Innovation 15 April 2025

Is Poppi acquisition another example of the inability of large CPG companies to develop transformative innovation?

In recent years, buoyed by easy access to capital, large CPG companies have increasingly turned to M&A to tap into emerging markets, acquire niche skills, and reduce the inherent risks associated with innovation. For example, Unilever reported a very strong M&A activity between 2016 and 2021 with 32 businesses acquired in different geographies (1) collecting different types of business models and new products.

Sevendots, Rome

3 minute read

PepsiCo’s recent acquisition of Poppi for approximately USD 2 billion exemplifies this trend. Instead of cultivating transformative innovations internally, PepsiCo opted for the costly yet apparently safer route of external acquisition to expand its presence in the fast-growing global functional beverage market.

M&A as Externalized Innovation: A Cautious Bet

Established CPG companies often find their innovation efforts hampered by structural inertia, complex governance, and a risk-averse culture. Generally, there is an implicit belief that a dollar spent on scaling already available assets provides a better ROI than one spent on innovation. This translates into a CPG industry which is not leveraging enough the power of innovation, as shown by R&D spending as well as new product launches declining substantially in the past years (2).

The Poppi acquisition highlights how large corporations might outsource innovation to circumvent these internal limitations. Poppi, a soda formulated with probiotics and lower sugar content, promises to provide the taste of soda in a better for you formulation linked to a functional benefit. The brand has become one of the fastest-growing beverage products in the USA, rapidly reaching the $100 million sales threshold.

Poppi has a specific social-first, millennial-driven marketing approach and built its brand on authenticity, community, and direct consumer connections. As Jill Smith, CEO Americas of Iris Worldwide, succinctly captures (3), Poppi succeeded through:

- “Social-first storytelling that makes you feel like you discovered it, not that it was marketed to you.”

- “Nostalgia-driven branding that taps into the millennial and Gen Z craving for feel-good aesthetics.”

- “Community culture that extends beyond the can – merch, collabs, and a sense of belonging.”

Looking at this approach, there is a tension emerging: can PepsiCo preserve Poppi’s authenticity within its extensive corporate framework? The crucial challenge isn’t distribution reach; rather, it’s sustaining authenticity amid corporate governance and standardized processes.

The Tension: Startup Agility vs. Corporate Constraints

Startup agility allows quick pivots, bold experimentation, and close consumer connections. Conversely, large corporations typically prioritize scalability, governance, consistency, and risk mitigation. These competing approaches create tensions that acquisitions alone often fail to resolve effectively. Cases like Coca-Cola’s acquisition of Honest Tea and Unilever’s acquisition of Dollar Shave Club underscore how maintaining startup agility and authenticity within corporate frameworks is challenging yet critical. On paper, the opportunity appears clear, yet the day-to-day management and effective integration often prove significantly more challenging.

Rigorous Due Diligence: Hard vs. Soft Elements

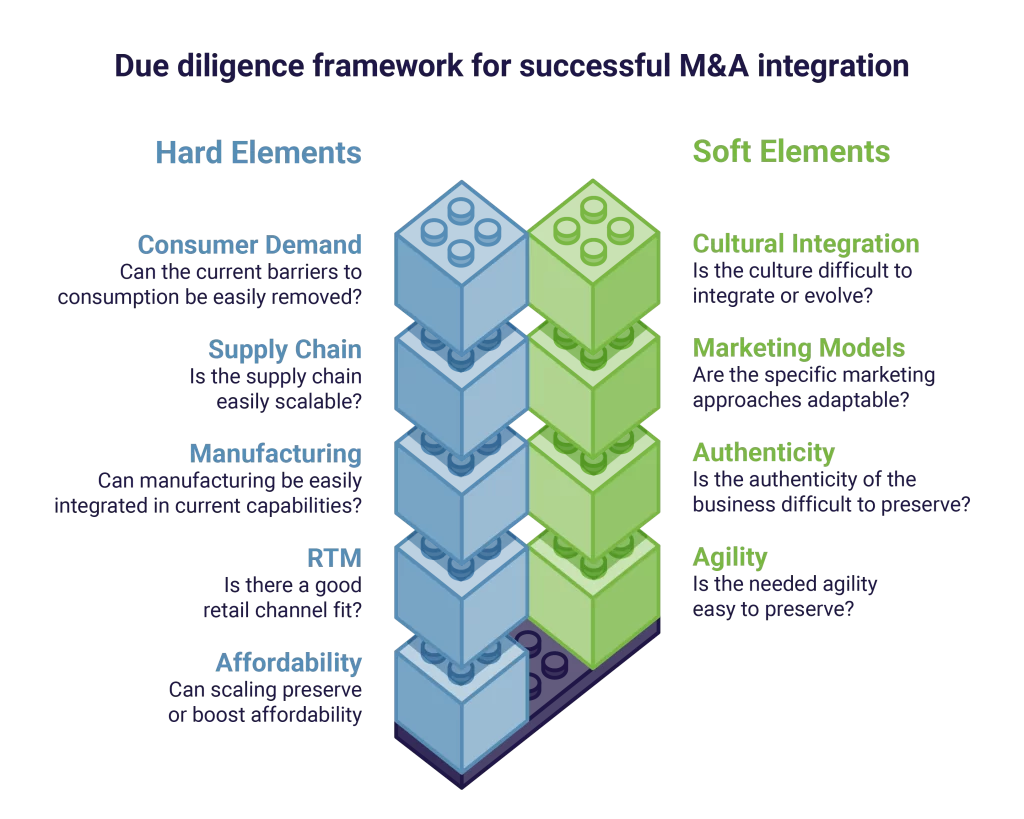

PepsiCo undoubtedly performed rigorous due diligence, evaluating “hard” integration factors like consumer demand, scalable supply chain, manufacturing integration, retail channel fit and overall affordability.

However, and this is particularly relevant to the Poppi acquisition, several critical “soft” elements need to come into play to truly leverage the value of a startup acquisition. These include cultural integration, the adaptability of marketing support models, and the capacity to preserve authenticity and agility.

A structured approach combining hard and soft elements is essential to successful M&A integration.

While comprehensive due diligence is undoubtedly essential, it alone does not guarantee the elimination of risks, particularly the risk of unintentionally destroying long-term value instead of creating it.

Transformative Innovation: A New Model

Rather than relying solely on external acquisitions, there is an opportunity to blend the strengths of agile startups and large-scale organizations into a unified model that systematically de-risks innovation and nurtures transformative growth internally.

At Sevendots, our structured innovation framework bridges precisely this gap, leveraging internal capabilities with an external ecosystem able to identify and produce transformative innovation MVPs in a short 6 to 9 months cycle.

The process is based on:

- Exploration: Identifying Future Growth Spaces: Leveraging insights from emerging trends and technologies and combining those with consumer trends uncovering high-potential opportunities.

- Internal Discovery: Identifying Capability Gaps: Rigorously evaluating internal competencies against these high-potential opportunities, spotlighting essential gaps like R&D capabilities, scalable sourcing, go-to-market approaches or consumer marketing expertise.

- Ecosystem Development: Connecting Resources & Capabilities: Connecting companies with cutting-edge startups, specialized research institutions, and manufacturing networks able to cover the identified gaps.

- MVP Design & Execution: Proving the Business Case Through rapid prototyping and agile testing, enabling companies to validate new products efficiently, ensuring scalable, consumer-ready solutions.

Our senior-only partner model, combined with our extensive industry-specific insights, uniquely equips us to navigate these tensions. Our team’s extensive experience within both multinational corporations and startups enables us to effectively transfer deployable knowledge to internal teams, embedding innovation capability and fostering a lasting, entrepreneurial mindset.

Conclusion: From Acquisition to Internal Empowerment

The Poppi acquisition is symptomatic of deeper structural challenges within large CPG companies. Relying exclusively on external acquisitions may be neither sustainable nor strategically optimal in the long run. By adopting a structured yet agile internal innovation model, corporations can leverage their inherent strengths and significantly enhance their capability for transformative innovation.

It’s time for large CPG companies to evolve beyond mere acquisition-driven growth and truly harness the transformative power of innovation from within. At Sevendots, we are committed to helping companies bridge the gap between startup agility and corporate scalability, converting bold ideas into sustainable, impactful, long-term growth.

Contact Sevendots today to discover more.