ready-to-heat meals inspired by the principles of the so-called blue zones – parts of the world where population lives longer than anywhere else (14).

2. Lifespan vs. health span: A new consumer mindset

While the idea of longevity might have previously been associated with anti-ageing (or delaying the inevitable), today’s focus appears to be much more proactive in nature. Consumers are no longer looking to merely treat ageing concerns, but prevent issues before they arise, suggesting that they do not just want to live longer (lifespan); they want to “live healthier for longer” (health span; 5) – and a shift from anti-ageing to well-ageing. Data from Mintel GNPD reveals that brands increasingly follow suit, launching more and more products in North America that promote well-ageing (6).

“I would define [health span] as the idea that people are trying to live better longer. […] Everyone is trying to die young, just as late as possible.”

Scott Dicker, Senior Director of Market Insights

SPINS (a provider of wellness-focused data and insights for CPG industry) (7)

This proactive approach is accompanied by rising awareness, as longevity is linked to optimistic values, such as health empowerment and self-reliance (8). Global data from Ipsos and Euromonitor suggests that 80% of consumers want more control over their health, 69% say they seek health information on their own, and 54% of consumer knew which vitamins or supplements to take for their specific health goals and concerns in 2024 (5, 8).

Likewise, consumers are increasingly adopting health tech, such as smart devices or apps to track wellness goals, with usage consistently rising across all generations on a global scale: As indicated above, and perhaps unsurprisingly, younger generations, that is Gen Z and Millennials are at the forefront of adoption (close to 35%, compared to 25% of Gen X and 15% baby boomers; 5), further underlining that they present as much of a target for longevity solutions as older generations. On top of that, health tech represents one of the fastest growing sectors for VC funding – in the UK, health tech start-ups raised more than $2.3bn in 2024 (9).

Consumers are certainly ready to be presented with longevity solutions, and so is the market. Categories that align that with longevity demands and concerns, such as supplements, functional foods or fermented beverages are growing steadily – global retails sales of vitamins and supplements, for example, are expected to surpass $139.9bn in 2024 (5). So, what are you waiting for?

3. Key trends in longevity-driven CPG innovation

At the forefront of longevity innovation is science-backed functional nutrition, food and beverages, including product ingredients that have clinically supported benefits, such as adaptogens, nootropics, probiotics, collagen, and NAD+ boosters.

“Longevity claims are still mostly confined to the healthcare sector, presenting an opportunity for brands to create food and drink that supports long-term health and wellbeing.”

Jolene Ng, Principal Analyst

Mintel Food & Drink (3)

Euromonitor data on global snack sales by health benefits show that products aiding brain, joint and vision are the three fastest-growing categories between 2024-2026: the number of products enhanced with the aforementioned NAD+ (which is a coenzyme involved in energy production, DNA repair and cellular metabolism) has tripled across consumer health categories from 2023 to 2024 (5). Elysium Health is the brand that offers “the product that started the NAD+ movement” and a wide range of cellular supplements targeting brain, metabolic, immune, skin and eye ageing. The company’s mission is to “translate critical scientific advancements in aging research into accessible health products and technologies”. (10)

Where nutrition and food could focus on protein-rich, gut-friendly solutions, beverages could provide mood, sleep and stress support. An example of a brand offering just that is Rootine, which has built a supplement system rooted in circadian health and emphasises personalisation through its ‘Smart Multivitamin’ (currently on hold in microbead format). (11)

Another pillar of innovation is preventative personal care where beauty and health are blended, for example in the form of collagen or hyaluronic acid enhanced products. The Nue Co. is offering supplements that aim to strengthen skin barrier by repopulating the skin microbiome – “formulated for long term skin health”. (12)

Where personal care is concerned, it is not only the products themselves, but marketing that can play an important role in empowering consumers and emphasise a well-ageing rather than anti-ageing narrative. A great example of this is L’Oréal’s mature influencers campaign to promote their ‘Age Perfect’ line that takes a “pro-ageing” angle (13).

Last but certainly not least, longevity has emotional drivers that are as relevant as the physical health outcomes, including mental health and “joyful” eating. The interconnectedness of mind and body and the need to reduce stress factors provide an opportunity for longevity solutions to promote balanced lifestyles – and not promising a single supplement as the solution. Indeed, Mintel data tells us that 50% of Thai consumers try to maintain positive mental wellness to minimise ageing, while 35% of German consumers agree that life is too short to worry about the food and drink they consume. (4)

4. The future of longevity in CPG

Start by acknowledging that there is a shift happening in CPG product design, innovation and marketing that is no longer geared towards surviving ageing or treating associated illness but to living your best (and healthiest) life in a proactive and empowered way. In other words, consumers are interested in higher-level solutions that improve their health in the long run, rather than accepting merely short-term benefits. Moreover, it is consumers of all generations that want solutions targeted at their specific health goals and concerns.

To this end, CPG brands should consider a consumer-centric ecosystem approach to longevity, rather than offering niche and separate products. This requires, for example, collaborating with health tech start-ups to benefit from a growth in wellness tracking, and considering the role of AI and diagnostics in tailoring and personalising solutions to the individual consumer, no matter their age. Likewise, the product design and data should be transparent and backed by science to help the consumer make an educated decision about their well-being and their longevity journey.

Contact Sevendots today to discover more.