Business Strategy 16 December 2025

The CPG Pendulum: Why Big CPG Companies Keep Swinging Between Focus and Diversification

The CPG industry moves in cycles. “Focus” and “diversification” are not opposites but alternating responses to changing times.

Today, public companies are tightening portfolios while private firms are broadening theirs — each driven by different time horizons.

Focus tends to win on performance, diversification on stability, and the great companies learn to balance both.

The future belongs to the “focused diversifiers”: those who know who they are, but aren’t afraid to stretch where it matters.

Making deliberate decisions and leveraging the opportunity to aggregate categories to provide higher-level solutions to consumers is a fundamental driver for long-term value generation.

Sevendots, Rome

4 minute read

Every few years, the world’s biggest consumer goods companies seem to change their minds.

One moment they’re narrowing down to “core strengths,” selling anything that doesn’t fit. The next, they’re buying everything in sight, from snacks to supplements, in a rush to catch new growth.

Think of Kraft Heinz splitting up, Unilever spinning off ice cream, Nestlé trimming water, or Ferrero buying W.K. Kellogg’s cereal business. What looks like chaos is, in fact, the rhythm of an industry that has always swung between “focus” and “diversification”, between depth and breadth.

The Eternal Question: How Broad Should You Be?

In consumer goods, success depends not only on what you sell, but on how many things you choose to sell.

A focus strategy means concentrating on the categories where you have real muscle, sharper identity, higher margins, and clearer execution.

A diversification strategy means expanding into new or adjacent spaces capturing growth, spreading risk, and staying relevant as consumer behavior shifts.

Both strategies work. Both fail. The art lies in knowing when to switch.

Why focusing or diversifying?

In principle, companies diversify when they seek new sources of growth, broader revenue stability, or the chance to participate in emerging consumer occasions.

They focus when complexity erodes profitability, or when leadership needs to reaffirm what the business stands for.

While these moves are usually financial or vision-driven, a third trigger remains underleveraged: one that is consumer-centric. Companies can combine categories to deliver higher-level solutions to consumers.

By offering multiple products, and potentially also services, in a consumer “set,” the business can capture more value, raise switching barriers, and deepen engagement. Examples could be combining health drinks, protein bars, supplements and other categories under a unified longevity platform.

When the Market Speaks: Focused Publics, Diversified Privates

Over the past decade, publicly listed giants have mainly chosen focus. Investors reward simplicity and punish complexity.

Unilever, Kraft Heinz, and Nestlé are all slimming down, shedding slow-growth assets, and homing in on profitable cores. Data backs the move: according to a recent BCG analysis, companies that narrowed their portfolios delivered higher annual total shareholder returns over the past decade.

Private and family-owned firms, by contrast, play the long game. Ferrero has bought more than 20 companies in ten years, expanding from chocolate into cookies, cereals, and ice cream, almost doubling its revenue, expanding occasions and categories covered by its portfolio. Mars, now merging with Kellanova, is doing the same: building breadth for resilience, not just short-term returns. Lactalis announced two major acquisitions this year being a bunch of yogurt brands, including Yoplait, in the US from General Mills and, more recently, the Fonterra’s consumer

unit. This expands further its geographical footprint.

Private companies being active in major M&A activities

Coke and Pepsi: The Clearest Test Case

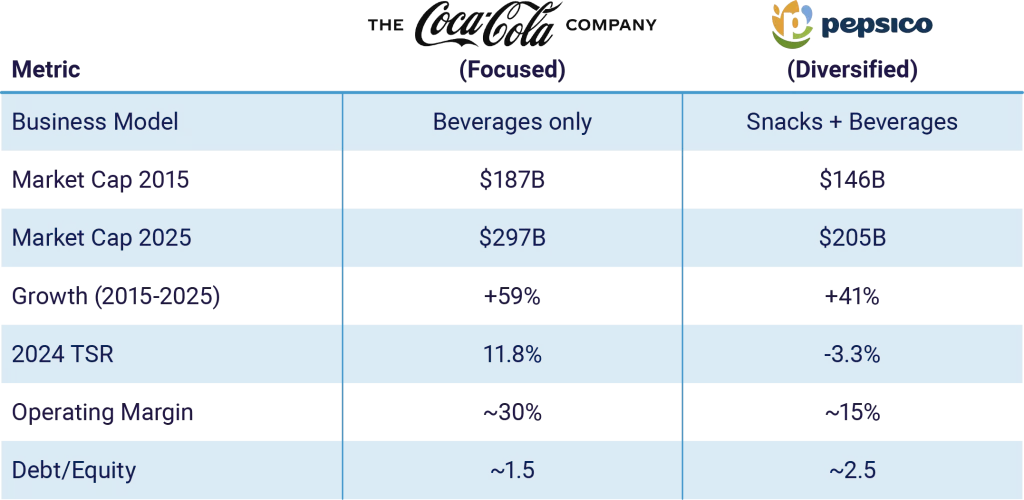

Two icons, two models. Coca-Cola is a focused pure play in beverages. PepsiCo runs a dual empire of drinks and snacks.

Over the last decade, Coke’s market capitalization rose by nearly 60%, PepsiCo’s by around 40%. Coke wins on margin and investor love; PepsiCo wins on stability and crisis protection.

The conclusion? There isn’t one. The right answer depends on what kind of company you are and what kind of world you operate in.

The Risk–Return Pendulum

Focus maximizes returns in calm seas. Diversification keeps you afloat in the storm.

In the 2008 financial crisis, and again during COVID, diversified companies outperformed because their broader portfolios cushioned shocks.

But in stable years, focused firms outperform because clarity, efficiency, and capital discipline command a valuation premium.

This is why the CPG industry never sits still. The pendulum swings back and forth, following the rhythm of the market.

The Emerging Middle Ground: Focused Diversification

The smartest companies today are learning not to choose sides. They are mastering focused diversification, staying disciplined around a strong core, but extending into adjacencies that make strategic sense.

So Where Does This Leave CPG Leaders?

There are two main considerations when speaking about focus or diversification.

- The need to be deliberate: knowing when to pivot, when to double down, and when to let go. This starts with understanding company assets and skills. This is based on making explicit decisions following an ongoing review of the company category portfolio.

- The opportunity to go beyond traditional financial and vision triggers and look at the possibility of combining categories that together can offer higher-level solutions to consumers. This unleashing increased value driving consumer preference and contributing both to top and bottom line development.

At Sevendots, we help CPG companies make deliberate, insight-driven choices, identifying where to focus, where to diversify, and how to build value through consumer-led higher level solutions.

We rapidly assess current and new categories, mapping the most relevant opportunities for growth. Our approach combines an external, unbiased perspective and the latest market dynamics with deep understanding of company assets and culture.

In short, we help our clients shape portfolios that are not just efficient, but meaningful to consumers and built for long-term relevance.

Want the Full Analysis?

Contact Sevendots if you want to receive the full analysis: “The CPG Pendulum: Focus vs. Diversification in the Age of PortfolioReinvention”.

About Sevendots

We’re a global team of passionate senior industry experts helping companies to navigate the CPG industry transformation, identifying sustainable growth strategies for the businesses and the people they serve.

We work for a variety of CPG companies including large multinational clients like Nestlé, Unilever, P&G with projects covering Consumer and Markets dynamics and Business Assets Deployment including Portfolio Optimization, Brand Positioning, Innovation, New Business Models, Channel and Geographic Expansion.

Our senior partners bring experience and track record in general management, M&A and finance, brand management, operations, innovation and R&D, sales, media and communication allowing us to provide multidisciplinary teams to support business issues and opportunities.