Consumer Trends 12 August 2025

What’s going on with proteins?

The booming protein market

Based on Grand View Research analysis, the overall global high-protein food market is projected to reach USD 117 billion by 2034, with a compound annual growth rate of 8.4%.

Main segments include:

- Protein-Fortified Food: estimated at USD 67 billion in 2023 and projected to reach USD 102 billion by 2030, with a CAGR of 6.2%

- Protein Snacks: expected to be worth USD 42 billion by 2034, up from USD 21billion in 2024 and growing at a CAGR of 7.0%

And growth isn’t just being reflected in retail sales: also in the service sector mentions of protein on menus have jumped by 10% over the past year, with one in five restaurants now highlighting protein in their dishes.

A strong expansion is underway

Food companies have seen a significant increase in demand for high-protein products, In particular:

- Consumers are increasingly interested in the functional properties of proteins, such as their ability to improve texture, enhance satiety, or contribute to specific health benefits.

- There’s a growing emphasis on using recognizable and natural ingredients in protein products, with consumers often preferring fewer, simpler ingredients.

- Plant-based protein sources like lentils and other legumes are gaining traction as sustainable alternatives to animal-derived proteins.

- Research is focused on developing more efficient and sustainable methods for extracting and processing proteins from various sources.

The challenge of sourcing and carriers in the protein-enriched landscape

Two critical factors are shaping the development of the protein-enriched food and beverage market: protein sourcing and carrier selection.

1. Sourcing: Balancing Performance, Cost, and Sustainability

Food manufacturers are navigating a complex landscape in their search for protein sources that are nutritionally effective, cost-efficient, and scalable. Traditional animal-based proteins such as whey have seen a remarkable transformation in market value. Once considered a byproduct with limited applications—often discarded or used as livestock feed—whey is now a hot commodity. As consumer demand for protein surges, especially for high-performance and clean-label sources, the U.S. whey protein market is estimated at between $5 and $10 billion, with forecasts suggesting it could double in size over the next decade.

The price of high-quality whey protein concentrate reflects this surge: a pound that cost roughly $3 in 2020 can now fetch up to $10, driven by both consumer demand and supply chain constraints.

Plant-based proteins, such as pea, soy, fava bean, and chickpea, are also widely used, but often come with trade-offs in terms of taste, digestibility, and amino acid completeness. As such, the protein sourcing puzzle remains open and competitive, with no single clear winner on the horizon.

In parallel, new protein technologies are gaining traction. Precision fermentation, for example, promises to produce high-quality, animal-free proteins with a lower environmental footprint. Companies like Perfect Day and Remilk are leading this frontier, offering dairy-identical proteins without the cow. However, these technologies are still in the early stages of scale and affordability, limiting their current ability to meet mass-market demand.

2. Carriers: Embedding Protein into Everyday Consumption

Beyond sourcing, a key question is: How do we deliver these proteins in a form that consumers will regularly use? In other words, what are the best carriers for protein enrichment?

The most promising opportunities lie in high-frequency consumption categories. If consumers are already using a product daily, enriching it with protein creates a habitual intake mechanism, increasing the likelihood of adoption and sustained usage. For example:

- Dairy has long been a go-to carrier, with Greek yogurts, protein milks, and cottage cheese leading the charge.

- Coffee is now entering the protein space. Brands like Dunkin’ in the UK have launched “Strong Brew” with 20 grams of protein per bottle, signaling a trend where even morning rituals are being reimagined through a protein lens. Starbucks is also piloting similar ideas in select markets.

- Snacking formats such as bars and shakes have seen strong growth, but are often perceived as functional add-ons rather than part of the core diet. This makes integration into meal-like occasions, such as breakfast foods, spreads, or even pasta, more attractive for sustained volume.

Meanwhile, some companies are experimenting with protein-enriched versions of bread, cereals, and even ice cream, trying to blend indulgence with functionality. The goal is to meet consumers where they already are, rather than asking them to add yet another product to their routine.

The drivers of growth

The protein trend in food and beverages is driven primarily by increasing consumer focus on health, wellness, and active lifestyles. Key factors fueling this trend include:

- Rising health awareness: Consumers are intentionally seeking foods that support fitness, muscle growth, weight management, and overall wellness. Protein is recognized for helping with satiety, muscle maintenance, recovery from exercise, and weight control.

- Mainstream adoption beyond sports nutrition: Protein-enriched products have shifted from niche sports nutrition to mainstream markets, making protein a desirable ingredient in everyday foods and beverages, including snacks, bakery items, and indulgent treats.

- Convenience and functionality: Protein beverages and snacks offer quick, accessible nutrition that fits modern, busy lifestyles, with growing demand for ready-to-drink options that are natural and free from artificial additives.

- Innovation and ingredient diversity: New protein sources such as whey, plant-based proteins (pea, oat, rice), canola, yeast, and precision fermentation-derived proteins have expanded possibilities for product developers. Advances in processing improve taste, solubility, and functionality, helping to overcome manufacturing challenges and meet consumer taste expectations.

- Social media and lifestyle influence: The trend is amplified by social media engagement, with protein-related content increasing significantly on platforms like Instagram and TikTok. Consumers are motivated by diet trends and lifestyle needs, driving higher protein mentions on menus and supermarket shelves.

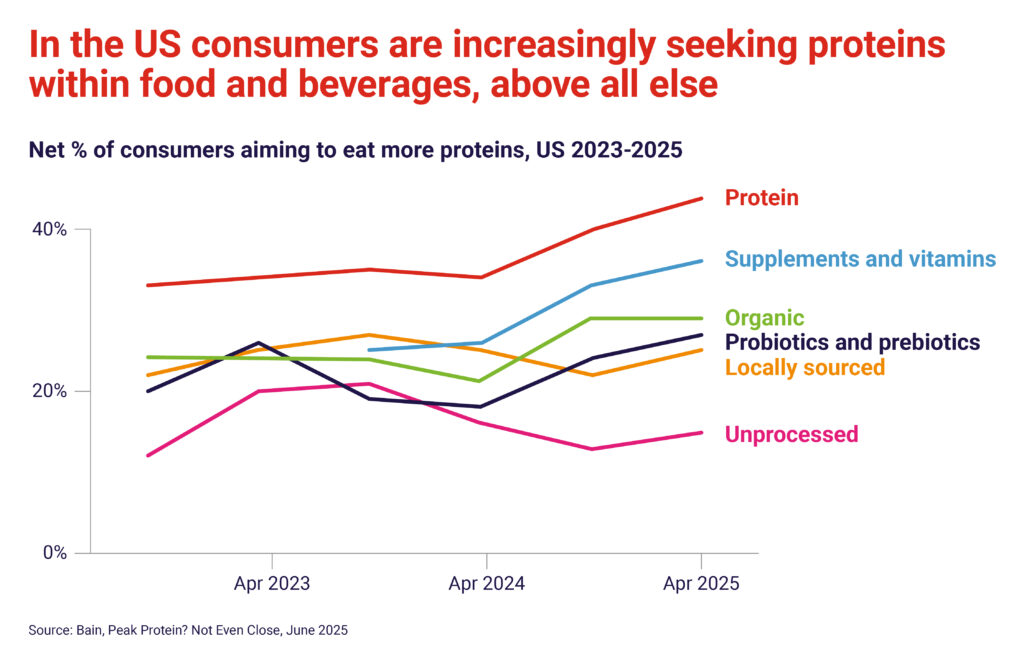

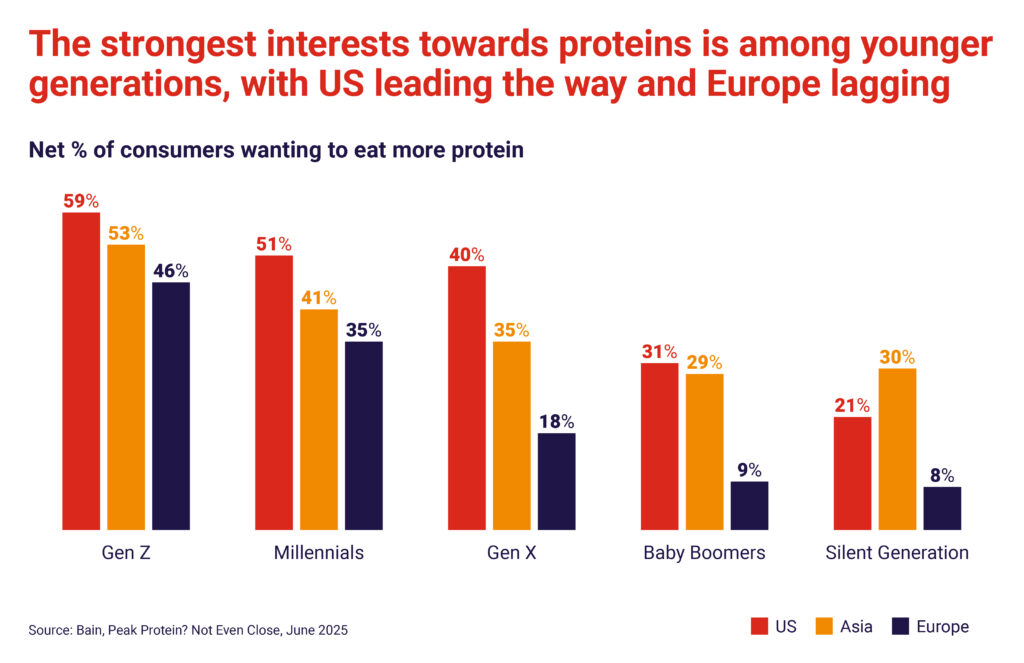

- Protein and current diets: 45% of US consumers claim that they are now aiming to consume more proteins in the future, compared to 35% for Vitamins & Supplements. A similar number of consumers make the same claim in China while the figure for increased protein consumption drops to 35% in UK and around 15% in Italy and France, indicating that current diets and eating habits play a key role.

The generational divide

While older consumers would be the first to benefit from additional protein intake it’s actually the cohort of younger adults that is leading the way in terms of demand in their daily food and beverage consumption.

Infants and children need proportionally more protein for growth, while older adults need more to combat age-related muscle loss but USDA data shows that almost 50% of women and 30% of men 71 and older fall short of protein recommendations. Older adults often don’t regularly meet their protein requirements due to taste changes, a decrease in appetite and dentition issues with chewing.

Perhaps there could be an opportunity for brands to boost protein consumption among older consumers by a) targeting them and b) overcoming their concerns.

A few watchouts

There are, however, risks of overconsumption to be monitored carefully.

For long-term safe protein consumption, current evidence and guidelines for healthy adults indicate:

- Recommended Dietary Allowance (RDA): 0.8 grams of protein per kilogram of body weight per day is sufficient to meet the needs of most sedentary adults.

- Higher requirements: People who are older, physically active, or looking to build muscle may need more—generally up to about 1.2–1.7 g/kg per day depending on age and activity level.

- Safe upper limit: Consuming up to 2 grams per kilogram (g/kg) of body weight per day is widely recognized as safe for most healthy adults.

More than the recommended amount offers no proven benefit and may increase health risks, particularly with long-term excessive intake and poor protein source choices

While protein is essential for muscle growth, repair, and overall health, consuming it in excess of recommended dietary allowances can cause health problems rather than benefits.

Key risks associated with excessive protein intake include:

- Weight gain: Excess protein calories not used for energy or muscle repair tend to be stored as fat, potentially causing weight gain if overall calorie intake is not controlled.

- Digestive issues: Too much protein can cause nausea, diarrhea, fatigue, dehydration, and uncomfortable digestive symptoms.

- And in some cases, Cardiovascular issues, Kidney strain and stones and Bone health problems.

Therefore, while adequate protein is vital, moderation and balance with other nutrients are crucial to avoid the potential harms of overconsumption.

Tapping into the growing demand

These regions promise dual growth engines; a rapidly growing population coupled with expanding middle-class consumers increasingly demanding branded goods. This translates into a much higher growth rate both in value and volume.

An industry wave is underway: more retailers and brands are introducing “high‑protein” across dozens of categories—from ice cream to chips to pasta—as consumers seek added nutrition and satiety.

A few notable examples include:

1. Barilla Protein+ Rigatoni

Barilla has expanded its Protein+ line with a new rigatoni shape made of lentil, chickpea and pea protein. Each serving delivers 17 g of protein, joining earlier shapes like penne and angel hair.

2. Starbucks — Protein‑infused latte

Starbucks is piloting a sugar‑free vanilla latte topped with banana‑flavored cold foam, incorporating unsweetened protein powder for 15 g of protein, tested at select locations. Coffee is a high-frequency ritual and is increasingly becoming a functional delivery platform.

This is no longer just coffee, it’s a higher-level solution delivery for consumers.

3. Nestlé — Vital Pursuit meals & Maggi products

Under its Vital Pursuit brand, Nestlé released 14 frozen meals (bowls/pizzas/etc.) rich in plant and whole‑food proteins. Example: Vermont White Cheddar Mac & Broccoli Bowl with pea‑protein pasta. In India and Latin America, it launched Maggi Besan noodles and Maggi Rindecarne, both fortified with chickpea‑ or soy‑based protein.

4. Myprotein × Müller yogurts & drinks

A collaboration between Myprotein and Müller created a line of protein-rich yogurts (49 g per 500 g pot) and protein puddings and mousses (~20 g each). These launched in UK retail from September 2024.

5. Confectionery meets protein

- Snickers Hi Protein bars and matching protein powders offer 20 g protein per bar, with dessert‑flavored powders in Europe.

- Mondelez’s Grenade Protein Flapjacks in the UK provide ~11 g protein with low sugar

- Ferrero acquired Fulfil Nutrition to expand its presence in the protein bar category.

6. Jams — Protein‑rich peanut butter & jelly sandwich

A new frozen PB&J sandwich brand, launched with 10 g of protein per serving, free from seed oils and artificial sugar. It’s marketed as a health‑forward snack supported by athletes such as C.J. Stroud, Micah Parsons, and Alex Morgan.

7. Kroger – Private Selection and Simple Truth range

Also, retailers are getting into the game: Kroger has announced the imminent launch of 80 new products under its Private Selection and Simple Truth labels, with many of them revolving around protein.

“Earlier this year, we identified protein as a major customer trend. These products are everything from bars and powders to shakes, all from a natural and organic brand that customers trust” (Ron Sargent, President)

Making the right moves

As often happens when a trend starts picking up many brands jump onto the band wagon and not all get it right.

In fact, nutrition experts warn of “protein washing”—where products carry “high‑protein” labels but don’t deliver real nutritional value and may be heavily processed or overpriced.

And articles in specialist publications don’t help clear the air when headlines imply that proteins are being “pumped” into products to solve more fundamental issues.

So, what are some of the Do’s and DON’T’s to carefully consider?

✅ Do’s

1. Match protein to product use case

- Use whey, casein, or soy for performance and fitness products.

- Use pea, rice, chickpea, or oat protein for plant-based or allergen-friendly lines, considering also sustainability: Pea, rice, and fava bean proteins have lower environmental footprints.

- Choose proteins that complement the product’s flavor and texture (e.g. dairy proteins in creamy products, collagen in clear beverages).

2. Ensure functional taste and texture

- Test for grittiness, chalkiness, and off-flavors, especially with plant proteins.

- Consider using protein isolates for a cleaner taste and better solubility.

- Use masking agents or flavor pairings (e.g., cocoa, vanilla, banana) where needed.

3. Provide meaningful protein content

- Target 10+ grams per serving to meet consumer expectations for “high protein.”

- Use claims only when they meet regulatory standards (e.g., FDA requires at least 10% DV to be labeled “Good Source of Protein”).

4. Maintain clean labels and transparency

- Highlight source and quantity of protein clearly.

- Explain why protein is added (e.g. satiety, muscle support, plant-based diet support).

- Keep ingredient lists as short and natural-sounding as possible.

❌ DON’T’s

1. Sacrifice core product quality

- Protein should enhance, not undermine, the product’s original appeal (flavor, texture, enjoyment).

2. Make misleading health claims

- Don’t imply that added protein alone makes a product “healthy.”

- Avoid overpromising benefits like weight loss, muscle gain, or energy unless scientifically supported.

3. Overlook allergen labeling

- Ingredients like whey, casein, soy, or egg are major allergens.

- Label clearly and offer alternatives for allergen-sensitive consumers.

4. Fall into the protein-washing trap

- Avoid adding token amounts of protein (e.g., 2–3 g) just for marketing.

- Consumers are increasingly savvy and will see through weak claims.

- Consider sustainability: Pea, rice, and fava bean proteins have lower environmental footprints.

How Sevendots can help – Turn Protein Potential into Portfolio Impact

Protein isn’t just a nutrient, it’s becoming a key battleground for relevance, differentiation, and value in the modern food and beverage landscape. But getting it right requires more than just adding grams to a label.

At Sevendots, we help Food companies unlock the full strategic potential of protein-enriched offerings, from concept to shelf, and from global to local relevance.

Our approach is grounded in a deep and ongoing review of the food industry, giving us a clear perspective on emerging trends, best practices, and the pitfalls to avoid.

Thanks to our unique blend of capabilities, including partners with deep R&D experience in food formulation and protein science, operations experts with a strong grasp of supply chains and manufacturing feasibility, and commercial strategists who understand consumers, channels, and global nuances, we are able to guide clients through:

- Matching the right protein to the right use case

- Delivering taste and texture consumers will return to

- Ensuring regulatory soundness and clean label transparency

- Avoiding common pitfalls like protein-washing or misleading claims.

Whether you’re considering protein for performance, satiety, or plant-based positioning, we help you translate nutritional trends into sustainable growth, ensuring every move adds value to your brand and your business

Contact Sevendots today to explore how we can work together to define your next winning move.