Business Strategy, Consumer Trends 15 January 2026

Q3 2025 CPG Results: Persistent Volume Pressure and a Growing Divide

Organic growth remains stable, but volume pressure intensifies across the CPG sector.

Investors turn cautious as weak volume performance drags share prices below market benchmarks.

A widening divide separates CPG winners regaining volume from those still in decline.

Sustaining growth now requires structural change: a return to fundamentals while embracing disruption.

Sevendots, Rome

7 minute read

1. Setting the Scene

Q3 performance for the 11 analyzed companies among the top global CPG players shows a picture of continuity rather than recovery.

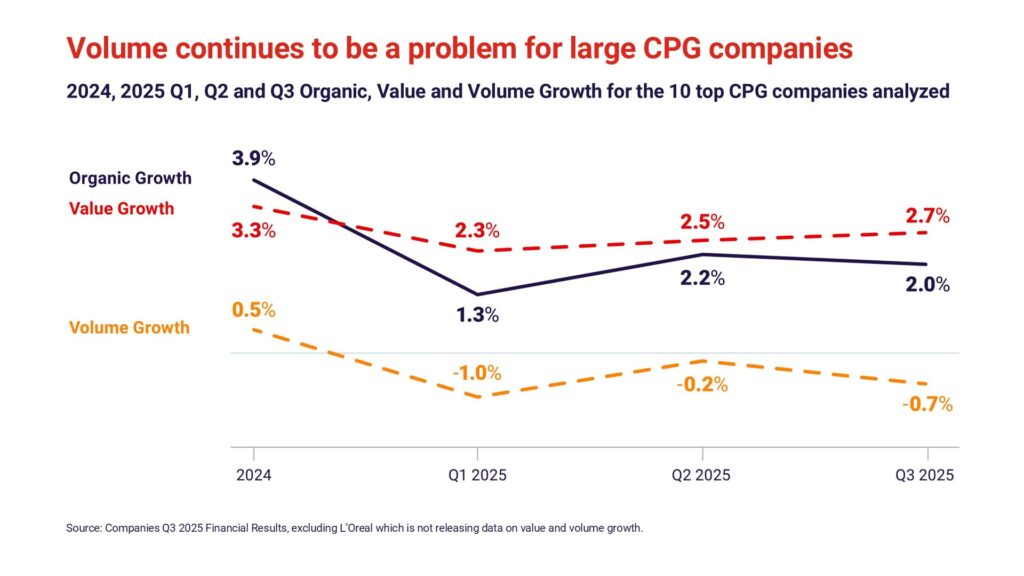

Overall organic growth remains stable at around +2%, still well below the 2024 full-year level of 3.9%, indicating an ongoing difficulty to sustain top-line performance”. This with the same bold parts.

This weakness continues to be driven by volume pressure. After a brief pause in Q2, average volume growth deteriorated again to –0.7%, compared to nearly flat in Q2 and –1.0% in Q1. Big companies are selling fewer products, a result of soft consumer demand, continued price sensitivity, and a shift toward alternative brands and offerings.

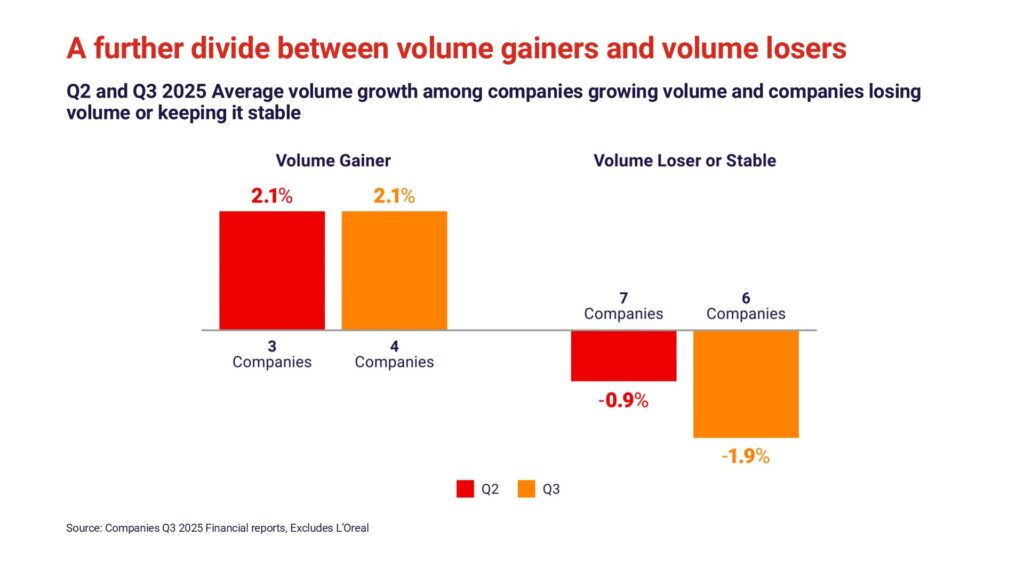

Within this average, the contrast between companies has become sharper.

In Q3, four companies (up from three in Q2 thanks to Nestle’ joining the group) managed to deliver positive volume growth. Their average growth remained unchanged at +2.1%, while the other companies saw their performance worsen, with an average decline of –1.9% vs. –0.9% in Q2.

This widening gap confirms that polarization within the CPG sector is intensifying, as a small group of disciplined players manages to hold ground while most continue to struggle in finding routes to recovery.

2. The structural volume challenge

The volume crisis is becoming structural for large CPG players.

While some companies are taking action and seeing initial results, the overall industry challenge remains significant, one that requires decisive and sustained effort.

Many companies still rely heavily on pricing to sustain top-line growth. This can offer temporary relief but is not sustainable in the long term, particularly when it undermines volume, weakens scale advantages, and narrows portfolio reach. Fewer products sold means fewer consumer touchpoints, reducing both market relevance and future growth potential.

This underlying weakness is also visible in the capital markets. In the first 9 months of 2025, the average share price performance of the 11 companies analyzed shows a 20-percentage-point gap versus their home market indices. While broader markets rose by nearly 14% in the first 9 months of the year, CPG companies collectively lost around 5%(1) in the same period.

Within the group, the companies growing volume gained +7% in share price, while those losing volume saw their value fall by –11%. (2)

This correlation reinforces a fundamental truth: volume, and holding on to penetration behind it, remains the essential driver of long-term value creation.

Companies that do not put penetration at the center of their growth strategy are missing the core opportunity to sustain and scale their business.

3. Volume and Value: A Growing Divide

Volume growth requires deliberate decisions across three critical dimensions:

- Portfolio: Clarifying the categories to play in and the brands to support. Companies that continuously assess and refocus their portfolios react faster to shifting consumer preferences.

- Geography: Leveraging a truly global footprint is essential. While most CPGs source and manufacture globally, their go-to-market strategies remain geographically narrow. In other words, they buy globally but sell selectively, limiting the ability to fully leverage assets and scale. Expanding commercial reach and activation beyond current strongholds can unlock meaningful growth.

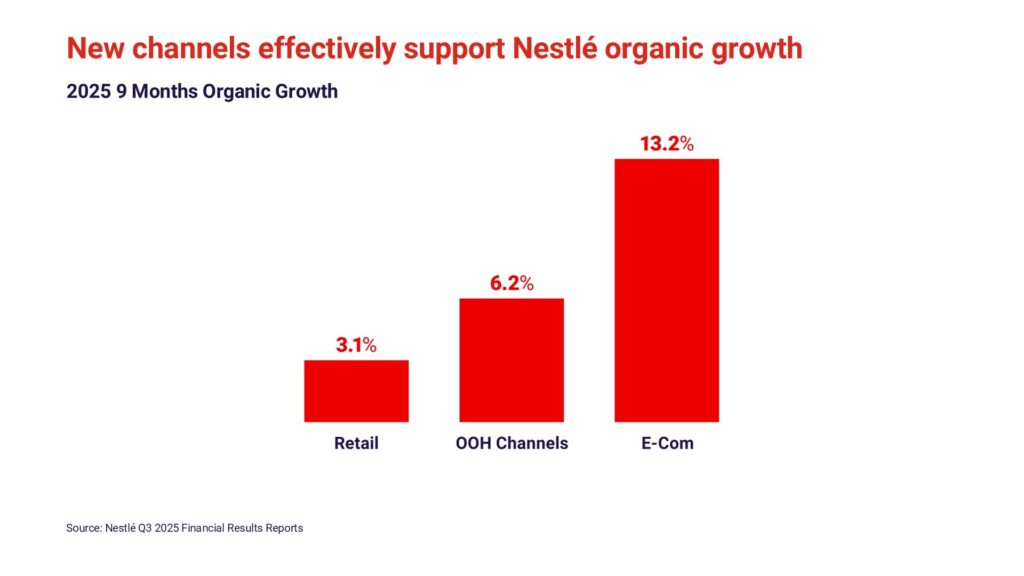

- Channel: Recognizing where growth is possible at a channel level is fundamental. Adapting the offer to the channel is essential. L’Oréal benefits from its leadership in online, where it continues to outperform in what is now the most dynamic sales channel. Nestlé approach to AFH and e-com is showing how a proper channel focus can provide great return. The level of growth in e-com is more than 4x the overall retail growth.

4. Who’s Winning in Volume and Why

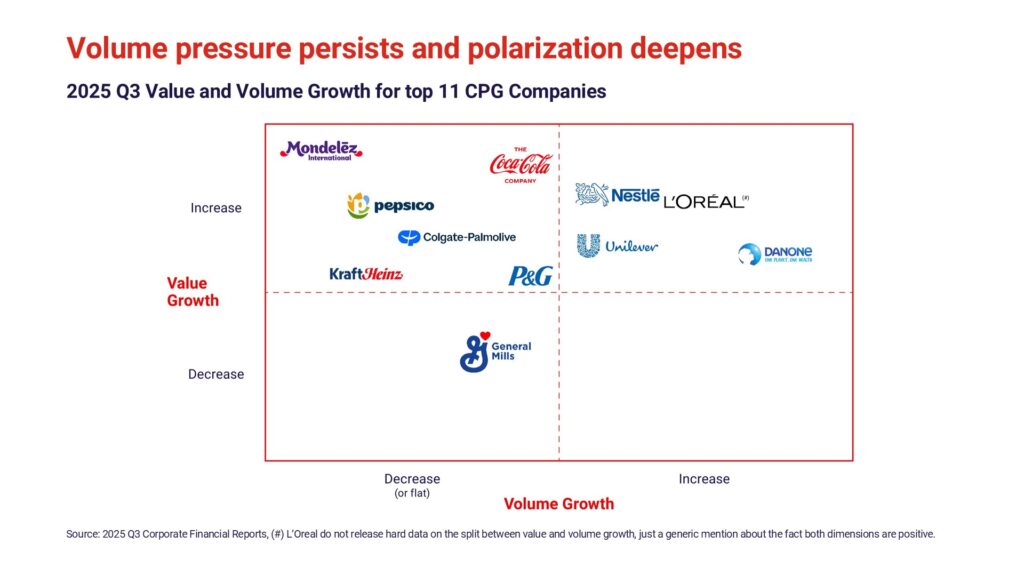

The same three companies that led in Q2 in volume growth, Danone, Unilever, and L’Oréal, continue to perform strongly in Q3, while Nestlé joins the cluster, marking a notable change after the weaker first two quarters.

There are different reasons behind the consolidating success, but clear decisions and more disciplined execution seem at the base of this result.

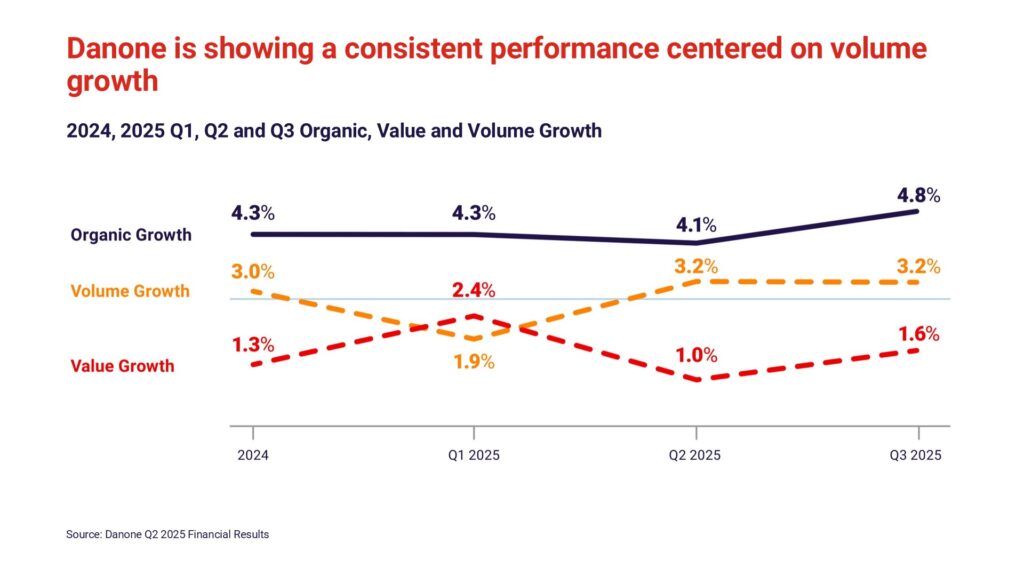

Danone remains the strongest performer, and the only company showing volume growth ahead of value growth. Its disciplined strategy centered on health-focused platforms, specialized nutrition, protein, plant-based, and essential dairy, continues to deliver positive results, with volume growth stabilizing above +3%.

The company’s ability to link a clear portfolio vision with consistent execution remains a differentiating factor.

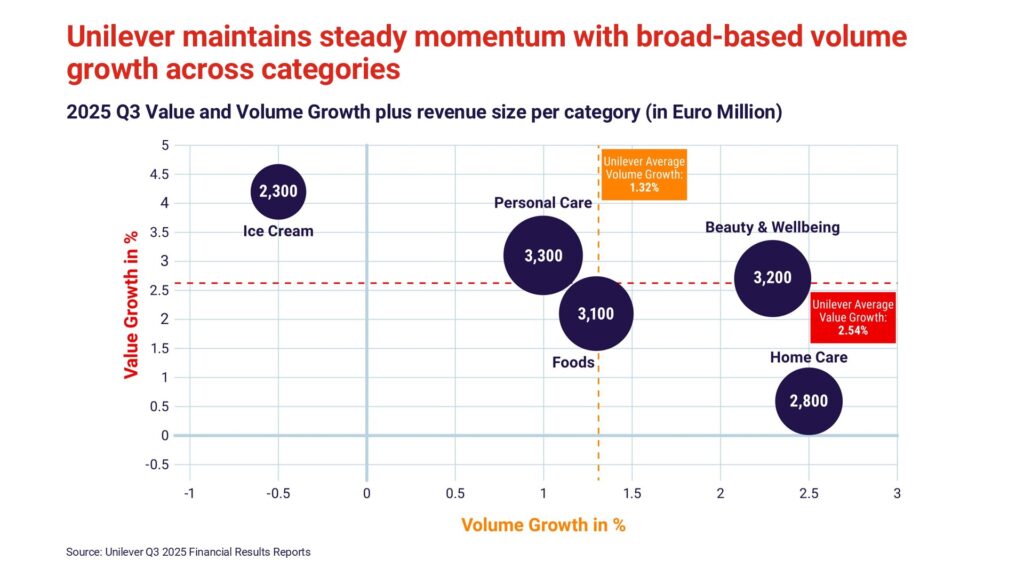

Unilever continues on its steady trajectory with organic growth at +3.9%, driven by +2.4% value and +1.5% volume. The decision to spin off the Ice Cream division — a lower-margin, less synergistic business — underlines its focus on profitability and strategic coherence. Its Power Brands, representing the core of the portfolio, grew +4.4% vs. less than +3% for the rest, showing the rewards of prioritization.

Unilever’s balanced geographical footprint, with 56% of turnover in emerging markets, continues to provide a resilience advantage.

Home Care shows the best volume growth performance at 2.5% driven mainly by a couple of strong brands.

L’Oréal reported +4.2% organic growth, with value and volume contributing equally, though precise figures were not disclosed.

Growth was broad-based across divisions — from Professional Products to Dermatological Beauty — and across geographies, with South Asia Pacific, Middle East & Africa up +12.2%, offsetting slower North America (+1.4%).

The company’s sustained focus on innovation, and the specific way they are positioning it, continues to fuel momentum as seen in TIME’s recognition of Air Light Pro, Lancôme Rénergie Nano-Resurfacer, and Melasyl among The Best Inventions of 2025.

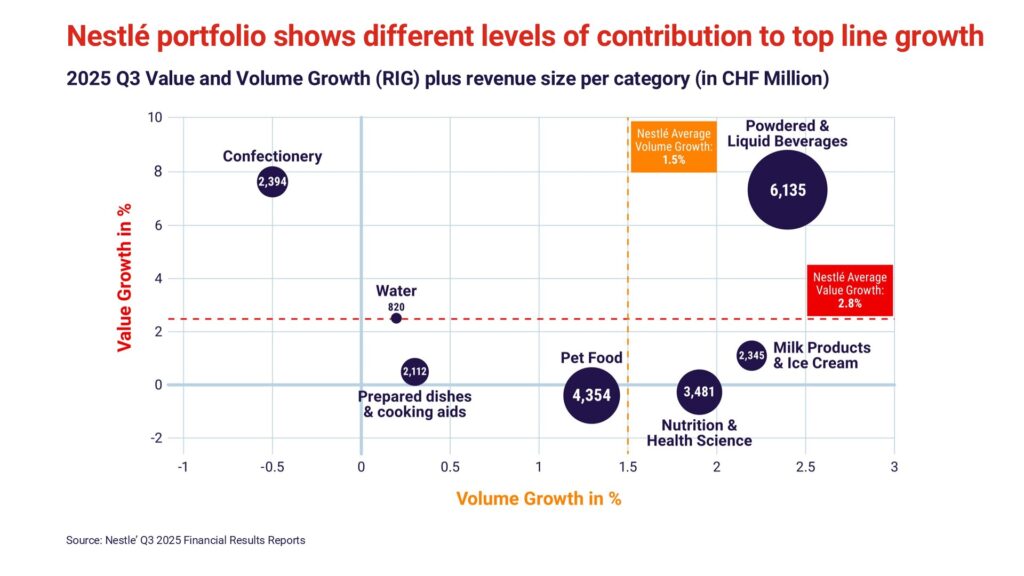

Nestlé delivered a noticeable +1.5% volume growth (Real Internal Growth – RIG) in Q3, a significant turnaround after two negative quarters and a weak 2024 (+0.8%). This reflects the impact of the previous and the newly appointed leadership on a volume-led strategy.

To sustain this recovery, two major and closely connected decisions Nestlé needs to make, both requiring disciplined prioritization, and likely in this order.

First, to define which categories and sub-categories to truly compete in. Pressure from shareholders to streamline the portfolio is rising, and focusing resources where growth and margin conversion are strongest will be essential.

Looking at the Q3 performance by macro-category reveals a potential over reliance on beverages.

Second, to determine which brands deserve full investment and scaling potential. Without concentrating marketing and innovation behind a tighter set of scalable brands, Nestlé risks diluting its efforts and underleveraging its global reach. Currently, only four Nestlé brands rank among the world’s top 50 most-penetrated, a sign of under-leveraged scale across its vast portfolio of more than 2,000 brands.

5. The path forward

The volume crisis is here to stay, at least for some time. And big CPG players must redefine their strategies to address it structurally. Some portfolio splits, such that of Kraft Heinz or KDP, reflect attempts to regain focus, but deeper transformation is required.

Moving forward, companies need to act on two complementary fronts:

- Return to fundamentals: Put penetration at the center of growth, supported by deliberate decisions on categories, brands, channels, and geographies.

- Embrace disruption: Reconsider categories definition, recognizing evolving and higher-level consumer needs and putting serious innovation as a driving force.

At Sevendots, we support CPG companies in navigating this transformation, optimizing portfolios at category and brand level, identifying opportunities to boost penetration, and supporting the implementation of effective actions that drive sustainable growth.

Contact Sevendots to explore how we can help you navigate the volume challenge, optimizing your portfolio and accelerating brand penetration.

A full analysis of quarterly performance, covering the top 35 global CPG companies, is available through our subscription service.

Contact Sevendots to learn more about the available modules and how they can support your strategic planning.

About Sevendots

We’re a global team of passionate senior industry experts helping companies to navigate the CPG industry transformation, identifying sustainable growth strategies for the businesses and the people they serve.

We work for a variety of CPG companies including large multinational clients like Nestlé, Unilever, P&G with projects covering Consumer and Markets dynamics and Business Assets Deployment including Portfolio Optimization, Brand Positioning, Innovation, New Business Models, Channel and Geographic Expansion.

Our senior partners bring experience and track record in general management, M&A and finance, brand management, operations, innovation and R&D, sales, media and communication allowing us to provide multidisciplinary teams to support business issues and opportunities.