External benchmarking and consumer input

26

Case studies analyzed

:

2000

Consumers interviewed

More complex portfolios are required to cope with the forces impacting the CPG industry

The forces impacting the need for a more active portfolio management remain valid and, to a certain extent, even accelerated from our previous observation in 2019.

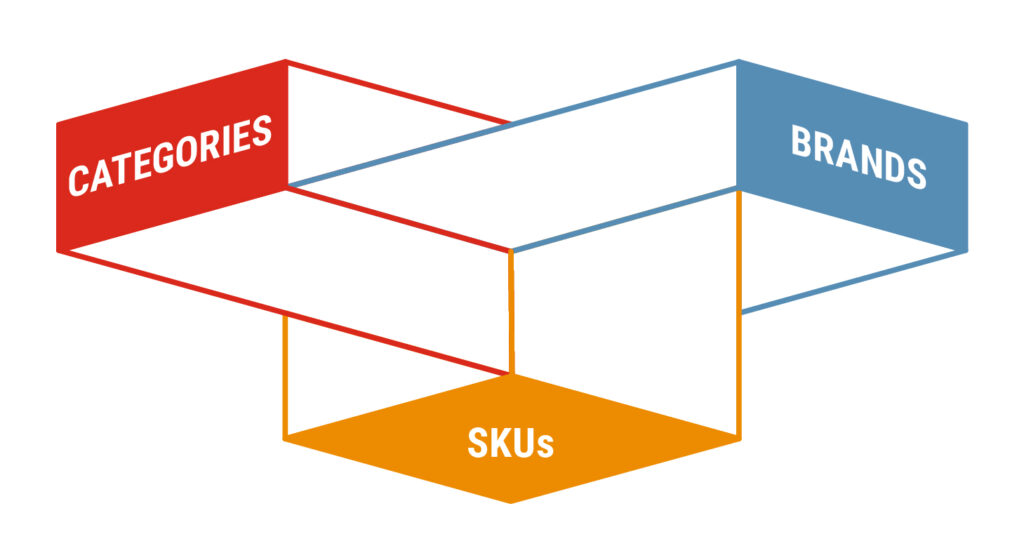

Portfolio management decisions continue to be linked to the relevant framework identifying the three main levels of categories, brands and skus and are triggered by strategy, financial, consumer and customer demand/reasons. Having a clear trigger can improve the efficacy and the return of portfolio decisions.

Portfolio management swinging between adding and removing

Over time, large CPG companies, much like in other areas, have exhibited a cyclical approach to portfolio management. In truth, there is no inherently right or wrong stance on adding versus removing. Decisions should not begin with ‘more’ versus ‘less’ as the primary consideration. Instead, a thorough portfolio analysis and strategic assessment, informed by performance metrics and external benchmarking, should guide decisions at the category, brand, and SKU levels.