Category Growth 19 May 2025

For Large CPG Companies, The Volume Challenge is Increasingly Obvious

Following our analysis of full-year 2024 performance, we revisited the Q1 2025 results of 11 major global CPG players (Nestle’, PepsiCo, P&G, Unilever, The Coca-Cola Company, L’Oreal, Mondelez, Danone, Kraft Heinz, Colgate, General Mills). The findings offer a revealing snapshot of how momentum is shifting – and where structural tensions are emerging more visibly.

Sevendots, Rome

3 minute read

Organic Growth is Slowing. Volume Pressure is Rising.

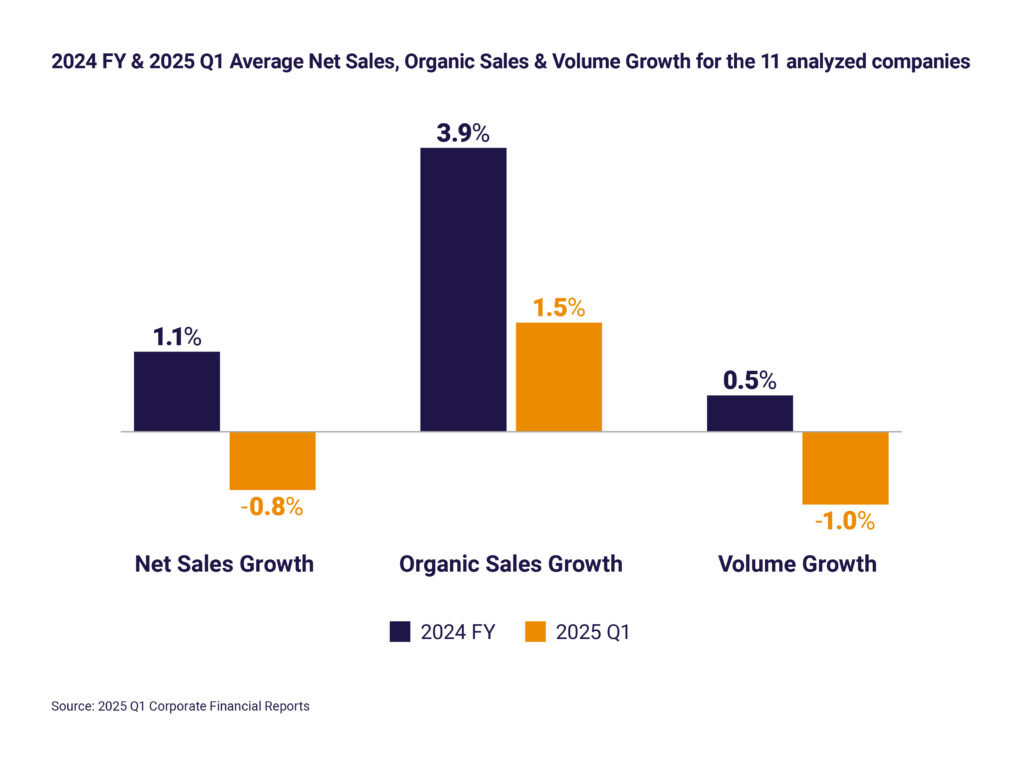

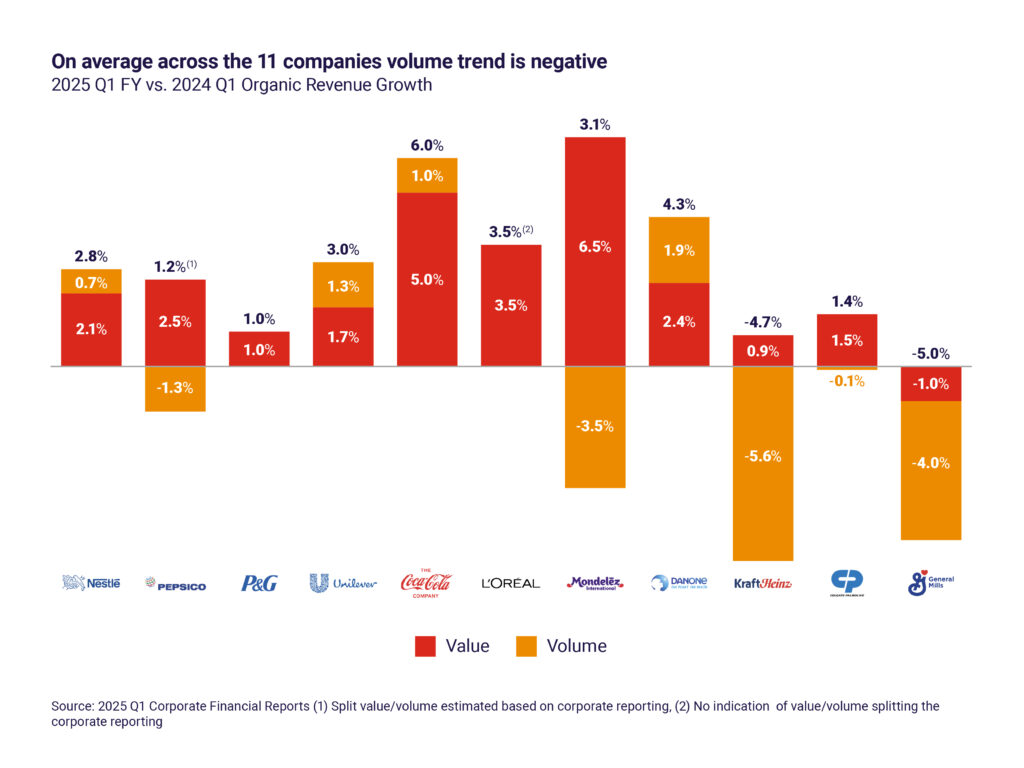

The headline is clear: organic sales growth is decelerating. The average organic growth rate across the 11 companies fell from 3.9% in FY 2024 to 1.5% in Q1 2025. But more critically, the volume trend has turned negative – from +0.5% in 2024 to -1.0% in the first quarter of this year. Six of the 11 companies posted flat or declining volumes.

Q1 2025 shows a further deterioration of growth, especially in terms of volume

Companies largely point to external consumer and market dynamics as the root cause:

- Inflation fatigue, especially in North and Latin America with consumers downtrading, delaying purchases, and reducing pantry loading.

- Input cost inflation – particularly in cocoa, dairy, and packaging – forcing pricing actions that are impacting elasticity.

These qualities have allowed small brands to gain traction not only in premium niches but increasingly in mainstream, high-velocity categories—ranging from pet care and functional beverages to personal care and home cleaning.

Category and Geographic Structure Matter

Divergences in performance underline the strategic impact of portfolio structure and market exposure.

Take the reported performance of The Coca-Cola Company vs. PepsiCo. Coca-Cola is reaping the benefits from a focused beverage portfolio and prior rationalization efforts. Its shift toward higher price-per-liter products, such as functional beverages, supported +5% value growth coupled with +1% volume growth. Its broader international exposure, especially in emerging markets, helped offset U.S. softness.

In contrast, PepsiCo’s dual portfolio (45% beverages and 55% food) is more exposed to complex sourcing and formulation costs. The food side of the business, including snacks, carries higher COGS and is more susceptible to input inflation and tariff pressures. A stronger reliance on the U.S. market further dampened volume, which declined by -1.3%.

Food-centric companies more broadly – Mondelēz, Kraft Heinz, General Mills, and PepsiCo – are disproportionately affected by rising commodity costs and volume softness. For instance, Mondelēz’s strong +6.6% value growth was more than offset by a -3.5% volume decline, largely driven by price adjustments attributed to cocoa cost inflation.

Balanced Growth is a Differentiator

Two companies stood out in delivering a better balance between value and volume.

Unilever posted +3.0% growth, with volume contributing +1.3%. It appears to benefit from strong presence in AMEA markets, where consumer spending remains more dynamic and well-calibrated pricing strategies in emerging markets. Also, Unilever is claiming an effective in-market execution, especially in Personal Care and Wellbeing.

Danone also delivered a well-balanced performance, with +2.4% value and +1.9% volume growth, supported by a clear focus on functional health-oriented products and strong operational execution.

Time to Reconfirm – or Rethink – Strategic Priorities

As growth becomes harder to secure, large CPG companies need to reinforce or review key decisions:

- Intensify focus on strategic portfolio management, reassessing performance and potential at category, brand, and SKU level and driving true innovation. Companies proactively working on their portfolios seem to benefit a better growth.

- Make deliberate geographic choices, with sharper market prioritization and related resources investments. Companies with a broader geographical scope seem to better sustain their organic and volume growth.

- Expand route-to-market models, including better coverage of new retail formats. Companies developing presence in new channels tend to better preserve their top line growth.

At the same time, productivity and operational efficiency remain essential levers for protecting margins and funding reinvestment. The companies that will outperform in the next quarters are those that can align portfolio choices, geographic coverage, and executional excellence to the evolving consumer landscape.

Contact Sevendots today to discover more about CPG industry transformation?